The term “European energy security” goes beyond the European Union’s (EU) 27 member states and concerns many other countries. It is, therefore, a significant issue which merits extensive studies from a broader regional perspective. Recent analyses on European energy security focus on the risks that might arise from: (1) the Russian state’s overwhelming control in the Russian energy sector;1 (2) the illiberal market conditions and extensive centralization in Russia;2 (3) the consequences of the asymmetry between the liberal understanding of the energy sector in Europe and the state-centric illiberal environment in Russia;3 (4) geopolitical concerns stemming from European energy supply security;4 and (5) Turkey’s emerging role in a new energy corridor.5

These studies point to supply-side features (reserves, field development potentials and transport options) as significant factors in energy security with regard to their effects on Europe’s relations with actual and prospective suppliers.6 Analyses on energy security necessarily stem from supply-side issues.7 Additional questions on a myriad of other significant factors arise from this perspective such as, to what extent does Gazprom’s difficulty in developing new gas fields in Russia channel its corporate expansion abroad? Is it possible to include additional suppliers from the Caspian, the Middle East and Africa under current conditions? What is the role that Turkey may assume as a transit state for the fourth gas corridor to Europe? What consequences might arise from Gazprom’s corporate initiatives in Libya and Algeria?

Energy markets and supply security issues are intertwined factors of the new global geopolitics and call for energy-centered foreign policies

This article matches a geo-economic perspective with international politics and aims to highlight some answers to these and similar questions by examining gas supplies from Russia, Azerbaijan, Turkmenistan, Kazakhstan, Iran, Iraq, Egypt, Libya and Algeria. It puts a particular focus on the relation between selected geo-economic factors (reserves, production, field development, transportation across territories, trade opportunities) and international politics. The second part, following this introduction, is entitled “Natural Gas in the New Energy Order.” It points to contextual shifts in global energy security arising from environmental and socio-economic factors, and maps European gas security within this framework. The third part, “Premises of Supplies from Russia,” elaborates the supply-side features with a particular focus on developing fields (e.g. Shtokman) and pipelines (e.g. Nord Stream and South Stream). The fourth part makes sense of Caspian resources under the title the “Significance of Caspian Resources via Turkey.” It looks into Azerbaijan, Turkmenistan and Kazakhstan. The fifth part, “Middle Eastern Prospective Gas Suppliers to Europe via Turkey,” discusses the potential of Iran and Iraq. The sixth part is entitled “North Africa’s Potential of Natural Gas and LNG Exports” and looks at Egypt, Algeria, Libya, and a possible extension from Nigeria, with a particular focus on Gazprom’s corporate expansion strategy in the region. In conclusion, the paper points to supply-side opportunities which channel new fields of international cooperation based on gas trade and highlights the political restraints which may decelerate the rise of new regional relations.

Natural Gas in the New Energy Order

Energy markets and supply security issues are intertwined factors of the new global geopolitics and call for energy-centered foreign policies.8 “In the planet’s new international energy order, countries can be divided into energy-surplus and energy-deficit nations.”9Relations between these two groups of countries are likely to determine the characteristics of regional and global affairs.10 Scarcity of supply and environmental restraints compel actors to move beyond a narrow definition of energy security based on quantity, price, location and time to a broader understanding in which the availability of energy needs to be not only secure and desirable in terms of amount, price, location and time, but also supportive of economic, social and environmental quality.11 Bilgin characterizes this transition as the New Energy Order (NEO) in which natural gas is likely to play a strategic role due to market conditions and environmental constraints.12

European natural gas demand deserves a special attention within this regard. The European Commission and international institutions, such as the International Energy Agency (IEA), recommend an increase in the consumption of natural gas for environmental and supply security reasons.13 Which characteristics make natural gas significant from this perspective? Natural gas consists of low-molecular hydrocarbons (50-95% of methane plus ethane, propane, butanes and nitrogen) and is obtained from underground deposits often in association with oil and coal and sometimes in non-associated form.14 It is possible to transport natural gas both via pipelines or by tankers after the gas is refrigerated and stored at -160 degrees Celsius at atmospheric pressure, thereby reducing its volume by 600 times and transforming it into liquefied natural gas (LNG).15 Natural gas, which has no natural sulfur dioxide (SO2) and discharges only insignificant amounts of nitrogen oxide (NOx) when burned, is the most environmentally friendly fossil fuel as it has low CO2 emissions and other pollutants. “Energy experts project greatly increased global use of natural gas during this century because of its fairly abundant supply and lower pollution and CO2 rates per unit of energy compared to other fossil fuels.”16

Today, in the EU natural gas accounts for 24% of energy consumption and for 20% of the primary energy used for electricity production.17 The market share of natural gas in Europe is expected to grow because the EU’s energy strategy is based on balancing supply security with sustainability and safety criteria.18 Natural gas is likely to become one of the primary energy resources in European consumption in industry, trade, transport, electricity generation, households and finally in hybrid applications with renewable sources of energy like biomass.

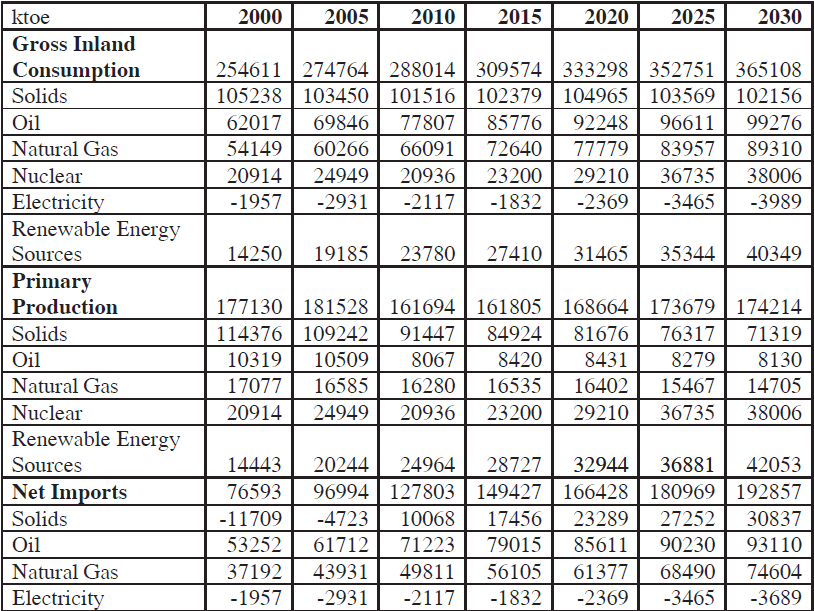

The EU’s gross inland energy consumption is predicted to increase to 365,108 ktoe in 2030 from 254,611 ktoe in 2000.19 Consumption of oil, natural gas, nuclear and renewable sources of energy will grow whereas the use of solid fuels will decline because of the associated environmental concerns especially regarding CO2 emissions. The EU member states are also likely to increase their nuclear and renewable energy production. In the mean time, the primary production of oil and gas in EU member states will decrease. Oil production is predicted to progressively decline from 10,319 ktoe in 2000 to 8,130 ktoe in 2030. Natural gas production is estimated to fall from 17,077 ktoe in 2000 to 14,075 ktoe in 2030.

Table 1. The EU Energy and Baseline Scenario to 2030

Source: Capros et al 2008, p. 100.

The EU will need more fossil fuel to satisfy the rising gap between domestic production and consumption. To the extent that European gas domestic output is expected to decrease, imports are likely to increase 100% from 37,192 ktoe in 2000 to 74,604 ktoe in 2030 as shown in Table 1. It is, therefore, possible to conclude that environmental, economic and geological factors will make the EU look for additional gas imports from existing and prospective suppliers.

Premises of Supplies from Russia

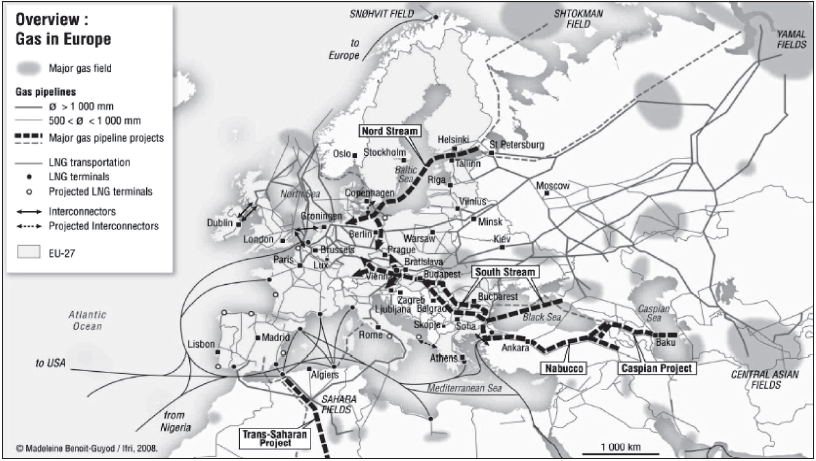

Russia is the most important supplier to Europe with its 47,577 billion cubic meters (Bcm) of proved natural gas reserves that rank it first in the world.20 Actually, and despite some difficulties which will be discussed later, Russia’s pipeline network to Europe is the most economic and technically feasible option for exporting oil and gas from Eurasia.21 Russia currently exports gas to Ukraine and European countries via a very complex web of pipelines.22 The Brotherhood, Soyuz and Central Asia pipelines are interconnected to transport gas from Western Siberia, the Caspian and Central Asia. They also feed the Blue Stream and Transgaz lines. The Northern Lights and Yamal pipelines are interconnected (and will include Nord Stream following its construction) to supply gas to Northern Europe with plans to develop the Shtokman field. Russia aims to develop this web of pipelines by new extensions. Yamal Europe I line transports gas to Poland and Germany via Belarus. The proposed Yamal Europe II plans to extend the existing Yamal line to reach Slovakia and Central Europe in 2010. Russia also wants to expand the Blue Stream pipeline, which starts from Beregovaya (Russia), passes through Black Sea and reaches Samsun (Turkey). Yamal II is now delayed because of the priority given to Nord Stream. As shown in Map 1, Russia is attributing high priority to construction of two other giant projects, namely Nord Stream and South Stream, to be completed in 2011 and 2015 respectively.23

Map 1. European Gas Transmission System (Gas Pipelines – LNG – Projects)*

* The map illustrates the situation in late 2008. Medgaz was already completed, and Scanled was cancelled as of August 2010

The Nord Stream pipeline (a joint project of OAO Gazprom, BASF/Wintershall Holding AG, E.ON Ruhrgas AG, GDF Suez and N.V. Nederlandse Gasunie) will link Russia (Vyborg, by the Baltic) and the EU (Greifswald, by the Baltic in northeastern Germany) via the Baltic Sea. It will also have interconnectors to Finland, Sweden and Denmark. The South Stream pipeline (a joint project of Gazprom with ENI) will start from Beregovaya in parallel with Blue Stream, reach Bulgaria along the bottom of the Black Sea and then split into two lines, one going northwest to supply gas to Serbia and Hungary with possible extensions to other central European countries. It will then be interconnected to other Gazprom pipelines. The second line will be routed southwest to supply gas to Greece, Albania and Italy with possible further extensions to other countries such as Spain and France.

“Nord Stream is the most advanced of all gas infrastructure projects designated as a ‘priority project’ by the European Union.”24 Many renowned companies throughout Europe work on Nord Stream, including Snamprogetti (Italy) for detailed design engineering; independent safety certification by Det Norske Veritas (DNV) (Norway); route surveys by Marin Mätteknik (Sweden), IfAÖ (Germany) and PeterGaz (Russia); environmental impact studies by Ramboll (Denmark) and ERM (UK); pipe production by EUROPIPE (Germany) and OMK (Russia); and concrete weight-coating and logistics by EUPEC (France).25

There are supply-side restraints regarding Russia’s ability to satisfy the growing demand. Most of the gas, expected to feed the new trunk pipelines is found in deeper wells with high exploration and production costs. The most important fields (Yamburg, Urengoy and Medvezhye) in Yamal, Western Siberia, which currently satisfy most of Europe’s gas demand, are in decline. Concerning new fields, the Sakhalin projects will have significant effects on Atlantic and Pacific gas markets26 and its production is primarily directed at meeting the rising demand of China and Japan. This is why the Shtokman field, in the Russian sector of Barents Sea, will be very significant for satisfying the demand from Gazprom’s forthcoming pipelines to Europe.

The Shtokman field, discovered in 1988, is estimated to have total reserves of 3.2 Tcm and lies around 550 km offshore to the north east of Murmansk at water depths of 300-350 meters.27 Russia expects to make new gas deals with EU members and to use the production from Shtokman to fill the Nord Stream (and even South Stream) pipeline.28 Initially, it was reported that Russia’s technology would not be adequate for exploitation of Shtokman until 2035 because of tough Arctic conditions and the sea depth.29“Central surface of the terrain is covered by a perennial drifting polar icepack that, on average, is about 3 meters thick, although pressure ridges may be three times that thickness.”30 Arctic winters, when gas demand from European countries peak, are characterized by continuous darkness and very cold weather which make it extremely difficult to work. “The icepack is surrounded by open seas during the summer, but more than doubles in size during the winter and extends to the encircling landmasses; the ocean floor is about 50% continental shelf (highest percentage of any ocean) with the remainder a central basin interrupted by three submarine ridges; Alpha Cordillera, Nansen Cordillera, and Lomonosov Ridge.”31

Gazprom, in need of technical support, said that Russia, which entirely owned the fields, would sell shares for up to 49% to foreign companies.32 Gazprom agreed to cooperate with Total (France) and StatoilHydro (Norway) to develop the Shtokman project.33Gazprom’s cooperation with its partners makes it possible to bring natural gas on stream from offshore and deeper underground sections. As to transportation of gas from Shtokman; Gazprom will use the North Stream pipeline. Gazprom and its project partners aim to start natural gas production from the Shtokman field in 2015, four years later than originally planned.34 The Nord Stream will then start transporting gas from Shtokman to European markets.

Russia’s insistence on developing Shtokman is partially related to its concern of meeting its rising domestic need without decreasing exports. Yet the production decline in the Yamal fields is still a significant problem and it is not clear whether the production from Shtokman will be enough to fill the gap coming from the rising gas demand both internally and externally. An extensive study carried out by NIIGazekonomika suggests that Russia will have the following five challenges which will make it difficult to fill the gap stemming from increased demand and the problems of increasing production:

1) The low price of gas for domestic consumers and high growth rate in consumption (earlier projections of Russian domestic consumption of gas were based on unreliable Soviet-era data and were found to be off the mark by tens of billions of cubic meters);

2) The energy intensive nature of the Russian industry;

3) Gazprom’s monopoly which discriminates against independent producers and so they are forced to flare billions of cubic meters of associated gas;

4) Gazprom’s reluctance to invest in new gas fields that would replace the four currently producing fields, all of which have high depletion rates;

5) Russia’s pressing need to rely on the sale of Central Asian gas to Europe (10 Bcm) in order to meet domestic needs and new export commitments.35

In order to satisfy growing domestic demand and export a total volume of 356 Bcm in 2030 (from 188 Bcm in 2004), Russia will rely on imports from Kazakhstan and Turkmenistan (172 Bcm) through the expanded Central Asia Centre pipeline as well as from Azerbaijan and Iran (65 Bcm) given that Russian domestic production is likely to remain flat at about 711 Bcm.36 This picture partially changed in 2010 due to the global financial crisis which curbed consumption in Europe and the Russian Federation. It is yet possible to conclude that the pressure on Russia to secure additional gas from Central Asia will increase following the recovery from the financial crisis.

Russia therefore requires not only additional production from new fields, but is also dependent on Caspian gas to satisfy its rising domestic needs without having to decrease the volume of exports to Europe. This dependence has improved the cooperation between Russia and Turkmenistan, especially for the latter who had been struggling to acquire higher prices from Gazprom. In July 2008, Russia and Turkmenistan signed two agreements each with a major strategic significance.37 The first agreement (a long-term contract until 2028) was based on a new pricing mechanism according to which Russia would pay Turkmenistan a price calculated from the average wholesale price in Ukraine and in Europe. Turkmenistan had already managed to increase the price from $55 to $100 per thousand cubic meters in 2006 to $140 in 2007 when Russia was charging European customers $250-$300 for the re-exported Turkmen gas due to transport costs, transit fees and taxes.38 The new pricing mechanism would increase the price at the time ($140 per thousand cubic meters) to $225-$295 in 2009 at the cost of $9.4-$12.4 billion to Gazprom.39 The second agreement ensured that Gazprom would remain the main partner in developing planned projects, costing $4-$6 billion, in order to improve Turkmenistan’s domestic gas infrastructure, transportation facilities and to develop/exploit/explore new gas fields. Price negotiations in 2010 will be shaped by two factors which made Gazprom bargain with contractors. First, the decrease in LNG prices made customers demand re-negotiations on prices with Gazprom. Second, the increase in shale gas production led to even more pressure on Russia to re-negotiate prices.40 It seems that Gazprom will need to decrease prices in order to cope with new market conditions.

The Significance of Caspian Resources via Turkey

The Nabucco pipeline project, which is shown in Map 1, might affect Russia’s market position by bringing natural gas from the Caspian and the Middle East to Europe.

Botas (Turkey), Bulgargaz (Bulgaria), OMV (Austria), Mol (Hungary), Transgaz (Romania) and RWE (Germany) are members of the Nabucco consortium, each with equal shares. The plan for Nabucco is to transport gas from the Caspian and/or the Middle East via Turkey to Bulgaria, Romania, Hungary, and Austria and further to Central and Western European gas markets.41 The pipeline, which will run for 3,300 km from the Turkish border with Georgia to Baumgarten in Austria, will cost approximately 7.9 billion euros, with a maximum transport capacity of 31 Bcm per year.42 On July 13, 2009, the prime ministers of Austria, Bulgaria, Hungary, Romania and Turkey signed the Intergovernmental Agreement (IGA) as transit countries for Nabucco in a ceremony attended by governmental and other official representatives, including the European Commission’s President Jose Manuel Barroso and Energy Commissioner Andris Piebalgs.43 Nabucco’s IGA made the consortium increase efforts to find suppliers for the proposed pipeline as the consortium is still in need of finding suppliers other than Azerbaijan.

It is possible to see Turkey as an emerging gas transit country, yet it is not the only option for countries such as Azerbaijan, as the White Stream pipeline project points out

Countries such as Ukraine are also interested in Caspian gas, which may help them reduce their dependence on Russia. This is exactly what the White Stream pipeline project (proposed by Ukraine in 2005) aims to do.44 This pipeline would start from Georgia and reach Ukraine and Romania probably via the Black Sea. Azerbaijan may become interested in supplying gas to this pipeline if it cannot acquire the terms it demands from Russia and Turkey. It is therefore possible to see Turkey as an emerging gas transit country, yet it is not the only option for countries such as Azerbaijan, as the White Stream pipeline project points out. Azerbaijan, within this framework, appears as a key country for the future of the fourth corridor.

Azerbaijan

Azerbaijan has 849 Bcm of natural gas reserves. The Bakhar field, which supplies 40% of current total production, is in decline due to a lack of additional drilling capacity. Azerbaijan, which had been importing gas from Russia, Turkmenistan and Iran until recently, promised to become an exporter after the discovery of the Shah Deniz natural gas field in 1999. The State Oil Company of the Azerbaijan Republic (SOCAR) produces 90% of Azerbaijan’s natural gas. SOCAR needs international support to develop the potential fields of Nakhichevan, Gunashli and Shah Deniz. The Shah Deniz field is the most significant one with reserves reaching 3 billion barrels of oil and 100 Bcm of gas.45 On March 12, 2001, Azerbaijan signed a gas contract with Turkey for exports between 2004-2019 starting with 1.9 Bcm in 2004, 3 Bcm in 2005, 5 Bcm in 2006, and 6.5 Bcm after 2007. The South Caucasus Natural Gas Pipeline, which starts at Baku (Azerbaijan) and passes through Tbilisi (Georgia) and Erzurum (Turkey), also known as the BTE (Baku-Tbilisi-Erzurum) pipeline,46 became operational at the end of 2006. Nevertheless, the gas flow from Azerbaijan to Turkey has remained limited and increased doubts on Azerbaijan’s capacity to supply the needs of the Nabucco pipeline. In November 2007, BP announced it had discovered a new, high-pressure reservoir in a deeper structure beneath the northern flank of the Shah Deniz field.47 This discovery will allow Azerbaijan to export 10-15 Bcm of gas to the Nabucco pipeline. Azerbaijan is interested in exporting gas to Europe if the existing BTE becomes connected to Nabucco. Having guaranteed 10 Bcm of gas from Azerbaijan, the Nabucco Consortium is still in need of 15-25 Bcm of gas to be supplied from Turkmenistan, Kazakhstan, Iran, Iraq or Egypt.

Turkmenistan

Turkmenistan’s natural gas reserves of 2,860 Bcm are quite noteworthy. Furthermore, Turkmenistan has discovered new fields in the Yashlar deposit of the Murghab basin as well as in Lebansky, Maryinsky and Deashoguzsky in addition to the giant Dauletabad-Donmez field in the Amu-Dar’ya basin, which was reported to contain almost half of the country’s proved reserves. Turkmenistan is exploring new fields not only in Darganata, in the northeastern regions, but also in the Karakum and Kyzylkum deserts with promising initial results especially in case of Osman-South Yoloten. Turkmenistan might be able to export gas to European countries if these new fields come on stream, which will necessitate cooperation with international energy companies.48

Turkmenistan currently exports natural gas to Russia via Soviet-era pipelines and to Iran via a pipeline built in 1997. Furthermore, Turkmenistan has an agreement with China National Petroleum Corporation for the exploration and field development in Sag Kenar.49 According to recent contracts, Turkmenistan was supposed to supply 90 Bcm to Gazprom and 30 Bcm to China per year starting in 2010. Turkmenistan, however, dismissed its commitment to Gazprom with a new deal which takes into account the new circumstances arising from the global financial crisis, the increase in shale gas production and the decrease in LNG prices in 2010. Despite commitments to Russia and China, Turkmenistan still says it will supply 10 Bcm (about 30% of Nabucco’s full capacity) of natural gas to Europe as was agreed in early 2008.50 It is not clear yet whether Turkmenistan will be able to supply this amount without decreasing gas flows to Russia.

Kazakhstan

Kazakhstan’s gas production was below its domestic consumption until 2008, despite 1,840 Bcm of proved natural gas reserves. Uzakbay Karabalin, president of KazMunaiGaz, reportedly said that the production of natural gas was set to rise from 29.6 Bcm a year in 2007 to 114 Bcm a year in 2020 as a result of additional production in the west of the country as well as in the Kazakh and Turkmen sectors of the Caspian.51 New discoveries, such as Tengiz, Kashagan and Karachaganak, might allow Kazakhstan to increase its proved reserves up to 2,850 Bcm and generate the boost in production mentioned by Karabalin.52 In the meantime, Kazakh consumption is expected to rise from 13.3 Bcm a year in 2007 to 18.7 Bcm a year in five years according to the optimized scenario of the government. These figures indicate that Kazakhstan is very likely to increase gas exports. However, Kazakhstan is less concerned with exporting natural gas directly to European markets. This is partially due to its established relations with Russia and largely due to its intention to sell gas to China through an emerging pipeline system, the construction of which is ongoing.

Iraq could export gas to European markets if it can cooperate with Turkey, and if Kurdish regional authorities and the Iraqi government agree on the terms of gas exploitation

Middle Eastern Prospective Gas Suppliers to Europe via Turkey

It is possible to conclude that the Caspian energy system has split into three. Azerbaijan has already committed gas to Turkey and to the Nabucco Consortium which corresponds to 30% of the full capacity of Nabucco pipeline and may be increased up to 50% if production starts soon in newly discovered fields. Kazakhstan is concerned with Russian and Chinese markets rather than Europe while Turkmenistan is interested in supplying gas to European markets by selling an amount equivalent to 30% of Nabucco’s capacity. However, this plan may have difficulties due to Turkmenistan’s agreements with Russia and China on the one hand, and the Caspian’s unresolved international status on the other. Consequently, the fourth corridor through Turkey will need additional suppliers from the Middle East or North Africa even if Turkmenistan becomes connected to European markets along with Azerbaijan.

Iran, with its second largest gas reserve in the world after Russia, is an important supplier and might also allow Turkmenistan to be included in Nabucco by having a trunk pipeline that passes through northern Iran. Iraq could export gas to European markets if it can cooperate with Turkey, and if Kurdish regional authorities and the Iraqi government agree on the terms of gas exploitation. The supply potential of Iran and Iraq can be seen as quite important in this area.

Iran

Iran is now aware that the productivity in its mature oil fields is in drastic decline and is in search of ways to establish gas trade not only with European countries but also with China and India

Iran’s 27,583 Bcm of proved natural gas reserves are the second largest in the world after Russia and natural gas production costs in Iran are remarkably lower when compared to Russia.53 Iran, however, offers a very discouraging buy-back contract type to importers. There are also other large problems, such as Iran’s insistence on its nuclear energy program and the lack of infrastructure to develop fields and transport the gas.

Iran, knowing that it did not have the means to produce and commercialize gas, put an emphasis on oil production so as to meet its OPEC quota. Since 1997, the Iranian Petroleum Ministry has taken measures (such as the maintenance of production equipment, modification of wells, drilling of development wells and development of oil fields) to prevent a decline in oil production as most of the producing oil fields in Iran were in the second half of their life span.54 The pressure fall in declining oil fields was a significant problem which limited production of the oil left in these decaying fields. Iran therefore re-injected gas into mature oil fields to increase the pressure and keep oil production up. It was reported that the injection of 25 million cubic meters of gas allowed the production of 150,000 barrels of oil.55 In other words, Iran chose a very expensive way to sustain oil production and until recently had to use its gas to do it.

Iran is now aware that the productivity in its mature oil fields is in drastic decline and is in search of ways to establish gas trade not only with European countries but also with China and India. The lack of a natural gas infrastructure in Iran increases the primary investment costs and hinders the government’s plan to become a significant exporter. Iran, despite its reserves, is a net importer of natural gas (with the exception of 2010) mainly from Turkmenistan through a 200 km pipeline completed in 1997 between Turkmenistan’s Korpedze and Iran’s Kurdkui regions.56 Iran imports upto 8 Bcm of gas per year from Turkmenistan for its domestic consumption and exports gas to Turkey by a pipeline between Tabriz and Ankara (functioning since 2001). Iran has also built another pipeline to carry natural gas to Armenia in exchange for electricity supplies.

Iran’s active natural gas field, Sarakhs, is located in the northeast. The most promising field is the South Pars, which contains almost half of Iran’s total reserves.57 Iran is committed to develop this field in cooperation with foreign companies in order to export natural gas to Europe via the Nabucco pipeline as well as to India via a proposed pipeline between Iran-Pakistan and India (IPI). The IPI would, however, face problems due to the tensions between India and Pakistan. This is why exports to, and through, Turkey are important for the future status of Iran in the world gas market.

It is very likely that Iraq will supply the Nabucco pipeline, and export 10 Bcm of gas, if the KRG can agree with the Iraqi government on the issue in due course

Iran launched a 25-phase plan to develop South Pars with multinational companies in 20 years.58 The Iranian government has made agreements with companies from Russia, China, France, Italy, the UK, Germany, the US, Japan, Turkey and Switzerland to develop its natural gas industry and framework.59 These agreements are reported to total $218 billion in the petrochemical, gas and oil sectors.60 Iran, therefore, appears to be a promising gas supplier in terms of reserves and field development potential.

Supplies from Iran, however, are still politically problematic due to the country’s insistence on pursuing a nuclear energy program, which has provoked fears in the international community about nuclear weapons proliferation. On May 17, 2010, Turkey, Brazil and Iran agreed to store 1,200 kg of Iran’s low enriched uranium – enough for a single bomb if purified to a high enough level – in Turkey where it will be then transported to another country (e.g. Russia and France) to be made into fuel and then given back to Iran in quantities to be used in reactors. The agreement was not approved by France, the US and Russia, claiming that Iran’s low enriched uranium had already exceeded 1,200 kg and Iran was still enriching uranium to a purity of 19.75 percent. On June 9, 2010, the UN Security Council approved resolution 1929 authorizing sanctions such as financial curbs, an expanded arms embargo and warned UN member states to be vigilant about a range of Iranian activities. Twelve members including the permanent five (Britain, China, France, Russia and the US) voted in favor; Lebanon abstained and Brazil and Turkey voted against. Consequently, the UN Security Council imposed a fourth round of sanctions in June 2010.61 The UN sanctions show how difficult it is for Iran to sell gas to Europe without convincing the international community of its nuclear program.

Iraq

Iraq’s natural gas reserves total 3,115 Bcm. Most of the proved reserves are associated gas. The Al Anfal natural gas deposits, 32 km from Kirkuk and 380 km from Turkey, constitute the only Iraqi gas field which is non-associated to oil production. Other non-associated fields, though with no production, are the Chemchamal, Jaria Pika, Khashm Al-Ahmar and Mansuriya fields.62 Iraq was exploiting the associated gas of the Rumaila and Zubair oil fields (the gas being transported to Zubair and Basra plants to be liquefied and processed there) until the 2003 war which caused the total collapse of gas infrastructure.63 Iraq intends to develop non-associated gas fields, with a special significance given to Al Anfal where production had started in 1990, but it remained largely undeveloped until 2003, and was then shut down due to the conditions in the country after the US invasion. Currently Iraq is reconstructing its associated gas production capacity in the Zubair and West Qurna oil fields, exploring for gas in Akas, Khor Mor, and planning to develop the Al Anfal field. Iraq is negotiating with the Turkish government for it to send the Al Anfal gas, which is being piped to the Jambur gas processing station near Kirkuk, to Europe via Turkey. In the meantime, the Kurdish Regional Government (KRG) signed agreements with several parties including the Turkish state company TPAO to develop the northern fields and to send the gas via Turkey.

Could Gazprom’s corporate expansion in Africa be conceived of as part of a Russian plan to implement a “gas containment policy” vis-à-vis Europe and expand its power against the US?

This agreement of the KRG, signed in 2009, very closely concerns the EU as the consortium that agreed on it was composed of OMV, Mol, Dana Gas and Crescent.64 This agreement makes a lot of sense regarding European supplies because two of the consortium members (OMV from Austria and Mol from Hungary) are also partners and shareholders in the Nabucco Consortium. It is therefore very likely that Iraq will supply the Nabucco pipeline, and export 10 Bcm of gas, if the KRG can agree with the Iraqi government on the issue in due course.

North Africa’s Potential of Natural Gas and LNG Exports

While the Nabucco Consortium has been looking for additional suppliers, some European countries (such as Italy, France and Spain) are in search of increasing gas imports from Egypt, Libya and Algeria. At the same time, Gazprom’s current activities to acquire shares in the production and transportation of gas in North Africa make energy geopolitics in this region more complicated. “Until recently, Algeria and Libya were off limit to foreign oil and gas companies because the first was torn by a civil war that did not sputter out until 2001, when peace accords were signed, whereas the economic sanctions against Libya were not lifted until 2003, after Libyan Leader Moammar Gadhafi agreed to pay reparations concerning the 1988 bombing of Pan Am Flight 103 over Scotland, and abandon plans to develop nuclear weapons.”65 Nowadays Africa, especially North Africa, has become a center of corporate expansion as companies from Russia and Europe are eager to sign gas agreements.

The Arab Gas pipeline, connecting Egypt with Jordan and Syria, was completed in 2008. This pipeline could be extended to Iraq to be connected with Nabucco pipeline

Gazprom’s emerging interests in Africa deserve further attention. Could Gazprom’s corporate expansion in Africa be conceived of as part of a Russian plan to implement a “gas containment policy” vis-à-vis Europe and expand its power against the US? Some analysts, such as Dempsey from the New York Times, consider Gazprom’s initiatives in North Africa (mainly in Libya and Algeria) not as corporate expansion but almost as a pincer attack on Europe.66 According to this point of view, Russia will enormously expand its geopolitical zone if Gazprom manages to secure long-terms contracts on production and/or transport. “In the highest-level U.S. visit to Libya since John Foster Dulles held talks with King Idris Senussi in 1953, Secretary of State Condoleezza Rice arrived in Tripoli on September 5th 2008 and met with the country’s revolutionary leader, Col. Muammar Gaddafi.”67 The US was now interested in developing relations with Libya in order not to allow Russia to consolidate power. “Rice’s sudden decision to join the pilgrimage to Libya reflects two recent events that are closely related: the conflict in Georgia and the Libyan decision to sign a deal with the Italian power firm ENI and Gazprom, the Russian power company which is the world’s largest producer of natural gas.”68 It is therefore necessary to examine Egypt, Libya and Algeria to understand the promises and challenges to EU energy security.

Egypt

Recent discoveries in the Nile Delta and Western Desert increased Egypt’s proved reserves up to 1,656 Bcm and supported the idea that additional possible reserves may reach 3,400 Bcm. Currently, the Abu Madi, Badreddin and Abu Qir fields contain non-associated gas and provide for almost half of Egypt’s production.69 Egypt, having already become the sixth-largest LNG exporter in the world in 2006, is planning on exporting gas to Europe after developing new fields in the Nile Delta such as the Port Fuad and South Temsah fields.70

Transport opportunities from Egypt to Europe deserve further interest within this context. The Arish-Ashkelon pipeline between Egypt and Israel was completed in 2008 and Egypt now sells about 1.5 Bcm of gas per year to Israel. The Arab Gas pipeline, connecting Egypt with Jordan and Syria, was completed in 2008. This pipeline could be extended to Iraq to be connected with Nabucco pipeline. It was originally planned that Egypt would be able to export 1 Bcm of natural gas in 2008 and 2 Bcm in 2009 through this pipeline. In the meantime, Turkey agreed with Syria to extend the Arab Gas pipeline to connect with Nabucco.71 However, this plan was suspended as “domestic upheavals in Egypt forced the government to prioritize supplies to its domestic market first, resulting in it proclaiming a moratorium on new export contracts until 2010.”72

Turkey agreed with Syria to extend the Arab Gas pipeline to connect with Nabucco

This moratorium postponed plans to supply Egyptian gas to Europe via the Arab Gas and Nabucco pipelines until 2010. Another difficulty, concerning natural gas supplies from Egypt to Europe, arises from Egypt’s plan to develop the LNG trade. The Spanish Egyptian Gas Company (SEGAS, a joint venture between Spain’s Union Fenosa, Italy’s ENI, the Egyptian Natural Gas Holding Company and Egyptian General Petroleum Corporation) is located at Damietta and has an export capacity of 7.56 Bcm a year, whereas Egyptian LNG (a joint venture among the government entities and Malaysia’s Petronas and BG, has an export capacity of approximately 10 Bcm a year.73 Egypt is also planning to build new liquefaction units in addition to its three trains to benefit from the strategic locations of Port Said and Damietta which will allow for about 17 Bcm of LNG exports to Mediterranean and Gulf countries.74 The development of the LNG industry in Egypt indicates that this country would be neither interested in nor capable of supplying natural gas to Europe in the mid term.

Libya

Libya’s proved natural gas reserves are about 1,473 Bcm. The Attahadi, Bahr Essalam, Wafa, Hatiba, Zelten, Sahl and Assumud are Libya’s most important natural gas fields.75 Libya exports its natural gas to Italy via the Greenstream pipeline, a 520 km long underwater natural gas pipeline between Mellitah (Libya) and Gela (Sicily, Italy), after processing the gas in the Mellitah plant that is fed by the Wafa (an onshore field along the Algerian border) and Bahr Essalam (an offshore field near Tripoli) fields. The Greenstream pipeline was constructed as part of the Western Libya Gas Project which was founded as a joint venture between the Libya National Oil Corporation (NOC) and Italian Eni (the project is 75% owned by Eni) in October 2004.76 Exports to Europe via Greenstream are projected to reach 11 Bcm in 2011, from 8 Bcm in 2007.

Gazprom, in 2007, bought exploration and development licenses and planned to invest $300 million in the project over the next year with the hope of cooperating with Eni to transport Libyan gas to Europe

In 1997 Libya concluded an agreement with Tunisia to export 2 Bcm of natural gas and Libya might start exporting gas to Tunisia in 2011 in accordance with this agreement. Furthermore, in 2001, NOC and Egypt’s EGPC agreed on a joint venture to construct a pipeline between Egypt and Libya to export Egyptian gas to Europe. Libya made an agreement with Shell to renovate existing LNG facilities, which were closed due to the former sanctions, and build new ones. Gazprom, in 2007, bought exploration and development licenses and planned to invest $300 million in the project over the next year with the hope of cooperating with Eni to transport Libyan gas to Europe.77 “In July 2008, Gazprom’s chief executive, Alexei Miller, met with the Libyan leader Muammar Gaddafi to buy “all future volumes” of gas, oil and liquefied natural gas available for export at market prices.”78 For some, Gazprom’s initiative aims to outmaneuver the EU’s plan to diversify away from Russian natural gas.79 “Currently, Libya and Algeria are rivals and competitors to Russia for the lucrative EU gas market; however, if any cooperation comes about either on a bilateral level or a multilateral one through perhaps the Gas Exporting Countries Forum, the EU will have precious little choice in its gas imports.”80Consequently, Algeria’s potential for supplying gas supply and for international cooperation to commercialize reserves must be analyzed in order to understand to what extent North Africa promises diversification of supplies to the EU.

Algeria

Algeria, with its natural gas reserves of 4,587 Bcm, is one the most important suppliers to European markets along with Russia and Iran. The largest gas field, Hassi R’Mel, which has been in operation since 1956, supplies 85% of total production.81 Algeria needs to bring new fields of non-associated gas on stream in order to increase its exports to Europe. In fact, Algeria is developing new fields in the Rhourde Nouss, Amenas and Salah regions.

Algeria exports natural gas to Europe via two pipelines. The trans-Mediterranean (Trans-Med) pipeline transports gas from the Hassi R’Mel field to Italy, passing through Tunisia and Sicily. It has been in operation since 1983.82 The Maghreb-Europe Gas (MEG) line, which became operational in 1996, also starts at Hassi R’Mel but transport gas to Spain via Morocco. There are three additional projects (two under construction, one proposed) to increase exports from Algeria to Europe. The Medgaz pipeline connects Beni Sarf (Algeria) and Almeria (Spain).83 This pipeline may also be extended to France. The Galsi pipeline, which is under consideration, is also planned to start at Hassi R’Mel.84 It will connect Algeria to Italy by an underwater pipeline. Gazprom is still negotiating with Sonatrach, the Algerian state-owned company, to acquire a share in this project. In the meantime, the proposed trans-Saharan pipeline, planned for completion in 2015, will transport Nigerian natural gas to Europe from Hassi R’Mel via Niger. This project requires further stability in the region, especially in Nigeria.

The EU is likely to diversify gas supplies so as to avoid becoming dependent on one producer (as in the case of Russia) or one transit country (as in the cases of Ukraine and Turkey)

In the meantime, Gazprom has become very interested in expanding its activities to African countries such as Algeria and Libya. “Gazprom recently opened an office in Algeria and Kremlin agreed to write off $4.7-billion of Algeria’s Cold War-era debt in exchange for a deal to sell Algeria weapons. Can an oil and gas deal be far behind?”85 If Gazprom manages to sign a comprehensive oil and gas agreement with Algeria (and with Libya), this will not only facilitate its exploitation of African resources such as those of Nigeria’s, but also leave the EU with fewer choices in terms of gas supplies. Nothing much of strategic significance came out of Russia’s initiatives in Algeria and Libya until recently because of some developments, such as the negative impact of global financial crisis, the increase in US production of shale gas, and relatively low LNG prices. It is not yet possible to know if Russia’s initiatives in Africa may gain momentum if gas markets start to grow as quickly as they did before the global financial crisis. Apparently, Gazprom and Russia have been trying to prepare for this possibility.

Conclusion

Energy security continues to be a vital issue for many state and non-state actors. It seems of utmost significance to adopt an inter-disciplinary approach, which looks at geo-economics along with security issues, in order understand the complicated features of international politics, especially when it comes to energy. This paper attempted to combine geo-economics with international politics to examine the likelihood of cooperation and conflict. It has indicated how geo-economic factors intersected not only with geography and trade, but also with regional relations, security concerns, and international politics.

As for practical findings, the study questioned in what ways supply-side issues have affected Europe’s energy relations with Eurasian, Caspian, Middle Eastern and African countries. The EU is likely to diversify gas supplies so as to avoid becoming dependent on one producer (as in the case of Russia) or one transit country (as in the cases of Ukraine and Turkey), and without diverging from the priorities of the international community, which will definitely concern supply candidates such as Iran.

If European gas demand increases at the rate of pre-global financial crisis levels, new pipelines from the Caspian, the Middle East and Africa will not necessarily lead to a reduction in Gazprom’s market share

Turkey has been emerging as a transit country for the fourth gas corridor to Europe whereas new pipelines from Russia and Africa are likely to contribute to European energy security. The Nord Stream and South Stream pipelines from Russia are also meant to support Gazprom’s demand security by curbing dependence on Ukraine. However, they will not necessarily mean more gas from Russia. In the same way, if European gas demand increases at the rate of pre-global financial crisis levels, new pipelines from the Caspian, the Middle East and Africa will not necessarily lead to a reduction in Gazprom’s market share. Assumptions on market shares, however, are hazy, if not contentious. Furthermore, they do not coincide with the priorities of the actors as shown by this study. Multiple pipelines lead to a question about whether they may all be built in the future. In a hypothetical situation, in which all projects are assumed to be accomplished, the EU-27 natural gas grid will include gas imports from the following: (1) Russia via the Brotherhood, Blue Stream, North Stream and South Stream pipelines; (2) Azerbaijan and northern Iraq through Nabucco and the Turkey-Greece Inter-connector (with the contingency of White Stream concerning Azerbaijan, and with possibilities of further extensions from Iran and Egypt); and finally, (3) Libya and Algeria through the Greenstream, Trans-Med, MEG, Medgaz and Galsi pipelines (with the possibility of extension from Nigeria through proposed Trans-Saharan pipeline).

This picture is theoretically possible as the reserves and field development projects of the selected countries are adequate for the projects. Practically, problems might arise due to political, economic and geopolitical concerns. The possibility of supplies from Iran will be highly linked to country’s position on the nuclear energy issue and on the European stance vis-à-vis Iran. Gazprom’s restraints concerning field development in Russia increase the significance of the Caspian and Central Asia to enable re-exports. Additional supplies from North Africa will be affected by Gazprom’s possible investments in Africa. Indeed, Gazprom’s corporate expansion strategy, designed to acquire concessions in the Caspian (Azerbaijan, Turkmenistan and Kazakhstan), the Middle East (Iraq and Iran), and North Africa (Libya, Algeria and Nigeria), will highly affect its gas export shares to Europe.

It is, within this context, possible to talk about geo-economic spatiality of European gas supplies given that (1) Russia needs Caspian and Central Asian gas (mainly from Turkmenistan) to meet domestic demand and sustain a strong position in Europe with least possible cost; (2) supplies from Iran are unlikely in the short term due to Iran’s political problems with international community on its nuclear program; (3) Iran’s status, regional clashes in Iraq, possible disagreement between the KRG and the Iraqi government and Egypt’s interest in the LNG trade raise doubts about the Nabucco Consortium’s ability to secure supplies without Russia; and (4) Gazprom’s corporate expansion, which aims at increasing market share in Europe by being involved in gas production agreements with suppliers in the Caspian, Middle East and North Africa.

European energy security will be strengthened due to new pipelines regardless whether they include the Nord Stream, South Stream, Nabucco and pipelines from Africa. This seems to be true for at least they will curb transit dependence on Ukraine. The really important issue, however, concerns the supply side because the inclusion of new countries from the Caspian and the Middle East within the European energy grid is not just a matter of energy security and can affect global security, if pipelines via Turkey facilitate solving regional problems related to Azerbaijan, Turkmenistan, Iran and Iraq. This is why supplies to Europe via Turkey entail additional strategic characteristics when compared to supplies from Russia and Africa which are based much more on the economic aspect of energy security.

Whether the EU really needs that much gas, and hence the pipelines as described in the paper, is a difficult question. Some gas pipelines will definitely be cancelled. It is not yet possible to decide how much gas European markets will need without seeing the end of the global financial crisis, and without being sure of the mid-term effects of shale gas production in the USA (and possibly in Poland), the geopolitical consequences of pipeline race, and the developments in LNG markets. Actually, and given the rise of LNG production, it appears as if European countries may prefer relying more on the LNG trade so far as geopolitical initiatives jeopardize emerging pipeline systems and increase dependency on a limited number of producers or on few transit countries. With regard to the supply side, the increasing significance of LNG can be shown in the case of Egypt where companies from Spain, France and Italy are involved in ventures to develop the LNG trade, and partially in the case of Iran where the government has started to consider the LNG trade as an alternative to pipeline projects that are confronting political difficulties.

Endnotes

- For state’s overwhelming control in Russian energy sector, see: K. Rosner, Gazprom and the Russian State (London: GMB Publishing, 2005). A. Heinrich “Under the Kremlin’s Thumb: Does Increased State Control in the Russian Gas Sector Endanger European Energy Security?,” Europe-Asia Studies, Vol. 60, No. 9, (2008), pp. 1539-1574.

- For illiberal market conditions and extensive centralization in Russia, see: R. Ahrend and W. Tompson, “Unnatural Monopoly: The Endless Wait for Gas Sector Reform in Russia,” Europe-Asia Studies, Vol. 57, No. 6, (2005), pp. 801-821. A. Spanjer, “Russian gas price reform and the EU–Russia gas relationship: Incentives, consequences and European security of supply,” Energy Policy, Vol. 35, No. 5, (2007), pp. 2889-2898.

- For the consequences of the asymmetry between liberal understanding of energy sector in Europe and the state centric illiberal environment in Russia, see: P. Aalto (ed.), The EU-Russian Energy Dialogue: Europe’s Future Energy Security (Hampshire: Ashgate Publishing, 2008). E.F. Van Der Meulen, “Gas Supply and EU–Russia Relations,” Europe-Asia Studies, Vol. 61, No. 5, (2009), pp. 833-856.

- For the geopolitical concerns stemming from European energy supply security, see: A. Correljé and C. van der Linde, “Energy supply security and geopolitics: A European perspective,” Energy Policy, Vol. 34, No. 5, (2006), pp. 532-543. A. Goldthau, “Rhetoric versus reality: Russian threats to European energy supply,” Energy Policy, Vol. 36, No. 2, (2008), pp. 686-692.

- For Turkey’s emerging role as a new energy corridor, see: M. Bilgin, “New prospects in the political economy of inner-Caspian hydrocarbons and western energy corridor through Turkey,” Energy Policy, Vol. 35, No. 12, (2007), pp. 6383-6394; M. Bilgin, “Geopolitics of European natural gas demand: Supplies from Russia, Caspian and the Middle East,” Energy Policy, Vol. 37, No. 11, (2009), pp. 4482-4491; A. Tekin and P.A. Williams, “EU–Russian Relations and Turkey’s Role as an Energy Corridor,” Europe-Asia Studies, Vol. 61, No. 2, (2009), pp. 337-356; G.M. Winrow, Problems and Prospects for the “Fourth Corridor”: The Positions and Role of Turkey in Gas Transit to Europe (Oxford: OIES, NG 30, 2009).

- A. Mañé-Estrada, “European energy security: Towards the creation of the geo-energy space,” Energy Policy, Vol. 34, No. 18, (2006), pp. 3773-3786; C. Le Coq and E. Paltseva, “Measuring the security of external energy supply in the European Union,” Energy Policy, Vol. 37, No. 11, (2009), pp. 4474-4481.

- S. Nies, Oil and Gas Delivery To Europe (Paris: Ifri, 2008).

- See, J.H. Kalicki and D.L. Goldwyn, “Introduction: The Need to Integrate Energy and Foreign Policy,” J.H. Kalicki and D.L. Goldwyn (eds.), Energy and Security: Toward a New Foreign Policy Strategy (Washington: Woodrow Wilson Center Press, 2005), pp. 1-16.

- M.T. Klare, Rising Powers, Shrinking Planet: The New Geopolitics of Energy (New York: Metropolitan Books, 2008), p. 14.

- S. Peters, “Coercive Western Energy Security Strategies: ‘Resource Wars’ as a New Threat to Global Security,” Geopolitics, Vol. 9, No. 1, (2004), p. 202.

- M. Bilgin, “New energy order and FAST principles: Premises of equitable and sustainable energy security in the 21st century,” International Journal of Global Energy Issues (IJGEI), Vol. 33, No. 1-2, (2010), p. 17.

- Ibid, pp. 4-22.

- European gas imports have tended to increase because of the expected decrease in domestic production. This assumption excludes non-conventional gas, such as shale, see: P Capros; L. Mantzos; V. Papandreou and N. Tasios, European Energy and Transport Trends to 2030 — Update 2007 (Luxembourg: Office for Official Publications of the European Communities, 2008). EU Commission, EU Commission Directorate-General for Energy and Transport, EU Energy and Transport in Figures (Luxembourg: Office for Official Publications of the European Communities, 2009), retrieved November 6, 2009, from http://ec.europa.eu/energy/

publications/doc/statistics/ part_2_energy_pocket_book_ 2009.pdf. - For technical components of natural gas, see: F.E. Banks, The Political Economy of Natural Gas (New York: Croom Helm, 1987), pp. 3-5.

- D.G. Victor; A. Jaffe and M.H. Hayes, Natural Gas and Geopolitics: From 1970 to 2040 (Cambridge: Cambridge University Press, 2006), p. 10.

- G.T. Miller, Living in the Environment (Pacific Grove: Thomson Brooks/Cole, 2005), p. 363.

- S. Basiu (ed.), The Role of Natural Gas in a Sustainable Energy Market (Brussels: Eurogas Fortemps Brussels Printing, 2008), p. 63.

- See, EU Commission, 2009.

- Ktoe: kilotonne of oil equivalent where a kilotonne describes 1000 tonnes. Toe (tonne of oil equivalent) equals 42 gigajoule (109 J) of energy released when 1 tonne of oil is burned.

- Figures on reserves and productions are from US Energy Information Agency unless otherwise stated. They are converted from cubic feet to metric system by the author, and there may be minor deviations from other sources. Data available at: US Energy Information Agency, retrieved August 8, 2009, from http://www.eia.doe.gov/oil_

gas/natural_gas/info_glance/ natural_gas.html - S.L. O’Hara, “Great Game or Grubby Game? The Struggle for Control of the Caspian,” Geopolitics, Vol. 9, No. 1, (2004), p. 148.

- U. Remme; M. Blesl and U. Fahl, “Future European gas supply in the resource triangle of the Former Soviet Union, the Middle East and Northern Africa,” Energy Policy, Vol. 36, No. 5, (2008), pp. 1627-1629.

- Estimated completion dates of pipelines may vary due to recent developments –e.g. consequences of global financial crisis, regional problems etc – and may be updated from the official websites of the consortia, firms and joint ventures.

- SOG, “Nord Stream project well on track,” Scandinavian Oil Gas, (October 24, 2008) retrieved January 15, 2010, from http://www.scandoil.com/moxie-

bm2/news/nord-stream-project- well-on-track.shtml. - Ibid.

- International Energy Agency, Natural Gas Market Review (Paris: OECD Publications, 2007), p. 40.

- J. Stern, The Future of Russian Gas and Gazprom (Oxford: Oxford University Press, 2005), p. 17.

- Gazprom Information Division, “Gazprom Management Committee Approves Progress with Investment Rationale for Comprehensive Development of Shtokman Gas Condensate Field,” Gazprom News (November 15, 2007), retrieved August 8, 2009, from http://www.gazprom.com/eng/

news/2007/11/26027.shtml. - F. Hauge, “Shtokman won’t be on stream until 2035,” Upstreamonline (April 17, 2007), retrieved August 8, 2009, from http://www.upstreamonline.com/

live/article131366.ece? service=print. - CIA “The Arctic Ocean,” The World Factbook (December 16, 2008), retrieved January 15, 2010, from https://www.cia.gov/library/

publications/the-world- factbook/geos/xq.html. - Ibid.

- A. Miller, “Gas from Shtokman to be Piped to Europe,” Gazprom News (October 9, 2006), retrieved August 8, 2009, from http://www.gazprom.ru/eng/

news/2006/10/21281.shtml. - Y. Shamalov, “Construction of first drilling platform for Shtokman field initiated,” Gazprom News (July 4, 2008), retrieved August 8, 2009, from http://www.gazprom.com/eng/

news/ 2008/07/29638.shtml. - IEA, 2007, p. 41.

- R. Kupchinsky, “Gazprom’s European Expansion Dilemma,” Eurasia Daily Monitor, Vol. 5, No. 149 (2008), retrieved August 8, 2009, from http://www.jamestown.org/edm/

article.php?article_id=2373286 . - Remme et al, p. 1634.

- M.K. Bhadrakumar, “Russia takes control of Turkmen (world?) gas,” Asia Times (July 30, 2008), retrieved August 8, 2009, from http://www.atimes.com/atimes/

Central_Asia/JG30Ag01.html. - Bilgin, 2007, p. 6390.

- Bhadrakumar, 2008.

- Russia and Gazprom had not already set new long-term prices while this article was being written.

- NC, Nabucco Consortium, Nabucco Gas Pipeline Project, Project Description / Pipeline Route (2009), retrieved September 5, 2009, from http://www.nabucco-pipeline.

com/project/project- description-pipeline-route/ project-description.html. - Ibid.

- J.M. Barroso, “Signature of the Nabucco Intergovernmental Agreement,” Press Release, Ankara (July 13, 2009), retrieved November 10, 2009, from http://europa.eu/rapid/

pressReleasesAction.do? reference=SPEECH/09/339. - P. Nino, “White Stream: Georgia’s Ticket to the Pipeline Big Time?,” Eurasianet Org (2009), retrieved September 15, 2010, from http://www.eurasianet.org/

departments/insightb/articles/ eav04 2209b.shtml. - M. Bilgin, “The Emerging Caspian Energy Regime and Turkey’s New Role,” The Turkish Yearbook of International Relations 2003, Vol. 34, (2004), p. 16.

- A.M. Koknar, “Conflict and Cooperation in Central Asia after 9/11,” A. Cohen (ed.), Eurasia in Balance (Aldershot: Ashgate, 2005), pp. 60-61.

- SPG, “Shah Deniz South Caspian Sea, Azerbaijan,” Offshore Technology SPG Media (2010), retrieved January 16, 2010, from http://www.offshore-

technology.com/projects/shah_ deniz. - Bilgin, 2004 and 2007.

- J. Roberts, “Caspian Oil and Gas: How Far We Have Come and Where are We Going?,” S.N. Cummings (ed.), Oil, Transition and Security in Central Asia (London: Routledge, 2003), p. 157.

- APS, “Egypt-Eastern Desert Operations,” APS Review Gas Market Trends (January 7, 2008), retrieved September 17, 2009, from http://www.entrepreneur.com/

tradejournals/article/ 173239294_3.html. - APS, “Kazakhstan Gas Production,” APS Review Gas Market Trends (July 28, 2008), retrieved August 19, 2009, from http://www.entrepreneur.com/

tradejournals/article/ 181878712.html. A.E. Peck, Economic Development in Kazakhstan (London: Routledge, 2004), pp. 144-182. - A.H. Cordesman, Energy Developments in the Middle East (Westport: Praeger, 2004), pp. 193-194.

- S.K. Soltani, “Injection of Gas Production of Oil,” Assaluyeh (October 14, 2005), retrieved January 16, 2010, from http://www.assaluyeh.com/

articles.php?124-en. - Ibid.

- Ibid.

- J. Aali; H. Rahimpour-Bonab and M.R. Kamali, “Geochemistry and origin of the world’s largest gas field from Persian Gulf, Iran,” Journal of Petroleum Science and Engineering, Vol. 50, No. 3-4 (2006), pp. 161-175.

- J. Javanmardi; K. Nasrifar; S.H. Najibi and M. Moshfeghian, “Feasibility of transporting LNG from South-Pars gas field to potential markets,” Applied Thermal Engineering, Vol. 26, No. 16 (2006), pp. 1812-1819.

- Reuters, “Foreign investment in Iran from 2000-2007,” Reuters (January 16, 2008), retrieved January 7, 2009, from http://www.reuters.com/

article/BROKER/ idUSL1684472920080116. - Ibid.

- L. Charbonneau and P. Worsnip, “U.N. council hits defiant Iran with new sanctions,” Reuters (June 9, 2010), retrieved September 14, 2010, from http://www.reuters.com/

article/idUSTRE6575A820100609. - T. Falola and A. Genova, The Politics of the Global Oil Industry (Westport: Praeger Publishers, 2005), p. 187.

- Ibid.

- Bilgin, 2009, p. 4490.

- E. Reguly, “The energy industry’s Mediterranean love affair,” Globe and Mail (September 9, 2008), retrieved September 15, 2009, from http://www.globeinvestor.com/

servlet/story/GAM. 20080909.RENI09/GIStory. - J. Dempsey, “Gazprom and Eni Plan Gas Pipeline in Libya,” New York Times (April 9, 2008), retrieved September 15, 2009, from http://www.nytimes.com/2008/

04/09/business/worldbusiness/ 09pipeline-web.html. - S. Macleod, “Rice in Libya: A Rare Mideast Success,” Time (September 5, 2008), retrieved January 16, 2010, from fttp://www.time.com/time/

world/article/0,8599,1839269, 00.html. - A. Talbot, “US Secretary of State Condoleezza Rice visits Libya,” WSWS (September 8, 2008), retrieved January 16, 2010, from http://www.wsws.org/articles/

2008/sep2008/rice-s08.shtml. - APS, “Egypt - Eastern Desert Operations,” 2008.

- G. Feller, “Egypt Seeks Ways To Use More Of Its Own Natural Gas,” Pipeline & Gas Journal, Vol. 233, No. 7, (2006), p. 35.

- K. Geropoulos, “Pan-Arab gas to supply Nabucco: Just a pipe dream?,” New Europe, No. 771 (March 3, 2008), retrieved September 17, 2009, from http://www.neurope.eu/

articles/83558.php. - GI, “Promising Offshore Acreage Offered in Upcoming Egyptian Licensing Round,” Global Insight (September 30, 2008), retrieved January 16, 2010, from http://www.globalinsight.com/

SDA/SDADetail14385.htm. - A. Eberhard and K. Gratwick, “From state to market and back again: Egypt’s experiment with independent power projects,” Energy, Vol. 32, No. 5, (2007), p. 735.

- Ibid.

- EIA, Libya Natural Gas (2009), retrieved September 17, 2009, from http://www.eia.doe.gov/cabs/

Libya/NaturalGas.html - Eni, “The Western Libya Gas Project, the first project that enhances the value of the Libyan natural gas through export and trading in Europe, gets underway,” ENI Media Press Release (October 7, 2004), retrieved September 17, 2009, from http://www.eni.it/en_IT/media/

pressreleases/2004/10/ Eni_the_Western_Libya_Gas_Pro_ 07.10.2004.shtml?menu2=media- archive&menu3=press-releases. - Dempsey, 2008.

- Reuters, “Gazprom offers to buy all of Libya’s gas and oil,” International Herald Tribune (July 10, 2008), retrieved September 15, 2009, from http://www.iht.com/articles/

2008/07/10/business/gazprom. php. - J. Dargin, “The More Things Change: Libyan and Russia Energy Cooperation,” Informed Insight (November 5, 2008), retrieved January 16, 2010, from http://belfercenter.ksg.

harvard.edu/analysis/ informedinsight/?p=108. - Ibid.

- M.T. Halbouty, Giant Oil and Gas Fields of the Decade, 1990-1999 (Tulsa: American Association of Petroleum Press, 2003), p. 161.

- OET, “Middle East and North Africa take growing share of EU’s gas market,” Oil and Energy Trends, Vol. 32, No. 8, (2007), p. 5.

- Regional Surveys of the World, The Middle East and North Africa 2003 (New York: Routledge, 2002), p. 136.

- A.H. Cordesman and K.R. Al-Rodhan, The Changing Dynamics of Energy in the Middle East (Westport: Praeger, 2006), pp. 333-334.

- Reguly, 2008.