Introduction

In our global world, the economic problems caused by the modern economic mind do not only affect the country where the crisis emerges. As the rate of integration in the global financial system increases, the rate of impact from crises also increases. Unfortunately, countries do not have alternatives to being in the global financial world. If they want to trade or take part in international organizations, it is imperative to be integrated into the network. Therefore, if a country wants to exist in the system, it has to bear all the negativities including financial crises.

Financial crises have many reasons, and perhaps the most important reasons. These fundamental problems are still obstacles to improving. The result is that capitalists have become the most important policymakers in the world, after the emergence of the states in Europe in the 16 th century, followed by capitalism which started with the Industrial Revolution. In a system where capital owners are so strong, it is naturally very difficult to combat the problems caused by interest, which is their main source of income.

This study aims to analyze the functioning of cash waqfs (CWs), which were able to meet both the financial and economic needs of the society. The Ottoman Empire, a Muslim state, solved social problems with mutual cooperation of, solidarity, and assistance through the waqfs (charitable foundations), although they had not established an institution for zakat , giving a prescribed amount of your wealth in charity, a compulsory action of worship one Therefore, the correct understanding of the Ottoman economic mind is also important for this analysis. The Ottoman Empire, for a long time, successfully resisted institutions such as banks, the stock market, joint-stock companies, etc., that were produced by capitalism and the capitalist mind. One of the most important organizations for facilitating this successful resistance was the CWs. For this reason, the fundamentals of which led to the success of CWs must be understood to enable us to produce solutions for modern financial problems. The CWs, which functioned properly within the framework of Islamic economics, in terms of their philosophy and functioning, became the pioneers of modern Islamic financial institutions. In this regard, the CWs can contribute to the development of Islamic finance today, which is an alternative solution to the current capitalist financial system. This study aims to show what the CWs can offer as an antidote to modern financial diseases.

Contemporary Financial Problems

To better understand the basis of modern financial problems, it is necessary to go to the era of mercantilism, which Adam Smith regarded as the forerunner of capitalism. This economic view advocates the idea that the power of countries is measured by the amount of gold and silver found in their treasuries. In other words, the richer country is the stronger one. The rationale of accumulation of wealth in certain individuals and institutions depends on the economic mind which emerged in this period. The amount of trade and the importance of trade increased, and while the need for money in the importing countries increased, precious metals such as gold and silver started to accumulate in the exporting countries. In this way, banking and financial institutions began to develop. In certain countries these developments led to the accumulation of gold and silver, of an amount which was already fixed in the market, while other countries became relatively poor. The countries that transferred the precious metals from undeveloped countries to Europe with their policy of colonization in doing so accumulated a huge amount of wealth which continued to rise with the Industrial Revolution. One of the institutions that emerged during this period was joint-stock companies. These companies, in which responsibilities correspond to their share, summarize the economic mind of the period.2 Significantly, this economic mentality, which only aimed at increasing wealth, had begun to ignore basic human values. The modern economic system is the result of a philosophy based on material prosperity and the resulting financial problems are unfortunately affecting the whole world negatively. The mechanisms of creating money and an interest system with the desire of increasing wealth –where the financial system in based– are the main reasons for the financial crises. Hence, the solution of modern financial problems will not be possible only by financial measures but also by the redefinition of the structure of the economic mindset. The modern economic and social system, which imposes more individualization without socialization, also works against peoples’ desire to help others. One of the ways to change this outlook is the waqf system which by its nature motivates people to help each other.

Mohammad Yunus announced the launch of the Grameen Credit Agricole Microfinance Foundation in Paris, on February 18, 2008. Grameen Bank is an important example of an alternative to the current financial system. THOMAS SAMSON / Getty Images

The Gap between Real Money and Bank (Fiduciary) Money

One of the most important problems of the modern financial system is the large gap between real money circulating on the market and the money that is supposed to circulate. The main reason for this anomaly is the money creation mechanism which is sustained by the debt-based financial system of banks. Banks can lend the money as a credit other than the money kept as a reserve at the central bank. The loan given is a deposit for other banks, which can then give credit from this deposit, except for the reserve ratio. At this point, the amount of cash that is available appears to increase in the balance sheets of banks. This process is a simple definition of money creation. So, it can be said that the central banks and commercial banks have a role in the money creation mechanism.3 The process of this mechanism depends on the existence of interest in the system. The interest rate mechanism that makes money from money without any effort, continues to accumulate wealth in the hands of capital owners. As a result, income injustice increases. The interest payments make the rich richer and the poor poorer.4 The interest income is paid to the capital owner continuously as rent on the capital which ultimately accumulates in certain persons or groups during this process.

The mechanisms of creating money and an interest system with the desire of increasing wealth –where the financial system in based– are the main reasons for the financial crises

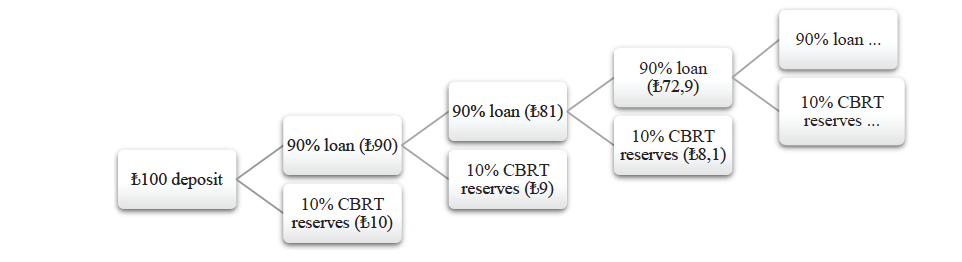

The banks are the only financial intermediary institutions in the market because there are no suitable alternatives available. Since the targets within the capitalist system are to make a profit, the banks want to give out all the deposits they collect. The reserve ratio, which the central bank sets, determines how much of the deposits, that the banks have collected can be used as loans. When this rate is lowered, the amount of loans that the banks will give out from deposits increases. In this case, more money is generated than the tangible money.5 Figure 1 shows a simple example of money creation of banks at 10 percent reserve ratio set by the Central Bank of the Republic of Turkey (CBRT) when ₺100 is deposited

Figure 1: A Simple Mechanism for Money Creation

The money creation mechanism creates a debt-based economy. A financial system in which borrowing with interest rate is more widespread than partnership models means that crises will emerge when the debts are not paid. As a result, the relationship between the real sector and the financial sector will deteriorate causing other problems in the economic system.

Disconnection between the Real Sector and the Financial Sector

The modern financial system, in which production-based financing and profit-loss sharing based partnership models are overlooked as they are not sufficiently profitable or dynamic, produces bubbles in the system and then financial crises occur. The latest financial crisis that the world witnessed, the 2007-2008 global financial crisis, was the result of the bubbles that were created by financial institutions whose appetite for profit destabilized the market. Although this crisis emerged in the United States, all the economies integrated into the global system were affected. The crisis spread in a short time through the domino effect and developing countries, like Mexico, South Africa, and Turkey, suffered especially. Although the pace of growth had slowed down, China and India were relatively less affected due to their production-based economies.6

In addition, the real sector and the financial sector have different approaches to capital. Capital is limited in the real economy because it depends on demand not supply. Buildings, equipment and other tools used for production are as valuable and important as capital in the real sector, because all of these directly contribute to the value-adding processes. As the volume of production increases, the producers need to use more capital. Even though the financial resources can be higher for investment, there will never be a high output in the financial system. Besides, the money that is saved for its own sake is worthless if it is not included in production. Savings are valuable only if they are to be used in production. Therefore, the excessive expansion of financial resources beyond the real needs of the real sector causes waste, even downsizing of the real sector.7 The overgrowth of capital, not based on production, will prevent people from being involved in real production.

The continuation of production in the real sector is very difficult in an unhealthy financial environment, where risk transfer is common but risk sharing is rare

In addition, a financial sector that breaks off its relationship with the real sector becomes open to manipulation. Scandals, such as WorldCom, Enron, Madoff, Libor, and Olympus have cost billions of dollars to people because of the financial system’s vulnerabilities. Due to the risks of manipulation and financial fraud, financial companies can collapse more easily and quicker than industrial companies. The value creation or destruction process of a financial company is more rapid than an industrial company with the derivative instruments being the primary cause of this situation. The financial derivative instruments, which are very useful in finding financing when used properly and in place, cause huge damages when used with bad intentions. Most notably the mispricing on investments leads to financial bubbles.8 The financial instruments that do not depend on the real sector and production are easily exposed to external interventions and excessively swollen ones are also one of the triggers of the financial crises. But the effects of a financial crisis are unfortunately not limited to the financial sector, as it also rapidly affects the real sector. The financial crises cause increasing costs of intermediation and loans are restricted because of the atmosphere of uncertainty. As a result, economic growth slows down and recession occurs.9 In other words, although the relationship with the real sector is disconnected, the financial crisis has a negative effect on the real sector and production. Therefore, the continuation of production in the real sector is very difficult in an unhealthy financial environment, where risk transfer is common but risk sharing is rare.

Debt-based Financial System and Preferring Risk Transfer to Risk Sharing

Banks do not have a model based on partnership, rather they ensure risk transfer for loans they give in the conventional system. The guarantee demanded from the debtor and foreclosure proceedings when the debtor does not pay debts are some examples of the risk transfer. Therefore, the lender in this system is often more advantageous. The difference between the interest rate that the lender applies when lending and the rate given when collecting deposits ensures continuous accumulation of assets and capital with the lender. Moreover, the selling of debts/loans and risks is a common situation in the current banking system.10 However, it is not permissible to sell the unpaid loans for a profit or loss to a third person in Islamic economics.11 For this reason, the borrower has left himself to the initiative of the lender in the banking system when he does not pay his debt.

Capitalist and Islamic Economic Philosophy

It is not only the financial system but the whole society which suffers from the problems established by the economic philosophy of the financial system. Since the second half of the 19th century, the increasing dominance of capitalism in the world must lead us to look at the capitalist economic mentality as the basis of current problems. While 10 percent of the world’s population lived in capitalist countries at the beginning of the 18th century, the rate had risen to 30 percent by the end of the century.12 Although the population has increased rapidly, the increase in individualization has led people to no longer consider communal interests or needs. The fact that people take care of their own interests before societies’ has inevitably led to social problems. Moreover, since capitalism originated from and is designed in Western countries, it can produce limited solutions for the economic and social life of other geographies. In other words, the capitalist mindset lacks in achieving universal reality13 because the challenges that each geography and every society face are different.

It is not only the financial system but the whole society which suffers from the problems established by the economic philosophy of the financial system

When examining the problems of the financial system, it is necessary not to concentrate only on material data. The philosophical structure of economic systems must also be analyzed. The endless desire for earning in the modern financial system is both the core and the problematic part of the system. The spirit of capitalism, which Weber describes as a Protestant ethic, has increasingly become the predominant paradigm in the world.14 Especially after the 1980s, the phrase “there is no alternative (TINA)” for capitalism has mentally captured the whole world. This imposition has caused the emerging crises to be regarded as natural and problems such as inflation and unemployment, that are caused by financial crises, are destroying social life. The capitalist economic mentality, which has distanced the financial sector from the real sector, has also torn people away from their own innate characteristic as social beings.

In contrast, Islamic economic philosophy is based on risk sharing. Warranty gains like interest income, gambling, and gharar (uncertainty) are prohibited in this system. The income of capital depends on partnership models. Thus, there is no guarantee on your returns from a capital investment. Moreover, this philosophy which is based on the following of the Sharia, that is Islamic laws, has as its basis the requirement to ensure justice and equity in society. However, in the current system so called Islamic Banks have confused these values with the conventional ideology of wealth maximization. The waqfs have traditionally been a part of this system of wealth sharing and ethical investment.

Ottoman Cash Waqf System

The meaning of the term “waqf” in Arabic is to hold, as in confinement or prohibition. This term is used to describe the holding of certain property, goods, cash, etc., and distributing their benefits for some philanthropic purposes in Islam.15 It was thought that the first waqf was founded for the Quba Mosque in Medina during the lifetime of the Prophet Muhammad. There was also a waqf that was established with seven orchards in Medina for helping the poor and the second Caliph Umar continued this tradition.16 The establishment of waqfs is based on the hadith –a saying of the Prophet Muhammad– that “when a person dies he is cut off from this world and his actions come to an end except for three things which will continue to affect him even after his death and which he leaves behind. Those are (i) the continuous act of charity, (ii) the knowledge (or book) which people will benefit from, and (iii) a dutiful child, who will pray for him.”17 Thus, people founded waqfs based on the belief that they would continue to earn sawab (spiritual merit), that is good deeds, after death.

The waqfs were very widespread during the Ottoman period and they funded educational and religious institutions (madrasahs –a type of educational institution, schools, masjids, mosques, lodges, etc.), infrastructural services (sidewalks, bridges, clock towers, etc.), and charity works (soup kitchens, student bursaries, etc.). All these services ensure that the Ottoman Empire is known as the waqf civilization. The waqfs that organized and funded the social life were also one of the determinants of economic life by both creating employment for people and funding investments. The cash waqfs are one type of waqf that provided funds for those who needed money for business purposes. They operated the money and derived income from it without applying interest. The CWs were one of the greatest contributions of the Ottomans to the waqf system. They developed in the Anatolian and Rumelia Provinces and operated for about 500 years (from the first quarter of the 15th century to the first quarter of the 20th century), with some still continuing today.

The History and Sharia-base of CWs

CWs, a successful example and a unique outcome of the flexibility of the Ottoman judiciary, were firstly practiced in the Ottoman Empire. The first CW was established by Yağcı Hacı Muslihuddin in Edirne. He devoted 10,000 akches (the main monetary unit of the Ottomans until 18th century) and some shops in 1423 to pay three employees one akche per day for reciting Qur’an at Kilise Mosque. The istirbah18 term was used for taking profit from the money, and the borrowing rate was settled as ten percent in this waqf.19

The administrative decisions and the implemented practices depended on the Islamic principles of the Ottomans. Therefore, an institution like CWs was much discussed and the establishment, functioning, and methods of generating income of the CWs were questioned by scholars. But the general belief was that the CWs were in line with Islamic law. To prove this, the views of the important Hanafi mujtahidimams (the religious authority who is able to make independent reasoning), who belong to the official religious school of the state, were used when the ulama (scholars) permitted the establishment of CWs. Their views are also available on the waqfiyahs –that is the documentation relating to the establishment of waqfs.

The waqfs were not considered as simply charitable foundations but also institutions that allowed the Ottomans to stand up to capitalism. They protected the individuals from a strong central administration and found a moderate and middle way/solution between state-centralized and competitive systems

There were a lot of discussions about CWs among Ottoman scholars. The first scholar who gave permission to CWs and wrote a treatise about it was Kemal Paşazade (1469-1534). İbn Kemal agreed that there had been a positive opinion and decision on the establishment of CWs that was taken previously by a qadi, a Muslim judge. Thus, this established a precedent and could not be ignored by other qadis.20 On the other hand, there were also scholars who were opposed to CWs. One of them was Çivizade Muhyiddin Mehmed Efendi (1476-1547) who banned the CWs in Rumelia Province.21 However, the ban could not be sustained, the widespread CWs were responding to the important needs of the community and the ban only led to the disruption of the services provided by the CWs. The view of Çivizade depended on the negative opinion of Hanafi scholars about the donation of movables as capital for the waqf.22 So, it can be said that his concerns were generally about the conditions of validity. One of the most important scholars who believed in the necessity of CWs was Ebussuud Efendi (1490-1574), in charge as Shaykh al-Islam of the Ottoman Empire for nearly thirty years. He commented on the differences between the profit rates in waqf operations and basic interest in the treatise he wrote for drawing a general framework of CWs operations. He had an important role in preventing usury in society by determining legal profit rates for CWs.23 Another scholar Bâlî Efendi (d.1553) supported that CWs were crucial institutions for society because educational, religious and infrastructural services were funded by CWs. Thus, after the ban of CWs in Rumelia for three years, he wrote letters to the Sultan that had an important role in making CWs legal again. The letters show the functions of the CWs clearly by describing the problems that occurred after the implementation of the ban.24 The general view among the Ottoman scholars was positive regarding the establishment of the CWs. Here, they used the flexibility of Islamic fiqh (jurisprudence) without opposing the fundamental laws of Islam. Furthermore, it is also an indication of the scholars’ role in society, in that they were effective in both implementing the ban of CWs and then permitting them when opinion changed.

The Establishment of CWs

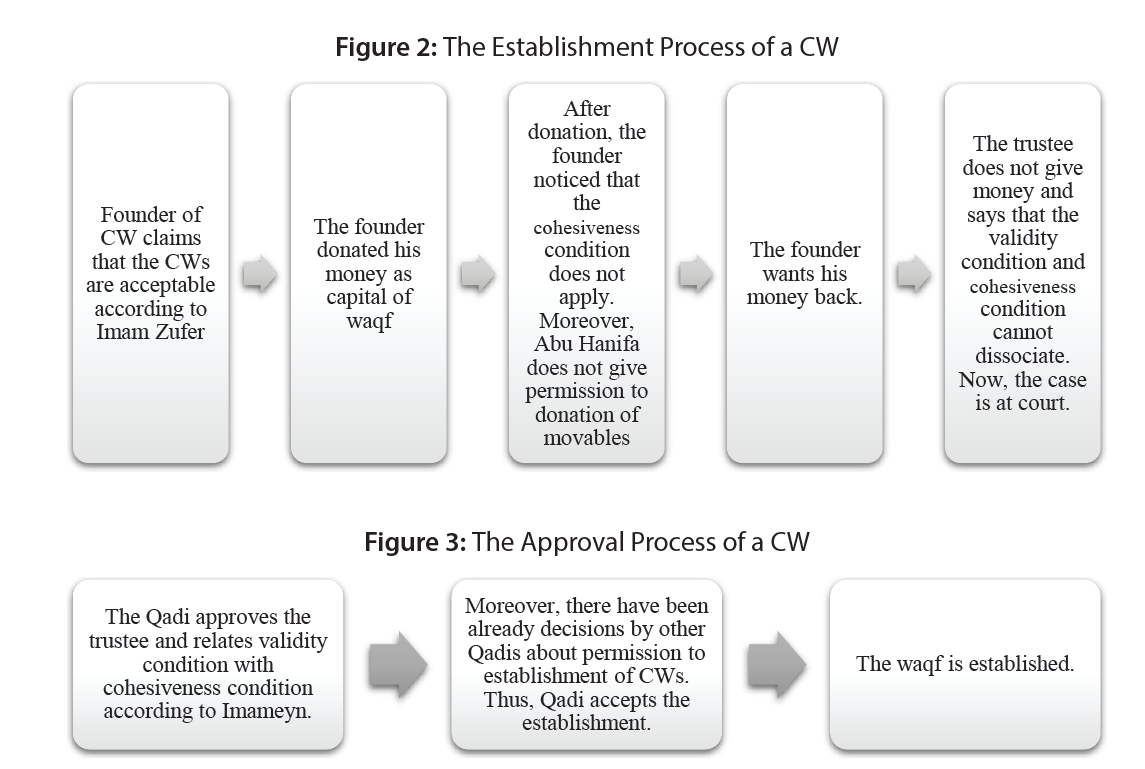

Islamic fiqh had a great influence on the establishment process therefore even the smallest details were very important as these could determine the suitability of the transactions to Islam. The waqfs can be seen as an act and there are four conditions that make an act complete: (i) occurrence, (ii) validity, (iii) gaining force, and (iv) cohesiveness.25 In the establishment process of the CWs, Ebussuud Efendi used a combination of these views: the permission to CWs by Imam Zufer, the view of Muhammad al-Shaybani on the role of customs/traditions, and the views of Abu Yusuf on the donation of movables. The view of Imam Zufer provided conditions for validity. According to Imameyn (two imams: Muhammad al-Shaybani and Abu Yusuf), validity also brings about conditions for cohesiveness.

It is important to remember that Ottoman jurists took into account the interests of the society. The reason for this flexibility is better understood if the fact that the CWs are important and necessary for the social and economic benefit of society is focused on. The establishment of CWs was ensured by a waqf establishment document, waqfiyah. Waqfiyahsare important, and they not only give a lot of information about the waqf in question but also about the social condition of society at that time. A simple waqfiyah contains (i) the aim of establishing the cash waqf, (ii) the name of the founder, (iii) the name of the trustee, (iv) the amounts of money to be devoted to the purpose, (v) the ways of using the money, (vi) the revenues and expenditures, (vii) the person who would manage it after the death of the founder, (viii) the date of registration, and (ix) the names of the jury.26 This order also shows the basic requirements for the establishment of a CW.

The Function and Importance of CWs

CWs aimed to serve society and funded many institutions and services from religious to educational, infrastructure to health, and also had an important role in the economic and financial life of the society. Therefore, the waqfs were not considered as simply charitable foundations but also institutions that allowed the Ottomans to stand up to capitalism. They protected the individuals from a strong central administration and found a moderate and middle way/solution between state-centralized and competitive systems. So, the waqf system was balanced and worked to ensure a fairer equilibrium for society by setting up a method for income distribution. Moreover, the waqfs were primarily established for the needs of the local society, thus they were also locomotives of regional development.

Soldiers, governors, and government employees with fixed income, do not qualify for loans. This condition is an indication that CWs aimed to provide for production-based financing rather than consumption

All public services were funded with income from the waqfs and the continuity of services was ensured with this regular income. The main functions of waqfs can be ordered as: (i) preventing violations to individual property rights by the strong central administration, (ii) protecting and funding the heritage of Islamic civilization for centuries, (iii) providing support to taxes during a crisis period, (iv) providing unity for land that could otherwise be divided through the Islamic law of succession, (v) providing pensions for old age and disability, (vi) providing a primitive social security system and insurance, (vii) preserving and building bridges, roads, harbors, lighthouses, libraries, cisterns, weirs, fountains, and pavements, (viii) providing employment, and (ix) establishing a specific system that was suitable for the Ottoman worldview.27 The CWs also operated as a microcredit institution by giving entrepreneurs cash for their needs while adhering to Islamic methods. They can be considered as a two-sided organization. One side collects cash from a philanthropist and provides loans by halal (permissible or lawful actions in Islam) methods to entrepreneurs. The other side funds charity activities, assistance, and needs of social institutions with the income from cash operations.

Ottoman CWs as Pioneers of Interest-Free Finance

All monotheistic religions –Judaism, Christianity, and Islam– ban the use of interest or usury. This ban is also clear in the Qur’an, Surah al-Baqarah.28 Therefore, there is no interest in the financial system that Islam prescribes and orders and the CWs continued their activities with this law/ban in mind.

Eight methods that were used by CWs to gain profit have been extracted from waqfiyahs. These are (i) bey‘i istiglal,29 (ii) bida‘a, (iii) purchase to rent, (iv) istirbah at Military Court, (v) mudarabah, (vi) murabahah, (vii) operations/transactions at Ministry of Awqaf, and (viii) qard.30 These methods can be considered as pioneers of modern Islamic financial instruments. In general, we encounter the terms istiglal and istirbahin the waqfiyahs. These terms mean to gain profit and income from the devoted money as waqf capital under the Islamic rules.

The CWs used Islamic financing methods as applied today. The methods also included partnership-based models. Most common partnership-based methods were bida‘a and mudarabah. Mudarabah can be described as a classical labor-capital partnership. The person or entrepreneur who asks for cash from the CW will put his labor into the partnership. When the earnings are calculated, the profit is shared between the waqf and borrower with the share rate previously determined. Thus, both the borrower and the CW gain with mudarabah transactions. As shown, mudarabahis a production-based financing model. This method, that brings labor and capital together, is now being applied in various forms, venture capital, sukuk al-mudarabah,31 etc. Bida‘ais separated from the mudarabahby one feature. It is also a partnership-based model however the borrower gives all the money borrowed together with all the profit back to the CW. So, his labor can be evaluated as charity. He could find a chance to increase his transaction volume with the cash but as all profit is returned to the CW, it is not a method for the entrepreneurs who need cash.

Muslims are the ones who will solve today’s financial problems with both the institutions they have historically established and the Islamic economic philosophy

It is a fact that all CWs did not work with the partnership model. Some of the methods used by CWs to reduce transaction costs are nowadays problematic in terms of Islamic fiqh. One of these methods is inesale32 where a commodity or a good sold for a term is rebought at a lower price so providing cash to the buyer. This method pioneered the tawarruk33 method used today.34 However, this method is contrary to the spirit of the CWs because it can cause financial problems in the same manner as the conventional interest system and there are debates about the likelihood of this being considered as interest. For this reason, the authors believe that the methods, that CWs will set as examples of good practice for the present day, should be methods based on partnership.

Some examples of CWs as financial institutions have been given below. Although the waqf documents do not directly convey expressions such as mudarabah, musharakah, bida‘a etc.; the condition of participating in production and trade by using funding from the CWs allows this deduction to be made. On the other hand, the mu‘âmele-i şer‘iyye (shari transactions) term in the first example brings to mind the method of ine sale, however, it is difficult to state this definitively.

Ranjit Ajit Singh, Chairman of Securities Commission Malaysia, speaks during a conference on Islamic Finance and Public-Private Partnership for Infrastructure Development on May 8, 2017 in Kuala Lumpur. CHRIS JUNG / Getty Images

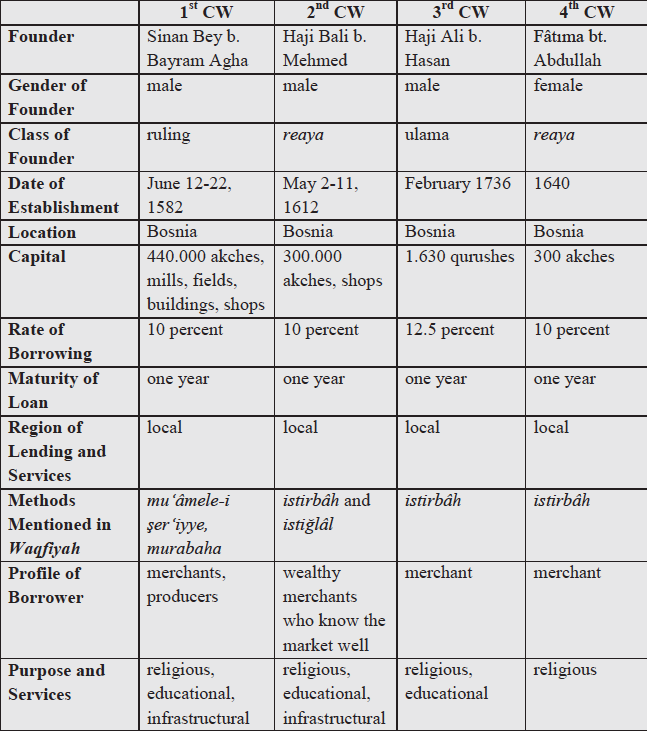

Sample CWs to Finance Production and Trade

In this part of the study, four selected examples of CWs are examined from the original waqfiyahs that were collected from the Archive of the General Directorate of Foundations. The waqfiyahs originate from the Bosnia Herzegovina region dating from the 16th, 17th, and 18th centuries, and were written in Ottoman Turkish. A waqfiyah is important because it provides information about wages of the period and prices of certain products, as well as showing the borrowing rates, methods, and services funded by waqfs.

The first example,35 which can be considered as a large waqf, was founded by Sinan Bey, son of the Bogoyna Governor, Bayram Agha, in 1582. He donated 440,000 akches and a lot of real estates.36 This CW funded expenses of staff, all kinds of needs (exhibition, illumination, etc.), meal costs of zawiyah (Islamic religious school) guests, and repair expenses of charity buildings and other buildings.37 The waqfiyah also contains a long introduction with many conditions which are important to understand the functions of the waqf. The borrowing cost ratio is determined as ten percent38 for one year. Moreover, the methods of giving money to the borrower must be carried out in a halal way. This situation is identified by the term mu‘âmele-i şer‘iyye(meaning an action of sharia). The features of borrowers are also written in detail, they must be local, experienced, and masterful tradesmen (artisan). It is stated that soldiers, governors, and government employees with fixed income, do not qualify for loans. This condition is an indication that CWs aimed to provide for production-based financing rather than consumption. There are also measures to ensure the continuity of the waqf. For example, the waqf demands a strong guarantor and a valuable mortgage from borrowers. There is a warning that people who are at risk of wasting money should be avoided. Moreover, the appointment of persons for the audit, functioning, accounting, and managing of the waqf may be included in these measures.

The Waqf of Haji Bali b. Mehmed39 was founded in 1612 for the staff wages and repair costs of the mosque and school that he built in the Hodja Bayezid Neighborhood of Mostar, two bridges that he built at Koniç and Llavtiçe on Neretva River, and a water cistern that he built on the hillside of the mountain known as Podim. The founder belonged to the reaya(ordinary) class. He devoted 300,000 akches and nine shops as the capital of the waqf. The borrowing cost ratio is determined as ten percent. Moreover, the characteristics of the borrower are provided in detail in the conditions. His transactions/trade must be trustworthy and true, he must be a rich merchant, an experienced producer, he must know the market well and have a shop in the marketplace.40 There are also measures that provide for the continuity of the waqf and the protection of capital. It is recommended that the cash is not given to merchants who are always on commercial voyages, state officials and single women. The waqf also employed some staff to manage its functioning.

The CWs that finance the production with partnership models rather than the debt-based system can be defined as Islamic financial institutions

The third example of a waqf belongs to Haji Ali b. Hasan41 who came from Stolaç but lived in Cairo. The waqf was established in 1736. Haji Ali b. Hasan devoted 1,630 qurushes (the main monetary unit of the Ottomans after 18thcentury) to build a mosque and a school as well as to cover the staff wages (imam, khatib –preacher etc.), illumination and other expenses of the mosque. Haji Ali b. Hasan was from the ulama class. The borrowing cost was 12.5 percent. It is instructed that the borrower must be honest and of the merchant class. The waqf demands both a strong guarantor and a valuable mortgage from borrowers. We can see the legalization process in the waqfiyah. First, the founder/donator gives up on the establishment process claiming that Imam Abu Hanifa does not allow the CWs. The trustee opposes this and says that Imam Zufar finds the CWs permissible and moreover Imameyn find the CWs necessary. The qadi accepts the demands of the trustee. He takes a decision firstly from the view of Imam Zufer and secondly regarding the necessity of the CWs. Like many other waqfiyahs, this waqfiyah also ends with the 181st verse of Surah al-Baqarah.42 This verse is seen as the guardian of the continuity of the waqf. Indeed, some waqfs have remained standing after the collapse of the Ottoman Empire and continued their activities even though they are not located in the resulting state, the Republic of Turkey.

Women also established waqfs in the Ottoman Empire. Fâtıma bt. Abdullah43 founded a waqf with 300 akches at Banaluka in 1640 for reading three Surah Ihlas for her soul before the dawn prayer in the Haji Perviz Mosque. The borrowing cost is ten percent and the method of operation is defined as istirbâh (taking profit). The conditions for taking a loan from the waqf are: being a merchant with a strong guarantor and a valuable mortgage.44

Evaluations of CWs Using Case Studies

As can be seen from the examples given, people from every economic and social class and regardless of their genders and locations they lived were able to establish waqfs. It did not matter if the capital was small or large and the borrowing cost was generally between 10-15 percent. However, there were a few cases that had a borrowing/financing cost below 10 percent or over 15 percent. This was very normal, as 15 percent was clarified by a decree issued in Ebussuud’s period. The fixed rate of borrowing cost provided financial stability for years. The CWs also prevented the usurers from lending money at high interest rates in the market. Table 1 shows the main characteristics of the case studies used in this paper.

Table 1: Summary of Four Case Studies of CWs

Conclusion

The basis of today’s financial problems could be said to be the distorted economic mentality of the West, the history of which goes back to the Mercantilist period. Werner Sombart emphasized the enrichment process of the West as “we have become rich because entire races, entire peoples have died for us. It was for us that continents were depopulated.”45 It is a mistake to expect from a mindset which is the basis of today’s problems to produce solutions to these same problems. Muslims are the ones who will solve today’s financial problems with both the institutions they have historically established and the Islamic economic philosophy. Especially when we look at the economic and financial crises that have emerged in history, it can be seen that a capitalizing economic mentality is at their foundation. Continuous acquisition and motivation for enrichment, unfettered material and financial appetite, an imposed perception that humans are rational and only pursue wealth for their own self-interest (Homo Economicus) are some examples of the features of this negative economic philosophy. Recently, the size and number of studies on this problem have increased in the literature about mainstream economics. Award-winning studies are generally on institutional and behavioral economics, while studies examining the relationship between ethics and economics have visibly increased. Even the Wall Street Journal published an article on waqfs that suggested they provided a connection between the billionaires and the middle class, with the functions and services of the waqfs being emphasized in this article.46 However, all of these studies are subject to criticism. There does not appear to be a desire to change the whole system. In other words, the fact that the system produces the problem itself has not yet been acknowledged. In addition, the current financial system does not allow other systems to be created as alternatives. It allows alternative systems to live in a way that must be integrated under its own constitution and control. For this reason, a strong theoretical infrastructure of the Islamic economic and financial structure, which will present a real alternative to the current interest based system, needs to be established. Islamic scholars need to analyze well the practices and institutions in their history for this theoretical infrastructure to be successfully realized in the current climate. In particular, the CWs, which were very active in the Ottoman period, should not be overlooked as they could provide an important alternative for many years to current financial and economic systems of the West.

The waqfs, which are locomotives of regional development, prevent the waste of resources by their need-centered structure

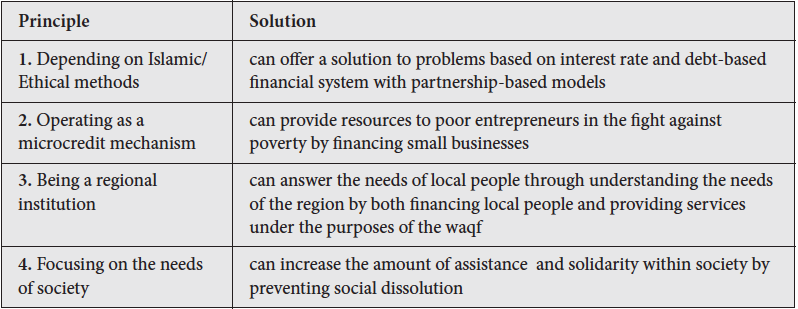

In the period when the European states acquired many colonies around the world which fed their capitalist economies back home, the Ottomans were not colonized nor did they colonize despite being very close to Europe. They even aided the poor, exploited states who approached them for help and this can be attributed to the Ottoman economic outlook. The CWs, as a result of Ottoman economic philosophy, put their charitable purposes first. However, there is a financial dimension of the CWs and thanks to this, Muslim traders, producers, and entrepreneurs had the chance to borrow following halal methods for many years. This model can be thought of as an altruistic finance system. Four main principles of CWs can be deduced and defined the model as altruistic finance47 and the solutions that they provide are shown in Table 2.

Table 2: Basic Principles of Ottoman CWs

The first principle produces solutions to the problem of economic bubbles with their corresponding boom and bust cycles in the modern financial system. The CWs that finance the production with partnership models rather than the debt-based system can be defined as Islamic financial institutions. There are also conditions about avoidance of interest in the waqfiyahs. However, the CWs differ from the Islamic financial institutions in profit distribution. The founders do not take profit or benefit from the transactions because the money they donated is completely out of their possession so the profit is spent for the waqf. The CWs are a mechanism that does not make a profit for the founder but serves both for the waqf as well as benefitting borrowers from the waqf. As it can be seen, CWs operating with Islamic financial principles will not produce artificial financial bubbles. In addition, the detailed definition of the people who are permitted to borrow from the waqf will prevent the problems such as unethical behavior, adverse selection, and asymmetric information.

Globally many efforts are being made to reduce poverty and ensure sustainable development. Various projects have been developed with respect to this, for example, the 2006 Nobel Peace Prize was given jointly to Muhammad Yunus and the Grameen Bank, which was founded by Yunus, for their work on microcredit and microfinance and their efforts to create economic and social development.48 Moreover, the United Nations (UN) declared 2005 as the International Year of Microcredit. As we have seen, studies on struggles against poverty have evolved to encourage the poor to build new businesses rather than simply giving them social assistance and benefits. CWs similarly did not give out large loans in the period they were active and borrowers from these foundations were often small entrepreneurs. In other words, these waqfs, which are also the pioneers of the microcredit mechanism, have the potential to be able to reduce poverty and achieve sustainable development.

If the Islamic world is looking for a solution to its problems, then the solution is in its history. Islamic societies longing for their glorious past have to make an in-depth analysis of the institutions and practices from their history

The 3rd and 4th principles are more often associated with social problems and the identification of these problems. Those who live in a particular region are best able to know the problems and needs of that region. The waqfs established even in the most remote villages in the Ottoman period provided a great deal of localization. Likewise, borrowers from the waqf were selected as local artisans or traders. The audit cost and risk were reduced with this method. Hence, the waqfs contributed to development in their regions both economically and socially. The waqfs, which are locomotives of regional development, prevent the waste of resources by their need-centered structure.

The problems in the financial world arise due to the increasing and deepening of the gap between the financial and the real sector. As the capital of the capital-owners grows because of the interest system, the borrower who is the real producer becomes increasingly poor. The transfer mechanism of wealth that is caused by interest is not fair. It is necessary to establish a system that will ensure that this transfer is fair and ethical. One of the institutions that will establish it is the CWs that embrace Islamic financial principles and do not have the ambition to over-profit. If the Islamic world is looking for a solution to its problems, then the solution is in its history. Islamic societies longing for their glorious past have to make an in-depth analysis of the institutions and practices from their history. Those institutions which will help the Islamic world overcome the problems caused by the modern financial system and which are appropriate to Islamic values must be restored to their former power.

Endnotes

- Surah at-Tawba (9:60): Zakah expenditures are only for the poor and for the needy and for those employed to collect [zakah] and for bringing hearts together [for Islam] and for freeing captives [or slaves] and for those in debt and for the cause of Allah and for the [stranded] traveler – an obligation [imposed] by Allah. And Allah is Knowing and Wise. / Surah Fussilat (41:7): Those who do not give zakah, and in the Hereafter they are disbelievers.

- Nurullah Karta, “Avrupa Merkantilizm ve Osmanlı Ekonomisi,” Uluslararası Hakemli Beşeri ve Akademik Bilimler Dergisi, Vol. 4, No. 11 (2015), pp. 130-146.

- Katalin Botos, “Money Creation in the Modern Economy,” Public Finance Quarterly, Vol. 61, No. 4 (2016), p. 444.

- Grah Hodgson, “Banking, Finance and Income Inequality,” Positive Money, (2013), retrieved September 17, 2018, from http://positivemoney.org/wp-content/uploads/2013/10/Banking-Finance-and-Income-

Inequality.pdf. - Richard E. Towey, “Money Creation and the Theory of the Banking Firm,” The Journal of Finance, Vol. 29, No. 1 (1974), pp. 68-69.

- Sher Verick and Islam Iyanatul, The Great Recession of 2008-2009: Causes, Consequences and Policy Responses, (Bonn: The Institute for the Study of Labor (IZA), 2010), p. 5.

- Hartmut Elsenhans, Saving Capitalism from the Capitalists: World Capitalism and Global History, (New Delhi: SAGE Publications, 2015).

- Raghuram G. Rajan and Luigi Zingales, Saving Capitalism from the Capitalists: Unleashing the Power of Financial Markets to Create Wealth and Spread Opportunity, (New York: Crown Business, 2003).

- Franklin Allen and Douglas Gale, “Financial Contagion,” Journal of Political Economy, Vol. 108, No. 1 (2000), p. 2.

- Rustom M. Irani and Ralf R. Meisenzahl, “Loan Sales and Bank Liquidity Risk Management: Evidence from a U.S. Credit Register,” Divisions of Research & Statistics and Monetary Affairs, (2005), pp. 1-2.

- “TKBB, Alacakların (Borçların/Deynin) Satımı Uygun mudur? [Is It Permissible to Sell the Receivables (Debts/al-Dain)?], (2015), retrieved July 8, 2018, from https://www.katilimbankaciligi.com/category/para-ticareti/.

- Beşir Hamitoğulları, Çağdaş İktisadi Sistemler – Oluşum ve Değişim Aşamaları ile Strüktürel ve Doktrinal Bir Yaklaşım, (Ankara: Ankara Üniversitesi Basımevi, 1982), p. 189.

- Ahmet Tabakoğlu, “İslâm İktisadı Metodolojisi,” in İsmail Kurt and Seyit Ali Tüz (eds.), İslâmî İlimlerde Metodoloji/Usûl Mes’elesi II, (İstanbul: Ensar Neşriyat, 2005), p. 1153.

- Max Weber, The Protestant Ethic and the Spirit of Capitalism, translated by Talcott Parsons, (London & New York: Routledge – Taylor & Francis Group, 2001).

- Monzer Kahf, “Waqf: A Quick Overview,” (2015), retrieved October 5, 2017, from http://monzer.kahf.com/papers/english/WAQF_A_QUICK_OVERVIEW.pdf.

- Paul Stibbard, David Russell QC, and Bromley Blake, “Understanding the Waqf in the World of the Trust,” Trusts & Trustees, Vol. 18, No. 8 (2012), p. 785.

- Syed Farouq M. Al-Huseini, Islam and the Glorious Ka’abah, (Bloomington: Trafford Publishing, 2014), p. 240.

- Istirbahmeans demanding/taking profit.

- Mehmed Tayyib Gökbilgin, XV.-XVI. Asırlarda Edirne ve Paşa Livâsı: Vakıflar, Mülkler, Mukataalar, (İstanbul: İstanbul Üniversitesi Edebiyat Fakültesi Yayınları, 1952), pp. 272-273; Jon E. Mandaville, “Usurious Piety: The Cash Waqf Controversy in the Ottoman Empire,” International Journal of Middle East Studies, Vol. 10, No. 3 (1979), p. 290.

- Ali Öge, “Şeyhülislam İbn Kemal’ın Fetvaları Işığında Osmanlı İktisâdi Hayatından Bir Kesit,” İslam Hukuku Araştırmaları Dergisi, No. 16 (2010), p. 287.

- Mehmet Şimşek, “Osmanlı Cemiyetinde Para Vakıfları Üzerinde Münakaşalar,” Ankara Üniversitesi İlahiyat Fakültesi Dergisi, Vol. 27, No. 1 (1985), p. 211.

- Tahsin Özcan, Osmanlı Para Vakıfları: Kanunî Dönemi Üsküdar Örneği, (Ankara: Türk Tarih Kurumu Basımevi, 2003), p. 37.

- Mustafa Akdağ, Türkiye’nin İktisadî ve İçtimaî Tarihi, Vol.2, (İstanbul: Tekin Yayınları, 1979), p. 256.

- Tahsin Özcan, “Sofyalı Bâlî Efendi’nin Para Vakıflarıyla İlgili Mektupları,” İslâm Araştırmaları Dergisi,

No. 3 (1999), pp. 125-155. - Aydın Kudat, “Bir Finans Enstrümanı Olarak Nukud Vakfı ve In ‘Ikad Formülasyonu,” İslam Ekonomisi ve Finansı Dergisi, Vol. 1, No. 2 (2015), p. 63.

- Mehmet Bulut and Cem Korkut, “A Look at Cash Waqfs as Islamic Financial Institutions and Instruments,” in Velid Efendić, Fikret Hadžić, and Hylmun Izhar (eds.), Critical Issues and Challenges in Islamic Economics and Finance Development, (Cham: Palgrave MacMillan, 2017), p. 88.

- Bulut and Korkut, “A Look at Cash Waqfs as Islamic Financial Institutions and Instruments,” pp. 86-87.

- Surah al-Baqarah (2:275): Those who consume interest cannot stand [on the Day of Resurrection] except as one stands who is being beaten by Satan into insanity. That is because they say, “Trade is [just] like interest.” But Allah has permitted trade and has forbidden interest. So whoever has received an admonition from his Lord and desists may have what is past, and his affair rests with Allah. But whoever returns to [dealing in interest or usury] – those are the companions of the Fire; they will abide eternally therein.

- Istiglalmeans taking incomes or profit of something. This profit or income can come from the rental income by the borrower. Thus, it means that a property is rented back to its former owner.

- Mevlüt Çam, “Vakıf Müessesi ve Para Vakıfları,”Lira – Bülten Central Bank of the Republic of Turkey,(2014), p. 40.

- Sukuk al-mudarabahis used for the sukuks that are based on partnership model.

- This method is also called as beyʻü‟l-ine.

- Tawarrukis the transaction of selling a commodity that is purchased with maturity before, at spot market.

- H. Yunus Apaydın, “îne,” in İslâm Ansiklopedisi, Vol. 22, (İstanbul: Türkiye Diyanet Vakfı, 2000), pp. 283-285.

- The Waqf of Sinan Bey b. Bayram Agha, Sarajevo Gazi Husrev-beg Library, V-162184.

- A 3-roomed mill near the Çernetive River of Samabor sub-district of Çayniçeye, Hamza Ranch in the Pejtak (Prztak) Village, Çerjenive Arable Field, fields in the Viraniye Village of Düştiçe sub-district, Gurab field and its buildings on the border of Aborişte Village, 22 shops in Çayniçe, 2 tanners, 2 mills on the river that pass through the town, a Turkish bath and caravansarai in the Çerik Town of Visokoya of Zapçe District, fields in the Lojonik Village of Düstice Sub-district of Çayniçe, Baştine-i Mustafa Fields in the Selçe Village, a caravanserai and mills in the Priboy.

- A mosque, a seminary, a school and a zawiyahthat were built in the Çayniçe Town; a school in the Nekoşevişe (Tekoşevişe) Village; a masjid in the Çot Town of Nevesin; a seminary and a school in the Çertik Town of Visoko; a masjid and a bridge that were built in the Supot Town of Hersek; a caravanserai and a bridge in Piroboy, and a bridge on the Virbas River of Banaluka.

- This term is written as “onu on bir akçe hesabı” (account of eleven akches to ten akches) on the waqfiyah.

- The Waqf of Haji Bali b. Mehmed, Sarajevo Gazi Husrev-beg Library, V-150568.

- This expression is written as “muʻâmelâtı sahîh-i münʻam ve mütemevvil tüccâr-ı zevi‟l-iktidâra ve erbâb-ı sanâyiʻve ehl-i pazara ve yerlerinde dağ gibi mukîm ve muʻâmelelerinde ser ü bâğ gibi müstakîm olub” on the waqfiyah.

- The Waqf of Haji Ali b. Hasan, Sarajevo Gazi Husrev-beg Library, A-3140.

- Surah al-Baqarah (2:181): Then whoever alters the bequest after he has heard it –the sin is only upon those who have altered it. Indeed, Allah is hearing and knowing.

- The Waqf of Fâtıma bt. Abdullah, Sarajevo Gazi Husrev-beg Library V-171358.

- All case studies used in this article are retrieved from the Project of Inspection and Analysis of Ottoman Rumelia Cash Waqfs administered by Ankara Center of Thought and Research (ADAM) and Istanbul Sabahattin Zaim University (IZU) involving 14 researchers including the authors. More than 1.000 CWs were examined and latinized in this project.

- Werner Sombart, “Der Moderne Kapitalismus,” Duncker et Humblot, (1902), p. 348. The statement is in original language (German) as follow, Wir sind reich geworden, weil ganze Rassen und Volksstamme für uns gestroben, ganze Erdteile für uns entvölkert worden sind.

- Charles Landow and Courtney Lobel, “How Billionaires Can Build Bridges to the Middle Class,” Wall Street Journal , (October 17, 2011), retrieved October 17, 2017, from https://www.wsj.com/articles/SB10001424052970203914304576628893908997616.

- Mehmet Bulut and Cem Korkut, Look A Look to the Ottoman Cash Waqfs as Altruistic Finance Model, ” Conference on Philanthropy for Humanitarian Aid Philanthropy for Humanitarian Aid as A Mechanism to Alleviate Poverty and Maintain Human Dignity , (Brunei Darussalam: Sultan Sharif Ali Islamic University (UNISSA), 2017), pp. 1-14.

- Nob The Nobel Peace Prize, ”(2006), retrieved October 11, 2017, from https://www.nobelprize.org/nobel_prizes/peace/laureates/2006/.