Since the early 1970s, member states of the Organisation of the Islamic Conference (OIC) have pursued the goal of enhancing economic and commercial cooperation to improve the economic linkages and coordination among themselves and to jointly act against the global challenges facing them. Special attention has been placed on trade. Accordingly, considerable efforts have been exerted at various OIC forums to develop ways and means of joint cooperative action to increase trade among the OIC countries (“intra-OIC trade”). However, these efforts are far from sufficient as the share of intra-OIC trade in the OIC countries’ total trade was only about 17 percent in 2009. This is disappointing because most of these countries are in close geographic proximity to each other and there is a lot of potential for trade based on their respective diversity of natural resources, agricultural, and manufacture products.

The Organisation of the Islamic Conference (OIC) began as an international organization in 1969 with 23 founding member countries. Over the last 40 years, the membership of the OIC has grown steadily and the number of member countries reached 57. The OIC is now the second largest inter-governmental organization after the United Nations. The OIC countries as a group account for one fourth of the world’s total land area and more than one fifth of the total world population. In 2009, the 57 OIC countries accounted for 7.2 percent of the world total output (GDP) and 10.3 percent of world total merchandise exports, both measured in current US dollars.1 However, they are not a homogenous group in terms of their economic development. Some OIC countries are categorized as high-income countries while some others are categorized as low-income.

In 2009, the 57 OIC countries accounted for 7.2 percent of the world total output (GDP) and 10.3 percent of world total merchandise exports

The OIC rapidly institutionalized its organizational structure and modelled itself after the United Nations. It formulated an initial agenda composed of urgent political issues of common interest to its members at the time. The OIC also added on to this agenda certain basic economic issues of substance that were important for its member countries and for those that necessitated effective cooperation and joint action in the face of the global challenges of the day. The OIC economic agenda, which was started in the early 1970s, gained momentum and substance during the Second Islamic Summit in 1974 and expanded rapidly in the second half of the decade. Later on, the agenda was consolidated within the framework of the 1981 Plan of Action to Strengthen Economic and Commercial Cooperation among the Member Countries of the OIC, which has been adopted by the Third Islamic Summit Conference in response to the initiation of the Third UN Development Decade.2

Special attention has been placed on intra-OIC trade since economic cooperation was put into the OIC agenda. In this respect, efforts to enhance intra-OIC trade are crucial for at least two reasons. First, having more economic ties would strengthen the relationships among the member countries. As a result of stronger relationships, OIC countries could become a more unified group with a stronger voice in the world political arena. Second, enhancing intra-OIC trade also has economic implications for the member countries. Higher trade translates into more economic development, and hence, prosperity for the people of the member countries. The European Union is a perfect example of how economic integration among a group of countries could lead to economic prosperity, more interaction, and stronger relationships in other areas. Other international organizations such as the Association of Southeast Asian Nations (ASEAN), the Commonwealth of Independent States (CIS), or the North American Free Trade Agreement (NAFTA) also show the type of dynamism that could be created by greater integration among member countries.

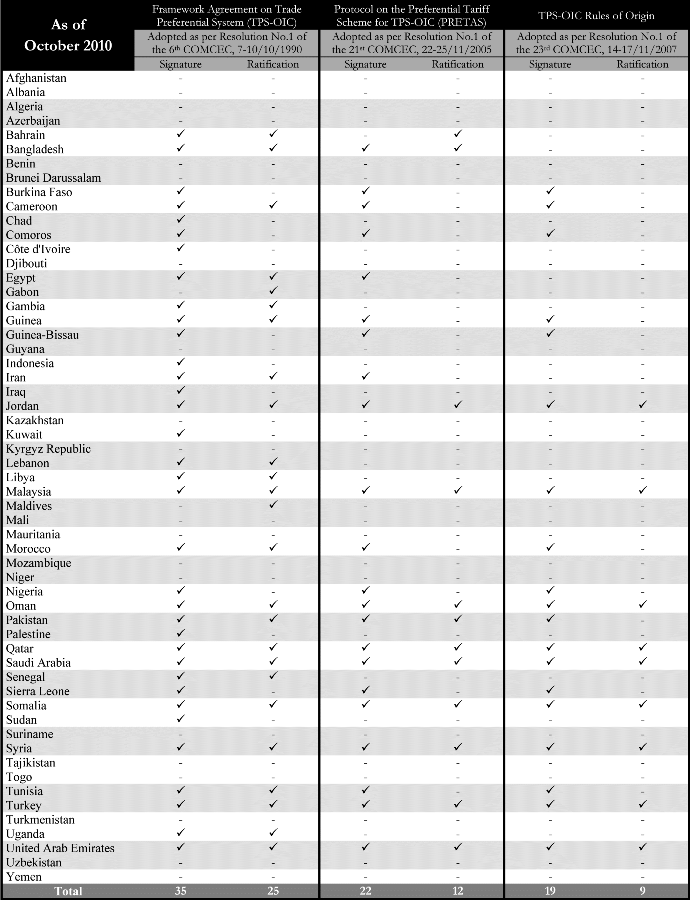

The Framework Agreement on Trade Preferential System among the Member States of the OIC (TPS-OIC), adopted by the 6th Session of the Standing Committee for Economic and Commercial Cooperation of the OIC (COMCEC) held in Istanbul, Turkey, in October 1990, is the most notable step, so far, in the direction of enhancing intra-OIC trade. The Agreement, which set up the general principles towards establishing a preferential trade system, aims at promoting trade among the member countries through the exchange of trade preferences on the basis of equal and non-discriminatory treatment among all participating member countries. Among the main features of this agreement are the most favored nation principle, equal treatment of member states, and special treatment for the Least Developed Member States.3 This agreement also allows the regional economic groups that consist of only OIC countries, to participate in TPS-OIC trade negotiations with a unified representation. However, it was not until 2002 that the Agreement became effective upon ratification by ten member states. Since, two related agreements followed in November 2005 and September 2007:

i. The Protocol on the Preferential Tariff Scheme for TPS-OIC (PRETAS): This agreement complements the Framework Agreement by laying out the concrete reduction rates in tariffs in accordance with a time-table for implementation. It also covers the removal of para-tariff and non-tariff barriers, and the application of safeguard measures.

ii. TPS-OIC Rules of Origin: After entering into force, this agreement will be used to determine the origin of the products eligible for preferential concessions under the TPS-OIC and PRETAS.

PRETAS entered into force on February 5th, 2010 after ratification by ten participating member countries while the agreement on rules of origin is still waiting for ratification by one more country.4

Enhancing intra-OIC trade was also among the priorities of the Ten-Year Programme of Action,5 which set a target level of 20 percent for intra-OIC trade to be achieved during the period covered by the Programme. This target was set to be achieved by 2015. The Programme also called upon the member countries to sign and ratify all existing OIC trade and economic agreements and mandated the COMCEC “to promote measures to expand the scope of intra-OIC trade, and to consider the possibility of establishing a Free Trade Area between the Member States in order to achieve greater economic integration” to reach the 20 percent target.

The paper is organized as follows: The next four sections are more analytical in nature and present an overview of the evolution and the current structure of the merchandise trade among the OIC countries. First, recent trends in global trade and the performance of the OIC countries are overviewed. Second, trends in intra-OIC trade in the last two decades with more focus on recent years are discussed. Top performers in the intra-OIC trade in 2009 are also considered in this section. Third, the geographical patterns of the trade flows between the OIC countries and the world as well as those among the OIC countries are studied. Fourth, commodity composition of intra-OIC trade and the top commodities are overviewed. In the final section, the highlights of the previous sections and some broad policy recommendations are discussed.

Recent Trends in Global Trade and the Performance of OIC Countries

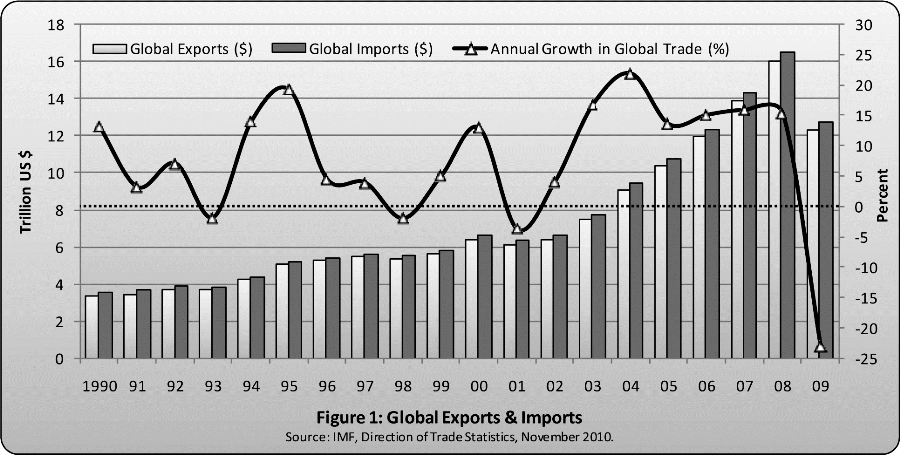

International trade has rapidly increased in the last two decades along with the broadest and deepest wave of globalization the world has ever seen. Estimates show that world merchandise trade –exports plus imports of goods– amounted to $25.1 trillion in 2009, compared to $6.9 trillion in 1990.6 In fact, global trade peaked at $32.5 trillion in 2008, in the wake of the recent global economic and financial crisis, which is widely considered as the worst since the Great Depression of 1929. With decreased global demand, accompanied by a sharp fall in commodity prices, global trade value fell 23 percent in 2009. That fall was more drastic than those experienced during the crises in 2001 (3.6 percent), in 1998 (1.8 percent), and in 1993 (1.6 percent) (see Figure 1).

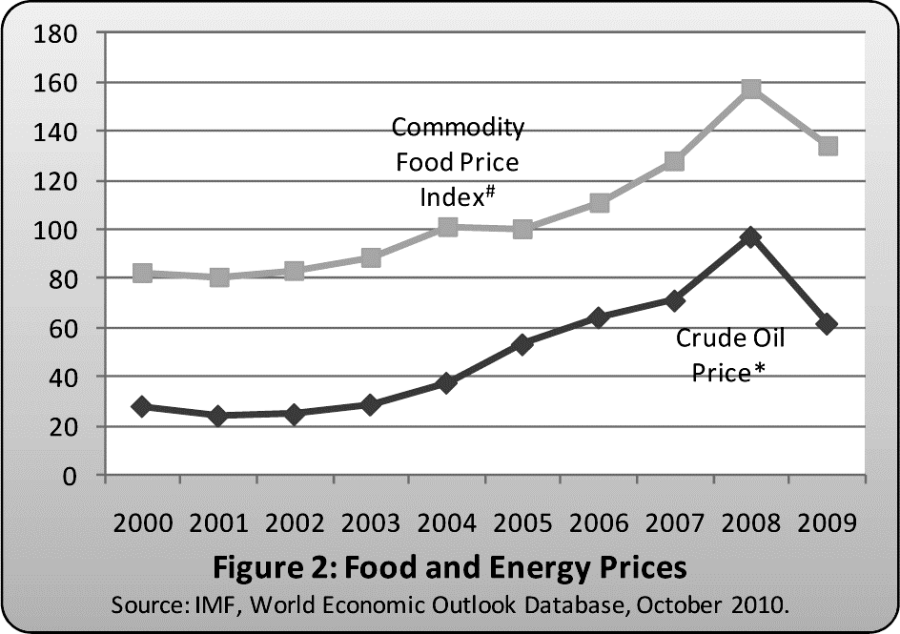

Global exports increased from $3.4 trillion in 1990 to peak at $16 trillion in 2008 before declining to $12.3 trillion in 2009 because of the crisis. In the same years, global imports paralleled exports as they increased from $3.5 trillion to peak at $16.5 trillion before dropping to $12.7 trillion (Figure 1).7 Most of the increase in exports and imports took place between the global economic downturn in 2001 and the recent global economic crisis in 2009. Global trade increased at an annual average of 14.6 percent in this period, while the increase in the period 1990 through 2000 was only 5.6 percent. The rapid increase in commodity prices, especially of food and oil, contributed largely to the expansion in both exports and imports value prior to the recent crisis, though the fall in these prices in 2009 was, on the contrary, a source of the decline in both flows (see Figure 2). Crude oil prices, on an annual basis, averaged at $97 in 2008 though this average was as low as $24 in 2001. Food prices also peaked in 2008 reaching a level on average that is almost twice as much as that in 2001. In 2009, oil prices decelerated to $62 and food prices declined on average by 15 percent from the previous year.

* Dollars per barrel. Simple average of three spot prices (APSP); Dated Brent, West Texas Intermediate, and the Dubai Fateh.

# 2005=100. Includes Cereal, Vegetable Oils, Meat, Seafood, Sugar, Bananas, and Oranges Price Indices.

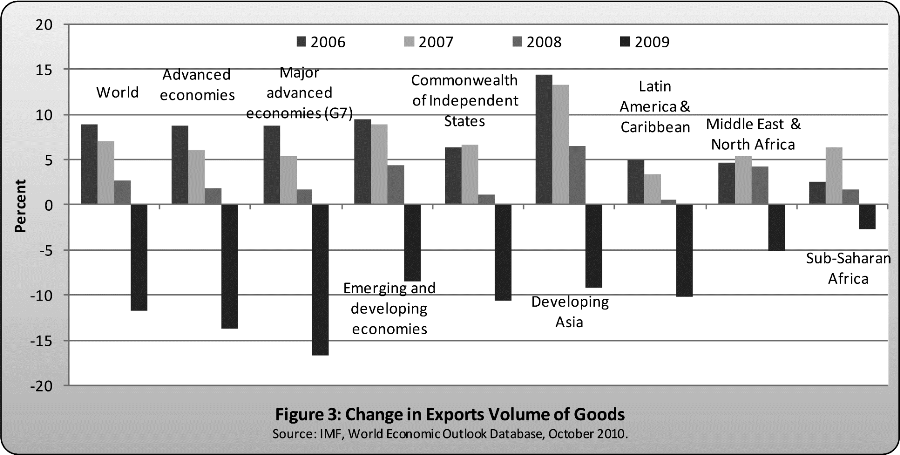

In addition to the fall in commodity prices, the decline in global demand and the credit crunch in export markets also contributed to the collapse in global trade in 2009. With all the regions around the world having witnessed a decline in their exports volume, world exports volume fell 11.8 percent in 2009. The advanced economies, particularly the G7 countries, were hit harder as compared to other groups of countries (see Figure 3).

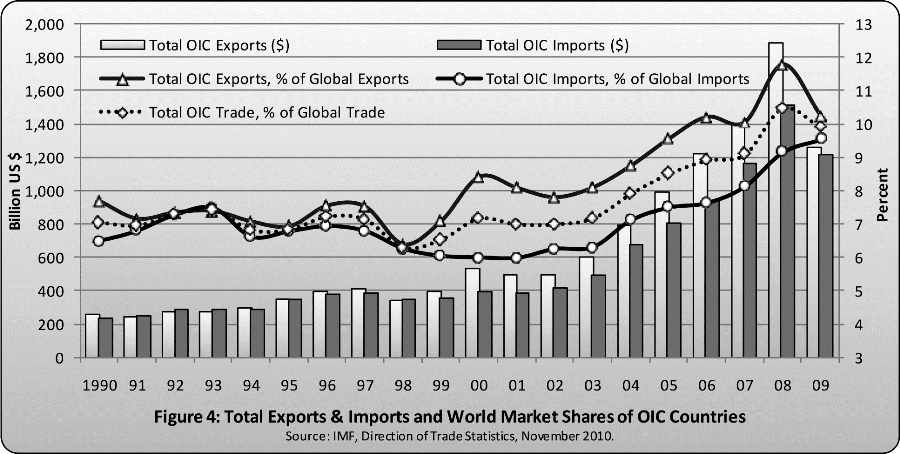

Total trade of the OIC countries dropped 27 percent from $3.4 trillion in 2008 to $2.5 trillion in 2009. Yet, it was still almost three times the level of a decade ago and five times the level of two decades ago. Until 2009, exports and imports of the OIC countries had demonstrated a significantly increasing trend after the economic downturn experienced globally in 2001 (Figure 4). Total OIC exports, reached $1.9 trillion in 2008, almost quadrupling in that seven year period while it had only doubled between 1990 and 2000. As oil accounts for a significant portion of the total exports of the OIC countries, the rapid increase in energy prices was a major source of the boost in exports in that period. In parallel, total OIC imports amounted to $1.5 trillion in 2008, four times the level in 2001 and almost seven times the level of two decades ago. After that boom, exports declined sharply in 2009 as a result of the deterioration in global demand and the sharp fall in commodity prices, particularly the price of oil. Total exports value, with 33 percent decline from the previous year, decreased to $1.3 trillion in 2009 while total imports value, with 20 percent decline, decreased to $1.2 trillion in that year (see Figure 4).

As one would expect, the growth performance in trade experienced by the OIC countries as a group, which surpassed the world average in recent years in particular, translated into an increasing share in global trade. World market share of OIC countries in trade, having fluctuated around 7 percent between 1990 and 2003, increased rapidly in the following years to reach 10.5 percent in 2008 before sliding down to 9.9 percent in 2009 (Figure 4). The share of OIC countries in global exports increased from around 8 percent in the early 2000s to 11.8 percent in 2008 but declined to 10.3 percent in 2009. Their share in global imports increased from around 6 percent to 9.2 percent in 2008. However, unlike in the case of exports, this share continued to increase in 2009, reaching 9.6 percent. The developments in 2009 indicate that exports (imports) of OIC countries were more (less) negatively affected from the crisis as compared to the world.

Recent Trends in Intra-OIC Trade

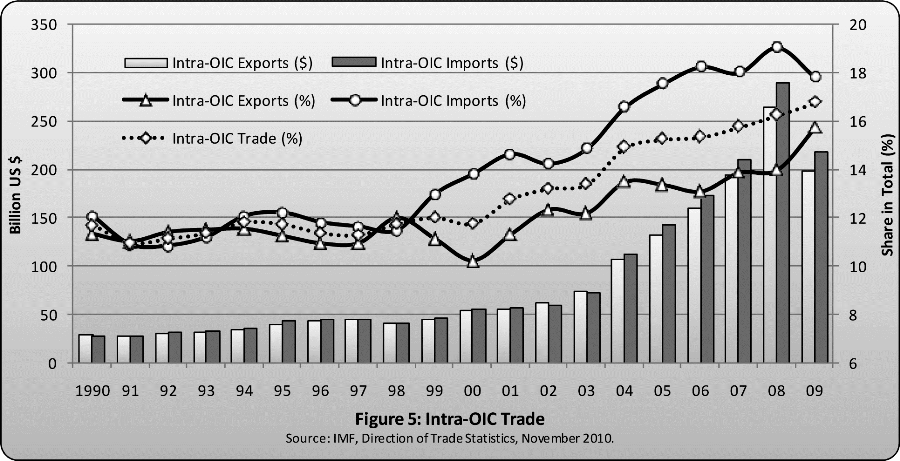

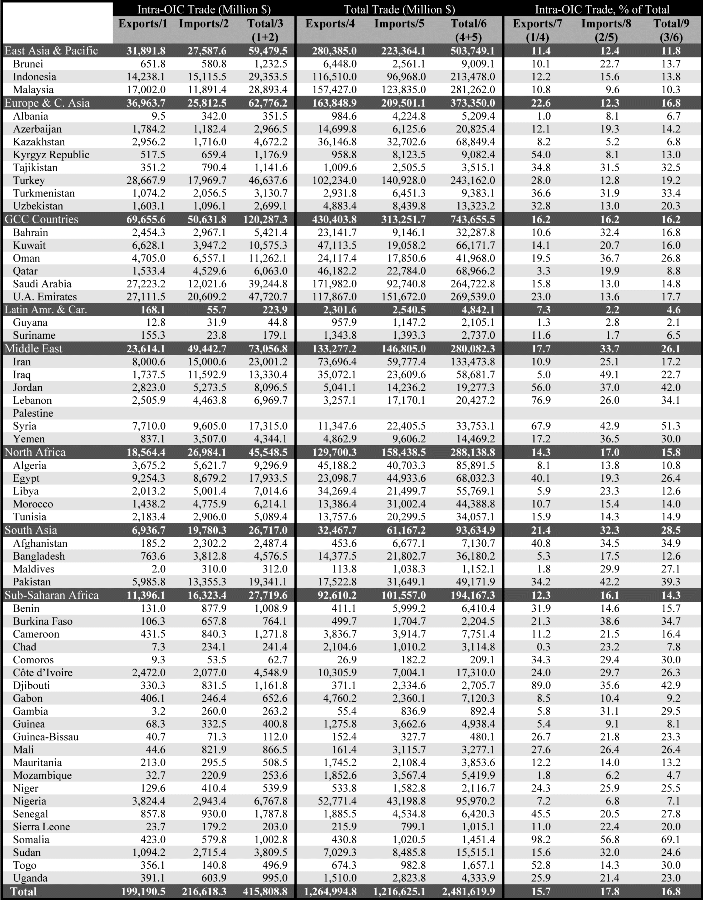

In nominal terms, trade among the member countries of the OIC (intra-OIC trade) peaked at $553 billion in 2008, almost five times the level in 2001 and almost ten times the level in 1990. With the accelerated transmission of the crisis to developing countries in 2009, intra-OIC trade decreased to $416 billion. Having amounted to only $57 billion in 2001, intra-OIC exports reached $264 billion in 2008 before declining to $199 billion in 2009. Similarly, intra-OIC imports that amounted to $56 billion in 2001 increased to $289 billion in 2008 before declining to $217 billion in 2009. (See Figure 5)

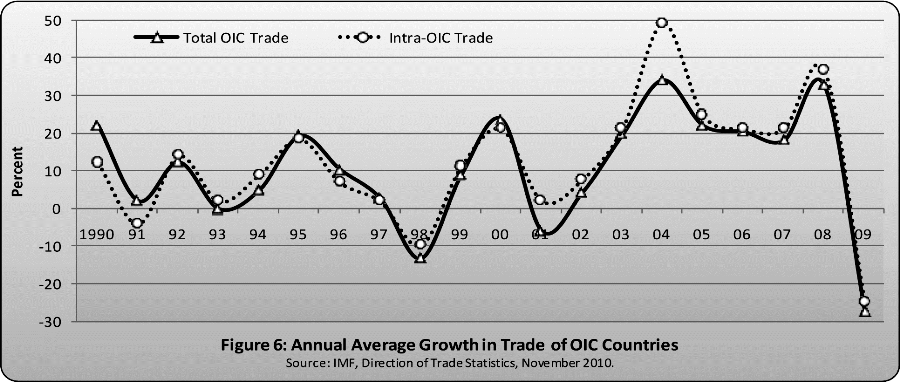

Despite the long history of the OIC, intra-OIC trade had not shown remarkable improvement until the beginning of the 2000s, representing only 11-12 percent of their total trade (Figure 5). Intra-OIC trade accelerated in the early 2000s. In 2001, intra-OIC trade was over 12 percent for the first time since 1989. This was primarily due to the global economic downturn in 2001 that resulted to the shrinking of global demand and consequently in exports of OIC countries to the world while the intra-OIC exports were not affected as much by the economic downturn. (See Figure 6) Intra-OIC trade continuously increased until 2009 to represent 16.8 percent of the total trade of the OIC countries. Intra-OIC exports accounted for 15.7 percent of the total exports while intra-OIC imports comprised 17.8 percent of the total imports. (Figure 5)

The continuous increase in the share of intra-OIC trade after 2000 indicates that the growth in trade among the OIC countries exceeded the growth in their total trade in the last decade, as shown in Figure 6. From 2001 onwards, intra-OIC trade increased, on average, by 18.2 percent while the increase in total trade remained at 14.3 percent. In 1990 through 2000, those rates were 6.3 percent and 7.0 percent, respectively. Consequently, the higher increase in intra-OIC trade relative to total trade of the OIC countries, as would be expected, translated into an increase in the share of intra-OIC trade.

Despite the recent improvement of intra-OIC trade in both volume and share in total trade, there is still a concern about the possibility to meet the target of 20 percent by 2015. Indeed, under the current patterns in OIC countries’ trade and given the recent growth rates in particular, it seems unlikely to reach that target on time. From the adoption of the Ten-Year Programme of Action in 2005 to 2009, total trade of OIC countries grew at an annual average of 13.3 percent while this rate was 2.6 percentage points higher for intra-OIC trade. In order for the share of intra-OIC trade to reach the target by 2015, the annual average growth in intra-OIC trade will need to exceed that in total trade of the OIC countries by at least 3.4 percentage points.

Top Performers in Intra-OIC Trade

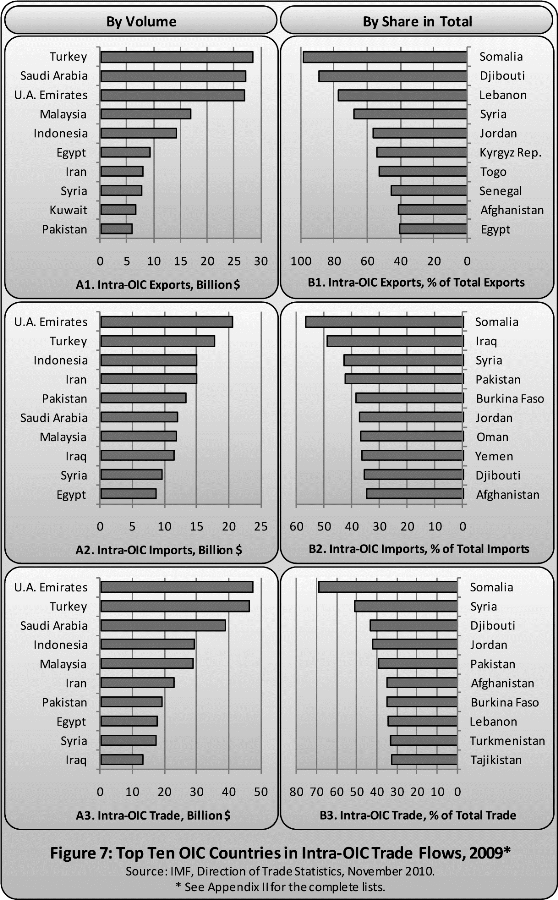

Although intra-OIC trade has increased in value significantly in recent years, most of that increase actually originated from a limited number of countries. In 2009, 76 percent of the intra-OIC exports were undertaken by only ten OIC countries (Figure 7.A1). Turkey took the lead with $29 billion or 14.4 percent of the total intra-OIC exports, followed by Saudi Arabia ($27 billion), United Arab Emirates ($27 billion), and Malaysia ($17 billion). However, it is worth noting that, despite those high volumes, the average share of intra-OIC exports in total exports of those top-ten countries was only 18.1 percent.

On the contrary, some OIC countries with relatively low volumes of intra-OIC exports reported higher shares of intra-OIC exports in their total exports. For instance, let us consider the top ten countries in terms of the share of intra-OIC exports in total exports. The share of exports from these ten countries to all OIC countries averaged 52.5 percent. On the other hand, these ten countries accounted for only 12.5 percent of the total intra-OIC exports, that is, these countries are relatively small in terms of their trade values within the OIC region. Somalia took the lead with 98.2 percent of its exports going to OIC countries while Djibouti also recorded a share close to 90 percent (see Figure 7.B1).

Similar patterns can also be seen in intra-OIC imports. Ten countries, the same countries as in the case of exports except for Iraq replacing Kuwait, accounted for 62.7 percent of the total intra-OIC imports in 2009. United Arab Emirates took the lead with $21 billion or 9.5 percent of the total intra-OIC imports, followed by Turkey ($18 billion), Indonesia ($15 billion), and Iran ($15 billion) (Figure 7.A2). Yet again, the share of intra-OIC imports in the total imports of the top-ten countries averaged at 17.2 percent.

On the other hand, as in the case of exports, there were countries with relatively lower volume of intra-OIC imports but with higher shares of imports from the OIC countries. For example, in Somalia, the share of intra-OIC imports in total imports was over 50 percent, that is, more than half of their imports were from the OIC countries. In Iraq, Syria, and Pakistan, that share exceeded 40 percent while Burkina Faso, Jordan, Oman, Yemen, Djibouti, and Afghanistan also recorded shares over 35 percent (Figure 7.B2). Overall, those ten countries accounted for only one-fourth of the total intra-OIC imports but the average share of intra-OIC imports in their total imports was as high as 41.4 percent.

The ten OIC countries with the largest intra-OIC trade volumes, namely, the United Arab Emirates, Turkey, Saudi Arabia, Indonesia, Malaysia, Iran, Pakistan, Egypt, Syria, and Iraq accounted for 68 percent of the total intra-OIC trade in 2009 (see Figure 7.A3). However, the share of intra-OIC trade in total trade was above 20 percent only in four of these top ten countries: Syria (51 percent), Pakistan (39.3 percent), Egypt (26.4 percent), and Iraq (22.7 percent). This share averaged at 15.3 percent for the other six countries on the top-ten list. Syria and Pakistan were also among the top-ten OIC countries with the highest share of intra-OIC trade in total trade in 2009 (Figure 7.B3). The average share for those ten countries was 41.2 percent though they accounted for only 14.8 percent of the total intra-OIC trade. The highest share, recorded by Somalia, reached up to 69 percent. The other countries that ranked in the top ten are Syria, Djibouti, Jordan, Pakistan, Afghanistan, Burkina Faso, Lebanon, Turkmenistan, and Tajikistan.

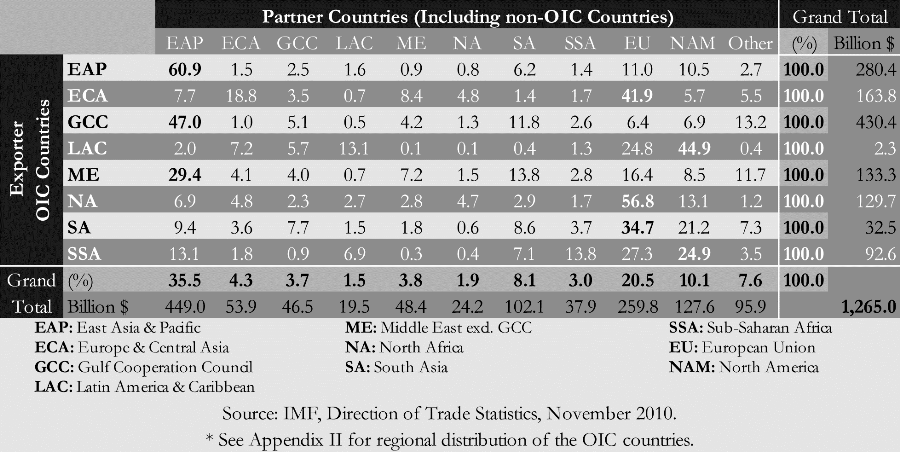

In 2009, more than one-third of the total exports of the OIC countries went to countries in East Asia & Pacific. The European Union and North America were also major destinations for the exports

Direction of the Trade

Understanding the geographical patterns of the trade flows among the OIC countries may be of particular importance to formulate strategies or policies to enhance intra-OIC trade. This section, in this regard, provides an overview of the regional distribution of both total and intra-OIC exports and imports by source and destination.8

For the purpose of understanding regional flows of exports and imports, the world is divided into 11 sub-regions: East-Asia & Pacific, Europe & Central Asia (excluding EU countries), Gulf Cooperation Council countries, Latin America & Caribbean, Middle East (excluding GCC), North Africa, South Asia, Sub-Saharan Africa, European Union, North America, and the others. The same sub-regions are also used to group OIC countries. Note that all the OIC countries are located in one of the first eight sub-regions (see Appendix II).

Direction of the Exports

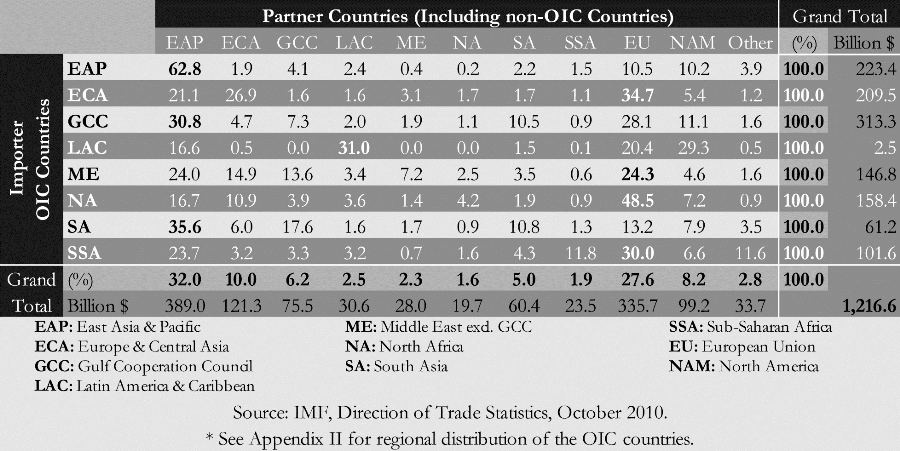

In 2009, more than one-third of the total exports of the OIC countries went to countries in East Asia & Pacific. The European Union and North America were also major destinations for the exports, receiving, respectively, 21 percent and 10 percent of the total exports from the OIC countries (Table 1). As a result, two-thirds of the exports were destined to those three regions, which could clearly be considered as the main export markets for the OIC countries.

Table 1: Direction of Exports of OIC Countries by Region,* 2009 (percent)

The European Union is the largest exporting market for four OIC sub-regions: Europe & Central Asia, North Africa, Sub-Saharan Africa, and South Asia. Geographical proximity and multilateral trade agreements are the major factors explaining why the European countries are the largest exporting market for these regions. East Asia & Pacific region, on the other hand, is the largest exporting market for three OIC subgroups: East Asia & Pacific, Middle East,9 and GCC. Geographical proximity and trade agreements explain why East Asia & Pacific is the largest exporting market for the OIC countries from the same region. On the other hand, oil export is one of the main reasons why East Asia and Pacific is the largest exporting market for the OIC countries in the GCC region. For instance, China is one of the countries in East Asia and Pacific region with high oil demand. The largest exporting market for the OIC countries in Latin America & Caribbean is North America (see Table 1). This can at least be partially explained by the geographical proximity of these OIC countries to North America.

In 2009, more than half of the imports of the OIC countries came from East Asia & Pacific (32 percent) and the EU (28 percent), indicating that these two regions are the major import markets for many OIC countries

Regional distribution of intra-OIC exports by origin is considered next. Of the total $199 billion of intra-OIC exports in 2009, 35 percent originated from the GCC countries. Member countries in Europe & Central Asia, East Asia & Pacific, and the Middle East, as groups, contributed to that amount with 19 percent, 16 percent, and 12 percent, respectively, while the other regions each accounted for less than 10 percent of the total intra-OIC exports (Table 2, the last column on the right).

Regional distribution of intra-OIC exports by destination reveals that almost one-fourth of the intra-OIC exports (23.4 percent) went to the GCC countries while another 22.8 percent were destined to the other Middle Eastern member countries. In other words, almost half of the intra-OIC exports were directed to the OIC countries in the Middle East.

Unlike in the case of total exports, intra-OIC exports usually have high intra-regional patterns. In each of East Asia & Pacific, North Africa, Sub-Saharan Africa, and the Middle East as well as the GCC, the majority of intra-OIC exports were destined to other member countries from the same region. Accordingly, in 2009, intra-regional exports among the OIC countries reached up to 64 percent in Sub-Saharan Africa, slightly more than 40 percent in East Asia & Pacific, 40 percent in the Middle East, 33 percent in North Africa, and 31 percent in the GCC region. Moreover, in Europe & Central Asia and South Asia, where exports to other regions are higher than intra-regional exports, the share of intra-regional exports among the OIC countries is as high as 28-30 percent. Therefore, one could argue that geographical proximity is very important for intra-OIC exports in almost all the regions.

The GCC countries are an important destination of intra-OIC exports for almost all OIC sub-regions. For instance, 78 percent of the total intra-OIC exports of Latin American members went to GCC countries. That share reached almost 36 percent for South Asian members and 22 percent for both East Asia & Pacific and Middle Eastern members. Other than the GCC, the Middle East and Europe & Central Asia are also important destinations for inter-regional exports among the OIC countries. For instance, around 20 percent of the total intra-OIC exports of the Middle Eastern and North African members went to the OIC countries in Europe & Central Asia while over one-fourth of the total intra-OIC exports from Europe & Central Asia and the GCC were destined to the member countries in the Middle East (see Table 2).

Table 2: Direction of Intra-OIC Exports by Region,* 2009 (percent)

Direction of the Imports

In 2009, more than half of the imports of the OIC countries came from East Asia & Pacific (32 percent) and the EU (28 percent), indicating that these two regions are the major import markets for many OIC countries. Europe & Central Asia was another source providing 10 percent of total intra-OIC imports while North America and the GCC provided, respectively, 8 percent and 6 percent (see Table 3).

Table 3: Direction of Imports of OIC Countries by Region,* 2009 (percent)

Two-thirds of the imports of the OIC countries in East Asia & Pacific were from their own region. Members in South Asia as well as the GCC countries made the majority of their imports from countries in East Asia & Pacific. Their imports from the region accounted, respectively, for 36 percent and 31 percent of their total imports. The EU provided the majority of the imports of the members in North Africa (49 percent), Europe & Central Asia (35 percent), Sub-Saharan Africa (30 percent) and the Middle East (24 percent) while the members in Latin America & Caribbean imported mostly from their own region (see Table 3).

Confirming the distribution of intra-OIC exports, regional distribution of intra-OIC imports by destination reveals that almost one fourth of the intra-OIC imports were destined to the GCC countries while another 22.8 percent to the other Middle Eastern OIC countries. Consequently, almost half of the intra-OIC imports were received by the OIC countries in the Middle East. Like those in East Asia & Pacific, member countries in Europe & Central Asia were destination to around 13 percent of the total intra-OIC imports. Members in North Africa and South Asia, as groups, also received 12.5 percent and 9.1 percent, respectively (Table 4, the last column on the right).

Considering the regional distribution of intra-OIC imports by origin, it is observed that, of the total $216.6 billion of intra-OIC imports in 2009, $75.5 billion or 35 percent originated from the GCC countries. Member countries in Europe & Central Asia, East Asia & Pacific, and the Middle East, as groups, supplied, respectively, 19 percent, 15.8 percent, and 12.1 percent of the total intra-OIC imports, while the other regions each accounted for less than 10 percent of the total intra-OIC imports (see Table 4, the last two rows).

Table 4: Direction of Intra-OIC Imports by Region,* 2009 (percent)

Member countries in five of the eight regions made the majority of their intra-OIC imports from the members within their region (Table 4). Accordingly, intra-regional imports among the OIC countries reached up to 57 percent in Latin America & Caribbean, 49 percent in East Asia & Pacific, 45 percent in both the GCC and Sub-Saharan Africa, and 36 percent in Europe & Central Asia. Even in the Middle East and North Africa, where imports from other regions dominate, the share of intra-regional imports is around 21-25 percent. Therefore, one could argue that geographical proximity is an important factor for imports of those regions.

Trade among OIC countries reveals that petroleum, petroleum products, and related materials were the top traded commodities in 2008, representing 27 percent of the total intra-OIC trade

As in the case of exports, inter-regional imports among OIC countries are most remarkable for imports from the GCC countries. For instance, 54.3 percent of the total intra-OIC imports of South Asian members came from the GCC countries. Members in the Middle East also received the majority of their intra-OIC imports (40.5 percent) from the GCC. Despite receiving the majority of their intra-OIC imports from their own regions, members in East Asia & Pacific, North Africa, and Sub-Saharan Africa also made a significant part of their imports from the GCC. Other than the GCC, East Asia & Pacific, Europe & Central Asia and the Middle East are also important suppliers of inter-regional imports to OIC countries. For example, 20 percent of the intra-OIC imports of the members in Europe & Central Asia came from the Middle Eastern members while 27 percent of the total intra-OIC imports of the Latin American members were made from the members in East Asia & Pacific (see Table 4).

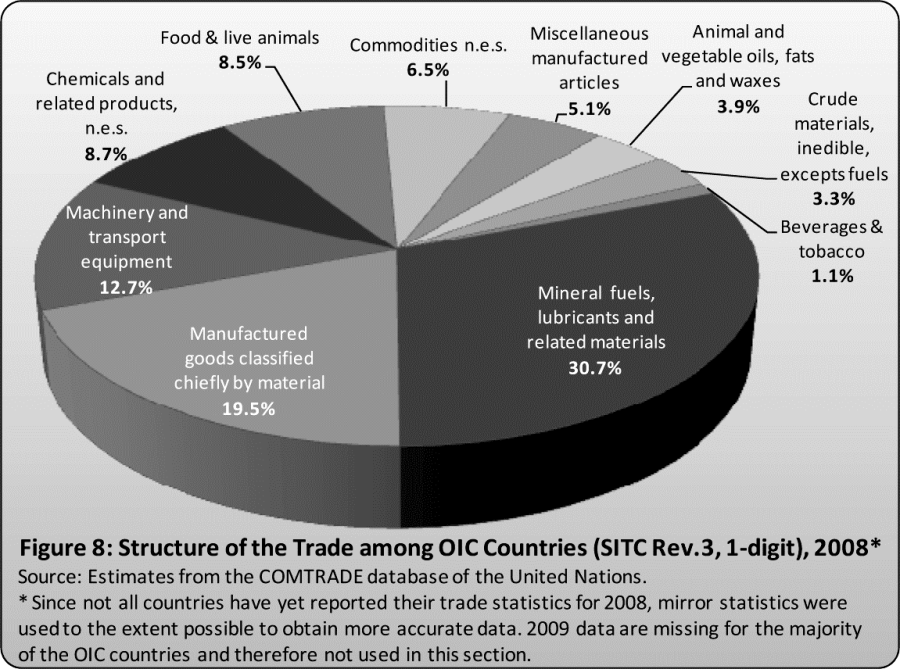

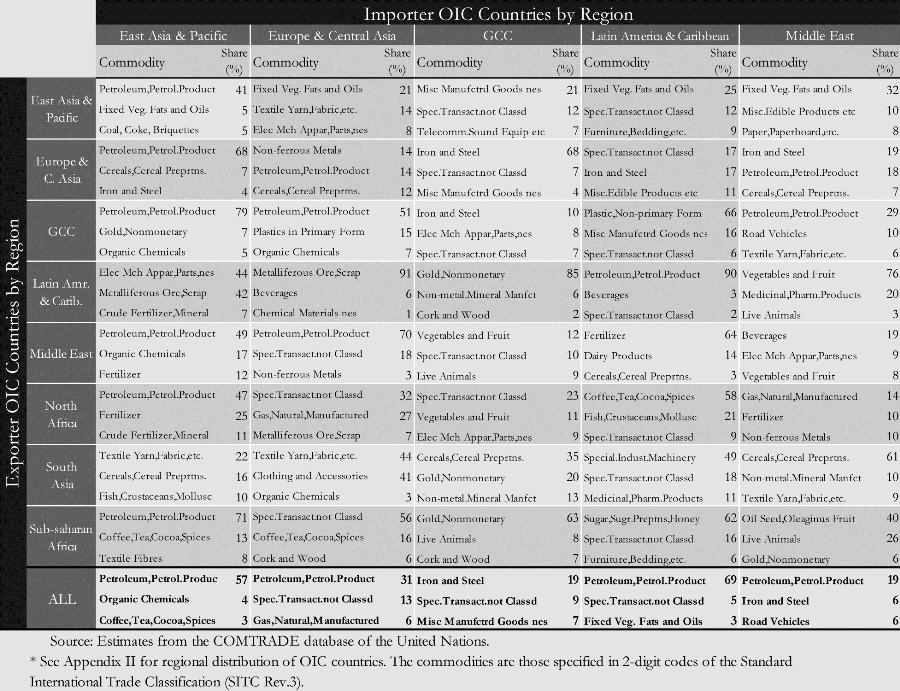

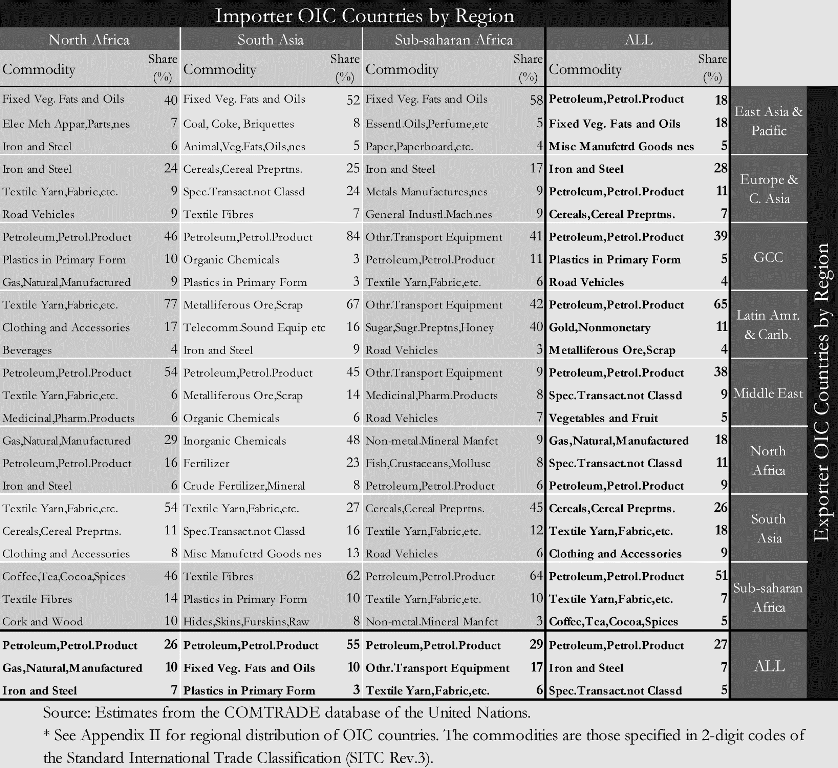

Commodity Composition of Intra-OIC Trade

In 2008, mineral fuels, lubricants, and related materials were the most traded commodity group among the OIC countries, accounting for almost 31 percent of the total intra-OIC trade. Manufactured goods classified chiefly by material, with a share of almost 20 percent, was the second most-traded commodity group, followed by machinery and transport equipment, which represented about 13 percent of the intra-OIC trade (see Figure 8). A closer look into the details of the commodity composition of the trade among OIC countries reveals that petroleum, petroleum products, and related materials were the top traded commodities in 2008, representing 27 percent of the total intra-OIC trade. It is worth noting here that 19 of the 57 OIC countries are classified as fuel-exporting countries, for which the prospects for growth and economic development rely heavily on the production and export of only oil or gas.10 Following the petroleum products come iron and steel and special transactions and commodities not classified according to kind, which accounted for 7 percent and 5 percent, respectively, of the total trade among OIC countries (see Table 5, bottom right corner).

It is well known that the GCC countries are major suppliers of petroleum and petroleum products to the world. In 2008, 39 percent of their total exports to the OIC countries consisted of that commodity group according to the commodity-level trade data. However, those products, by value, were also the top commodity group in intra-OIC exports of the member countries in Latin America, Sub-Saharan Africa, Middle East, and East Asia & Pacific as well, accounting for 18 to

65 percent of their exports to the OIC countries (see Table 5, column “ALL”). On the other hand, those commodities were the top import commodities for the OIC members in all regions except for the GCC; accounting for about 20 to 70 percent of the total imports from the OIC countries (see Table 5, row “ALL”). However, it is not surprising to see such a picture given the ever growing energy demand and the increase in oil prices. Note that oil prices in US dollars increased by 36 percent in 2008 over the previous year.11

The second-most traded commodity group among the OIC member countries, iron and steel, was mainly exported by members in Europe & Central Asia, where it represented around 28 percent of their intra-OIC exports, and mostly imported by the GCC countries and the members in North Africa and the Middle East, accounting, respectively, for 19 percent, 7 percent, and 6 percent of their total intra-OIC imports (see Table 5).

In order for the OIC countries to strengthen their economic ties and to increase intra-OIC trade, it is imperative that these countries commit to removing or reducing substantially all tariffs among them

The variety in the member countries in terms of the level of economic development and geographical dispersion is clearly reflected by the diversity in top export/import commodities. For the eight regions in Table 5, 45 out of the 67 two-digit commodity groups of the SITC made it into the top-three export/import commodities list. Moreover, it is noteworthy that exports or imports of some regions are highly concentrated to few commodities. For example, exports of the members in East Asia & Pacific to members in South Asia, Sub-Saharan Africa, and North Africa consist mostly of fixed vegetable fats and oils, accounting for 40 to 50 percent of the total exports to those regions, while the second-most exported commodities have shares of only 5 to 8 percent. In this respect, both exporters and importers are very likely to be exposed to vulnerabilities due to such heavy reliance on a few specific commodities since any negative shock affecting such a trade flow may have some serious adverse impacts on their economies.

Policy Recommendations and Concluding Remarks

One of the main reasons for establishing regional organizations is to enhance economic cooperation among member countries. Having more economic ties strengthens the relationships among the member countries in other areas as well. The EU, NAFTA, and ASEAN are good examples of such organizations. As compared to other similar organizations, the economic cooperation among the OIC countries has not been at the desired level. This prevented the OIC countries from becoming a more unified group with a stronger voice in the world political arena. Low level of economic integration can be clearly seen in unsatisfactory levels of intra-OIC trade. In fact, the analysis of intra-OIC trade conducted in the previous sections indicates that intra-OIC trade is still far from the target level of 20 percent set to be reached by 2015. Even though the share of intra-OIC trade in total trade of the OIC countries has increased continuously since 2000, moving up from 11.8 percent in 2000 to 16.8 percent in 2009, the OIC countries should stay committed to reaching the target by exerting even more efforts in the next five years. The analysis in this paper was intended as guidance for the OIC countries in this direction. In the rest of the section, some broad policy recommendations are discussed in this regard.

To enhance intra-OIC trade, governments should facilitate interaction among the private sector in the OIC countries

Economic theory suggests that economic agents make their decisions, in most cases, with the objective of profitability, reliability, and/or sustainability. In international trade, economic agents who are in need of raw, intermediate, or final products seek suppliers from whom they can purchase their needs at reasonable prices, with whom they can make long-term relationships, and whose product quality they can rely on. This is almost always the case for the private sector, whose share in trade is very high in many OIC countries, and even for the public sector to a large extent. Therefore, it is essential for governments to ensure that their exporters can provide competitive prices, high quality, and long term commitments if they want to increase their market shares in global trade. In general, any initiative aiming to enhance economic cooperation and, in particular, to increase trade among a group of countries is destined to fail if the players who are expected to materialize this initiative are not given sufficient incentives to do so.

Companies tend to buy from countries with lower tariffs all else being equal because lower tariffs mean higher profits. The level of tariffs a country is subject to has a huge impact on the competitiveness of that country. Unfortunately, high tariffs are one of the major barriers against achieving higher intra-OIC trade. Almost all OIC countries have bilateral or multilateral agreements to ensure lower tariffs with non-OIC countries or groups of such countries; however, they do not offer these preferential tariff rates to many OIC countries. For instance, South Asian OIC countries have a trade agreement called “ASEAN Free Trade Area” with the other non-OIC countries in their region. One of the most important components of this agreement, which was signed in 1992 with the objective of increasing the South Asia’s “competitive advantage as a production base geared for the world market,” is the so-called Common Effective Preferential Tariff.12

Kazakhstan, which is another example, recently signed a Customs Union agreement with Russia and Belarus. According to expert estimates, this agreement could translate into an additional GDP growth of 14-15 percent.13 Some North African OIC countries such as Morocco or Tunisia have trade agreements with the EU.14 Also, Turkey has a Customs Union agreement, which was signed in 1995, with the EU.15 These are only a few of the regional agreements that the OIC countries have made with other country groups.

In order for the OIC countries to strengthen their economic ties and to increase intra-OIC trade, it is imperative that these countries commit to removing or reducing substantially all tariffs among them. TPS-OIC and the related agreements are very important steps towards achieving this goal. Unfortunately, 32 out of the 57 OIC countries have not ratified the TPS-OIC as of November 2010. TPS-OIC Rules of Origin, which is one of the two related agreements, has not been effective yet just because only nine countries ratified this agreement. Also, 45 of the 57 member countries have not ratified the Protocol on the Preferential Tariff Scheme for TPS-OIC (PRETAS) yet. In this regard, the preferential tariff rates as determined in the PRETAS agreement are not “preferential” enough to provide strong incentives for the private sector to shift their existing trade to the OIC countries and should certainly be revisited. The OIC countries that have not yet signed or ratified these agreements should accelerate the process to take advantage of the existing preferential tariffs in their trade with other member countries.

Our analysis indicates that intra-regional trade is generally higher than inter-regional trade among the OIC countries. In this regard, geographical proximity of most OIC countries is an important advantage that should be utilized. Even though the cost of transportation in today’s world is substantially lower than that only a few decades ago, it is still one of the major components of transaction cost for trade. The OIC countries should definitely take advantage of their geographical proximity by first improving their cross-border transportation systems such as railroads or air networks, and then effectively using them. In this regard, the COMCEC should keep transportation as an important item on its agenda.16 Also, two OIC projects in the area of transportation, namely the Dakar-Port Sudan Railway Project and the Establishment of Islamic Civil Aviation Council,17 are important steps towards establishing a strong transportation system among the OIC countries and similar projects should be initiated and supported to strengthen it even further.

The private sector in the OIC countries should be encouraged by the governments to make more trade connections and increase their trades within the OIC region. Companies tend to do business in countries in which they already have experience and well-established relationships. Building trade partnerships or seeking new markets in other countries is often costly and risky. In most cases, companies have little incentives to incur these costs or take these risks. To enhance intra-OIC trade, governments should facilitate interaction among the private sector in the OIC countries. Organizing trade fairs or advertising in other countries are great ways of disseminating information about business and trade opportunities. Especially in the recent years, the subsidiary organs of the OIC that are mandated to promote economic and commercial cooperation and some member countries have been organizing more Islamic trade fairs and sector-specific exhibitions. Such platforms provide the private sector of the member countries with the opportunity to establish trade partnerships or build business networks for future relationships. The OIC countries should encourage and support their private sector to participate in these fairs and to take leadership roles in such platforms.

In this regard, National Trade Agencies could take the lead as the national bodies to encourage private sector for increasing trade with the other OIC countries. The Chambers of Commerce of the OIC countries should also get involved more actively in supporting and guiding the private sector for more trade within the OIC region. They should also enhance their cooperation with the Islamic Chambers of Commerce and Industry, which is an affiliated organ of the OIC with the mandate of strengthening closer collaboration in the field of trade, commerce, and other related areas in the member countries.

Establishing special economic zones (SEZ) is another way of increasing international or regional trade. There are currently hundreds of SEZs in the OIC countries. However, many of these SEZs were established without adequate feasibility plans, have been poorly managed, and, as a result, cannot be used effectively. The OIC countries should rehabilitate such SEZs for better performance. In particular, switching from government operated SEZs to private sector or public-private partnership management may be an important step in the direction of more effective SEZs. Also, cumbersome procedures and controls should be eliminated and uncompetitive policies such as reliance on tax holidays, rigid performance requirements, and poor labor policies and practices should be avoided.18 International standards should be followed when establishing new SEZs. However, SEZs cannot be a substitute for trade and investment reform efforts. SEZs should not be viewed as “pressure valves” to avoid the public demand on more comprehensive reforms.

Finally, harmonizing trade and customs laws and regulations with World Trade Organization (WTO) and World Customs Organization (WCO) standards is one of the major reforms required to increase transparency and promote simplification in trade. In this context, technological improvements should be pursued in customs procedures in the OIC countries. Privatization and regulatory reforms, competition policies, and intellectual property rights are among the other trade and investment reforms that are crucial for economic development of the OIC countries. Also, diversifying product capacity and increasing the value added content of the exported goods are also important policies for the OIC countries to increase their intra-OIC trade as well as total trade with the rest of the world. The governments should undertake actions to encourage the private sector to shift production from raw or intermediate materials to manufactured products and high-tech products in particular. Establishing brands is another way of adding value to trade goods and should be a priority for the private sector in the OIC countries.

Appendix I: List of OIC Member States Who Signed/Ratified the Three TPS-OIC Agreements

Appendix II: Total and Intra-OIC Trade, 2009

Endnotes

- OIC countries, as a group, constitute a substantial part of the developing countries. In 2009, the OIC member countries accounted for 26.5 percent of the total population, 23.2 percent of the total GDP, and 28.1 percent of the total merchandise exports of the developing countries.

- COMCEC and SESRIC, “Enhancing Economic and Commercial Cooperation among OIC Member Countries,” October 2009, p.1.

- Out of the world’s 49 countries which are classified as the “least developed countries” (LDCs), 22 are OIC members. For more information on the LDCs, see http://www.unohrlls.org/.

- See Appendix I for a list of the member states having signed/ratified the three TPS-OIC agreements.

- Ten-Year Programme of Action to Meet the Challenges Facing the Muslim Ummah in the 21st Century, adopted at the Third Extraordinary Session of the Islamic Summit Conference, Kingdom of Saudi Arabia, December, 2005.

- All trade values in this study are expressed in current prices of US dollars. Exports are valued at free-on-board (f.o.b.) prices while imports are valued at cost-insurance-freight (c.i.f.) prices.

- The difference between global exports and imports can mainly be explained by the f.o.b and c.i.f. valuation of exports and imports, respectively.

- The direction of trade data were obtained from the IMF Direction of Trade Statistics.

- Unless otherwise stated, the region specified as the Middle East in this paper does not include the GCC members.

- SESRIC, “Annual Economic Report on the OIC Countries 2010,” (Ankara, 2010), p.13.

- International Monetary Fund, “World Economic Outlook, April 2009: Crisis and Recovery,” (Washington DC, 2009), p.10.

- ASEAN website, “ASEAN Free Trade Area (AFTA): An Update,” retrieved November 25, 2010, from http://www.aseansec.org/7665.

htm. - RIA Novosti, “Russia, Belarus, Kazakhstan sign Customs Union agreement (Update 1),” (July 5, 2010), retrieved November 25, 2010, from http://en.rian.ru/world/

20100705/159693245.html. - European Commission website, “Bilateral relations,” retrieved November 24, 2010, from http://ec.europa.eu/trade/

creating-opportunities/ bilateral-relations/. - European Commission website, “Turkey,” retrieved November 24, 2010, from http://ec.europa.eu/trade/

creating-opportunities/ bilateral-relations/countries/ turkey/. - The OIC decided on “The Impact of Transportation Networks on Trade and Tourism” as the theme for the 2011 session of the COMCEC.

- COMCEC Coordination Office, “Annotated Draft Agenda: Twenty-Sixth Session of the COMCEC (Istanbul, 5-8 October 2010),” August 2010, p.18.