Introduction

The global financial crisis of 2008-2009 (the 2008 crisis, henceforth) was a turning point for the global economy and the financial system. Financial structure, policy approaches, and strategic priorities have all transformed after the crisis. Central banks have adopted new trends and policy-making has since dramatically shifted across the world. Along with the increasing power concentration, responsibilities are also increasing. Monetary policy and central banking instruments have also diversified. The focus within the institutions has shifted toward more regulation, an interventionist stance, power concentration, and market design.

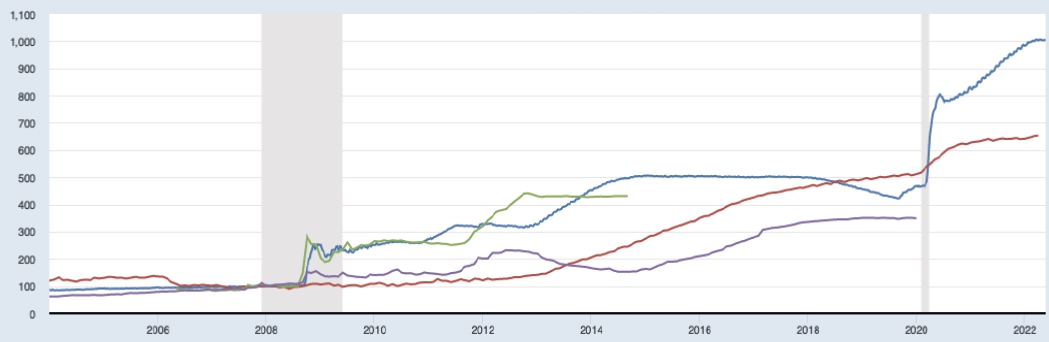

Major world economies (e.g. the U.S., the euro zone, the UK, and Japan) have since increased the balance sheet of their central banks from a little more than $3 trillion in 2007 to almost $30 trillion in 2022 (Graph 1).1 Unprecedented money supply and quantitative easing (QE) policies after the 2008 crisis and the COVID-19 pandemic of 2020-2021 (the pandemic of 2020, henceforth) have turned into the new normal. These QE policies have also predominantly worked during the past two decades. Yet, national economies need to insure themselves against the tail risks of a new currency crisis, new global pandemics, new rounds of negative shocks to the global economy, and most importantly the increasing debt burden or even rising inflation risks too.

Graph 1: Central Bank Balance Sheets

Source: The Fed, the BoJ, the BoE, the ECB, retrieved from FRED, Federal Reserve Bank of St. Louis

Source: The Fed, the BoJ, the BoE, the ECB, retrieved from FRED, Federal Reserve Bank of St. Louis

A rationale for this expansionary case is that this increased role for central banks could indeed be an outcome of discretionary monetary, endogenous money, and flat LM (money and liquidity) curve assumptions. As in the post-Keynesian endogenous money theory, the quantity of money supply could solely be endogenously determined.2 Policymakers may also be thinking outside the box and reconsidering central bank and fiscal authority coordination, as suggested by the modern monetary theory (MMT).3 Active fiscal policy could be supported by monetary policy. For example, domestic currency-denominated borrowing would enrich policy options such that economies would have no reason to default on their debts.4

Digital currencies would help make cross-country payments less costly and create more efficient domestic payment systems

Zero interest financing that is benfited by the rich world economies with their own reserve currencies would also be shared with their other counterparts. They could also be benefiting from along list of literature ranging from the endogenous money theory to the MMT, the importance of time consistency, and credible commitments to some optimal contracts between central banks, the government, and the public.5 In line with this view, the U.S. Federal Reserve (Fed) (Blue), the European Central Bank (ECB) (Red), the Bank of England (BoE) (Purple), and the Bank of Japan (BoJ) (Green) have all increased their monetary base post the 2008 crisis and the pandemic of 2020 (Graph 1). The Fed’s interventions, in particular, are noteworthy.

This paper focuses on the ways a new instrument, central bank digital currency (CBDC), is expected to improve the modern payment systems, increase the efficacy of monetary policy and ensure financial stability in the new era.6 Digital currencies are also a necessity as economies go digital. As digitalization becomes the new normal, central banks will inevitably need to issue their own electronic or digital liabilities instead of printing money as they do now.

Keep in mind that technological transformations in finance, payment systems as well international money transfer systems have all initially led to a rise of private ventures of cryptocurrencies, coins, tokens, and earlier electronic or card systems. The block chain technology behind cryptos, unlike poor imitations of physical central bank currencies (cryptocurrencies), however, is likely to remain and change finance forever. The following modern digital wallets, mobile payment applications, cryptocurrencies, and more recently stable coins (that are pegged to the reserve currencies), on the other hand, have all even led national central banks to reconsider the possibility of issuing their own digital central bank currencies.7

Having said that, in today’s ever-changing world, demand for cryptocurrencies, new digital currency technologies, digital assets and the need for more efficient international payments or international financial transactions is also consistently increasing. Along that line, the digitalization of the renminbi is a recent popular example to meet this increasing demand for a safe digital medium of exchange.8 These developments have, in the meantime, led to volatility and financial instability concerns in financial markets.9

Central Bank Digital Currency

An institutional solution to many modern monetary puzzles is about the instrument change. After the 2008 crisis and the pandemic of 2020, along with financial innovations such as the new cryptocurrencies and stablecoins, many central banks have today voiced an interest in the introduction of their own digital money.10 A CBDC is, in essence, a new form of electronic currency that is backed and issued by a country’s central bank.11 A digital form of paper money.

Increasing financial stability concerns post the 2008 crisis and the pandemic of 2020, as well as the QE trends, stable coins and cryptocurrencies have all contributed to the advances and acceleration in this new CBDC technology.12 CBDCs are expected to amplify the influence of the central banks further and reinforce their position and central power in the financial system. Central banks could potentially gain much greater power over the money supply and its control.

A CBDC is also important since a cash-based economy is restricted by many weaknesses such as a zero lower bound (ZLB). In addition to many other benefits, a CBDC would help avoid an effective lower bound (ELB) with a negative interest rate (NIR).13 Digital currencies would also help make cross-country payments less costly and create more efficient domestic payment systems.

On the other hand, while trade with national currencies is usually deemed as a crucial component of economic and financial independence; digital currencies, in particular some regional and cross-country digital alternatives to the current dominant reserve currencies, would help achieve this flexibility much easier. Such an alternative instrument could also be created through the coordination of central banks, as recently suggested by many regional powers (Iran, Russia, China, etc.). This could also facilitate a modern (regional or global) alternative to John M. Keynes’ international clearing union (ICU).14

Regulation and legislation are other aspects. The need for more regulation is becoming ever more evident in today’s much decentralized financial system. The creation of virtual currencies (such as Bitcoin) and other financial innovations introduce the issue of balance between regulation and innovation to discussions.

China leads in this new financial technology by becoming the first major economy to introduce an official digital currency. However, China’s leadership and the country’s standard-setting advantages could have further, much longer, and enduring strategic financial and economic implications for the new era, as well. Given the current demand for digital currencies and its advantage as the first country to act, China’s digital renminbi project is also a global threat to the dominance of the U.S. dollar (the modern global reserve currency with exorbitant privilege).15

Digital currencies are, part of the block chain-backed transformation of the payment systems and will help in dealing with the modern decentralized threats to financial stability

Meanwhile, demand and the need for paper and other forms of physical money or currency are also de- creasing all over the world.16 Cash usage is already in decline in many world economies, including Sweden, Finland, China, and South Korea.17 Digital society (as in e-Estonia) and cashless society (as in Sweden and Finland) trends are commonplace nowadays in many advanced economies. Citizens no longer need to carry paper or metallic currencies in their pockets.

Block chain technology and the post-pandemic digital transformation will certainly speed up this process as a catalyst. Some countries, such as El Salvador and the Central African Republic have already accepted cryptocurrencies as legal tender. In those cases, some form of digital currency has already replaced physical money. The market capitalization of cryptocurrencies also reached $2.6trillion by the end of 2021.18

On the other hand, the pandemic of 2020 has also accelerated the digitalization process overall.19 The globalization process, along with its increasing transaction costs and increasing global competition, has also led to the quest for new means to decrease costs and search for benefits in these new areas such as the digital society and the cashless society.20

Digitalization and Electronic Currencies

Digital or electronic currencies do indeed already exist in many forms. For example, not all dollars in circulation are printed today. Modern central banks already print money digitally. They print money digitally and share this electronic money with other financial institutions. Therefore, base money, today, is physical cash and electronic reserves together. In that sense, the world of finance is already familiar with the idea of electronic or digital currencies.

However, only banks and other financial institutions had access to the old-fashioned electronic currencies. They were allowing individual consumers to use electronic money in exchange for the physical money held in bank accounts. Therefore, consumers had access to this predecessor via credit cards, bank cards, mobile apps, and online payment systems. The transactions were backed by physical money in accounts. With the CBDCs, on the other hand, these digital currencies will be in widespread use. Money itself will be digitally reserved at banks and in central bank accounts.

Advanced world economies are swiftly moving into the world of digital currencies, decentralized finance, and block chain technologies

CBDCs are also proposed to complement the conventional financial system with physical currencies. Therefore, they are expected to complement cash. It is part of the digital transformation in finance and is an outcome of the central banks’ effort to adjust to the digitalization trend and the new block chain technologies. China’s digital renminbi, or e-yuan, is a good example. Moreover, CBDCs are predominantly built on block chain technology (as in the Swedish e-krona), while some are not (Chinese e-yuan).21

The creation of the CBDCs was a long journey forward, too. First, it was credit cards, bank cards, checks, and mobile apps, and now electronic, crypto and stable currencies are replacing the conventional physical currencies. The next step in that line seems to be the introduction of official CBDCs. Digital currencies are, in essence, part of the block chain-backed transformation of the payment systems and will help in dealing with the modern decentralized threats to financial stability, as well. In that sense, central bank digital currencies are meant to limit the widespread usage of cryptocurrencies in payments and the money supply process and also aim to mitigate the negative implications of decentralized finance.

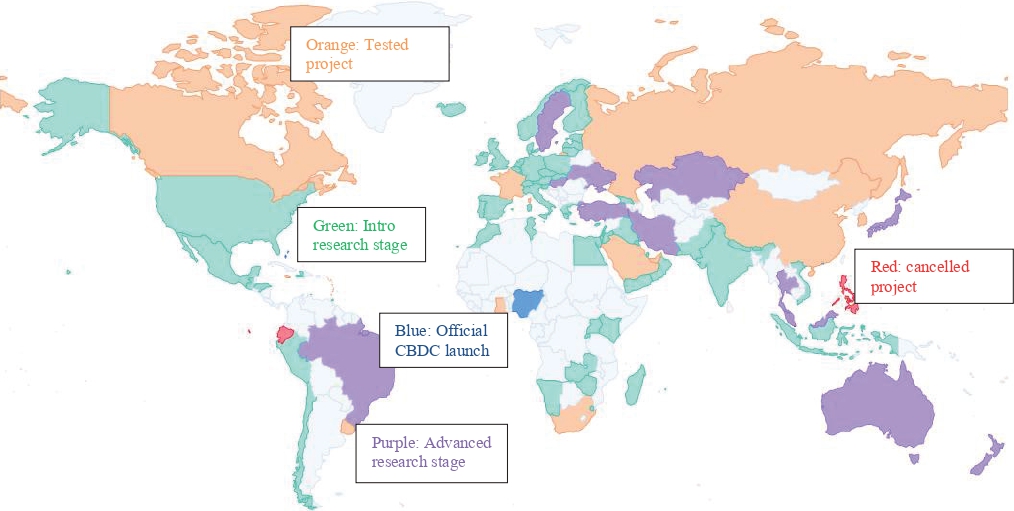

Meanwhile, the number of countries expressing willingness to issue digital currencies is also steadily increasing (Figure 1). According to a recent BIS sur- vey, 90 percent of central banks are exploring CBDC opportunities and more than two-thirds of the world’s central banks consider CBDCs a very likely option within the medium term.22 On the other hand, the BIS has already been practicing the use of digital money for cross-border transactions with various world central banks, including Australia, Malaysia, and South Africa.

China is currently leading the CBDC technology. However, the euro zone (digital euro), the UK (Britcoin), and even Estonia (Estcoin) are also watching China closely. On the other hand, countries such as the Bahamas (Sand Dollar), the Caribbean monetary union of seven countries (DCash), and Nigeria (e-Naira) have already launched their own CBDCs.23 In some BRICS economies (Russia, China, and South Africa), many newly industrialized (Malaysia, Thailand, Saudi Arabia, Ukraine, and South Korea) and even some advanced economies such as Sweden, Singapore, Hong Kong, and the UAE (Project Aber), pilot programs for CBDCs are already being deployed (Figure 1).24

In other countries such as India and Brazil (BRICS), as well as Australia, Canada, Japan, and Türkiye, CBDCs are still under development. These countries are still experimenting with or exploring the technology. Others such as the U.S., the UK, Norway, and the EU, as well as developing economies such as Iran, Pakistan, Kazakhstan, Indonesia, Mexico, and Chile, are still in the research process.

The People’s Bank of China (PBOC) and the ECB have recently agreed on co- operating on cross-border payments via CBDCs. The partnership program was launched in November 2021. The Fed and the BoE have also been working on digital currencies. Yet, they are still analyzing the benefits and risks of this new instrument. In Türkiye, on the other hand, the ‘Digital TL’ project is still in the development process and the Turkish central bank has just created a new platform to do further research on this project.25

As is further explained in Figure 1 and endnote26 in details, some world economies have already cancelled their CBDC projects; while in some others, the first explanatory CBDC research projects are conducted. Many South American, Asian and European economies are in an advanced research stage and have published a CBDC proof of concept. There are also countries that have developed and tested a CBDC in a real environment, and countries that have a CBDC officially launched (Figure 1).

Figure 1: The Current Status of Central Bank Digital Currencies (CBDC) Worldwide as of May 2022.

Source: CBDC Tracker26

From Stable Coins to the CBDCs

Advanced world economies are swiftly moving into the world of digital currencies, decentralized finance, and block chain technologies. As a recent Bank for International Settlements (BIS) report demonstrates, they had a rather neutral view as recent as 2021.27 Yet, things have dramatically shifted, even in the past one or two years. Transitioning from volatile cryptocurrencies toward stable coins (cryptocurrencies pegged to fiat currencies) was the first step in this process toward digital currencies. Stable coins were usually considered a great potential challenge to the monopoly of central banks, legal fiat currencies, and their control over monetary policy. In particular, 2021 was the year of stable coins.

Therefore, central banks had to use the same technology to maintain their control over monetary policy and their monopoly over the money supply. Hence came the CBDCs.28 CBDCs should, meanwhile, be able to deal with modern issues, such as the ELB. And of course, the increasing ‘financial stability concerns’ following the crypto revolution. For example, recent volatilities even in the stable coins Terra, DEI, and Tether have once again brought forth concerns regarding the increased risk in financial stability. Cryptocurrencies and stable coins are expanding rapidly and the risk for financial stability is ever-mounting. This, of course, adds to the recent huge volatility in other standard cryptocurrencies as well.

Broadly speaking, confidence in the national currency and its payment systems is maintained by: (i) Stability in monetary policy, (ii) Financial stability, (iii) Ensuring a safe and efficient payment system. CBDCs, on the other hand, could help in all three main areas of central banking operations: (i) Facilitating payments, (ii) Implementing monetary policy, (iii) Ensuring financial stability.

CBDCs could, in the meantime, be used as ‘retail CBDCs’ intended for individuals or the general public (also called general purpose CBDCs), or ‘wholesale CBDCs’ that are intended for financial institutions. Central banks, however, are predominantly interested in retail CBDCs today.29 Meanwhile, while retail CBDCs seem more likely, wholesale CBDCs (just as in the modern central bank reserves) are also considered essential for the efficiency of international payment.

On the other hand, block chain-based digital currencies are no longer just private ventures. They are actively researched and debated among renowned central banks as well. From Türkiye to the U.S., many world economies are working on their own digital currency projects nowadays.30 For instance, in the U.S., the Biden Administration recently announced a new executive order pointing to the potential introduction of a new CBDC.31 This is noteworthy, in particular, since in the past major central banks used to think they had strong enough payment systems and that they would not need any new instruments to implement monetary policy.

Together, all these developments demonstrate that central banks will inevitably opt for the creation of their own digital or electronic currencies (legal tenders). After the 2008 crisis, this trend has become much more evident and outspoken. Such an instrument shift, on the other hand, would increase the role and power of national central banks (for all the reasons below). It will increase their power over the money supply and improve the efficacy of monetary policy. It could also potentially turn them into the ultimate financial power concentration centers.32

The CBDCs are digital central bank liabilities as opposed to other commercial bank liabilities or digital money transfers used in the previous financial entity liabilities form

CBDCs as an Electronic Legal Tender

Bitcoin may have failed to become a new currency or a legal tender, but the technology behind it is already transforming the whole financial industry. It will potentially further transform the way we do financial transactions by, for example, getting rid of the intermediaries, decreasing the costs, and increasing the speed of transactions.

Moreover, while cryptocurrencies are decentralized, digital currencies are is- sued by the authority of central banks, just like physical currencies. Crypto currencies also have a limited supply constraint, while the supply of digital currencies would not be limited. This limited supply could also make cryptocurrencies an asset, in addition to being a medium of exchange. However, CBDCs are not constrained by any supply amount. Digital currencies, in the mean- time, help transform payment systems (or networks) using new block chain technology and deal with the potential side effects of private cryptocurrencies.

Block chain technology also helps increase the use of national currencies in international trade and decrease dependence on reserve currencies such as the U.S. dollar.33 It helps replace the conventional reserve instruments such as the U.S. dollar and alter the dollar-denominated current global financial system. After all, a sound alternative to the dollar-dominated modern financial system would be either to return to the gold standard or the modern block chain- based new instruments, such as the stable coins or CBDCs.

The CBDCs are digital central bank liabilities as opposed to other commercial bank liabilities or digital money transfers used in the previous financial entity liabilities form. They neither require deposit insurance nor are they backed by any assets, as in the commercial bank liabilities. In a CBDC case, there is no need to back currencies with an asset or commodity or to verify the accuracy with multiple devices all over the world. The trust comes from a central authority, i.e. the central bank of the country issuing the digital currency.

CBDCs help central banks re-emerge and resume their central and powerful role as the ultimate supplier of the medium of exchange and the money supply

In cashless economies (or digital societies), the tendency toward new means for financial transactions is also certainly increasing. Finland, Sweden, China, and South Korea are just a few popular examples. In advanced economies where cash payments are still popular and rebounding after the pandemic and where they will still maintain their popularity in payments, people will still be using and paying with cash, even in the future.34

Digitalization in Monetary Policy and Potential Benefits

Digital currencies and fintech are two critical recent monetary phenomena. The fintech industry, improvements in payment systems, cryptocurrencies, and CBDC have, thus, been dominating the financial progress. Meanwhile, they are not just private ventures anymore and are actively researched and implemented, even by leading central banks. Therefore, digital currencies seem to be the future of money.

Central banks are also closely watching this new trend of digitally created currencies. After all, they affect payments, price stability, financial stability, and the efficacy of monetary policy. They help enrich the monetary policy toolkit as well. Furthermore, monetary policy could even be more effective, data-driven, timely, and seamless. Conventional issues such as the ZLB would also be avoided as even negative interest becomes possible (via taxation, for instance).

Moreover, as the financial system transforms, digitalization trends and global economic synchronization become more evident, payment systems, monetary policy, the international financial system, and even the modern financial sanctions will also need to be reorganized and re-designed. Increased digitalization in monetary instruments, financial transactions, and payment systems may also, in return, increase the influence of central banks, their high power over the money supply, and central power within the financial system.35

Whether CBDCs will be interest-bearing or not is also a huge policy choice to be made. If they are interest-bearing, they could be assessed as very attractive assets, especially during financial turmoil. Such a choice would have huge financial structure and monetary policy implications. It would, for example, affect choices between a CBDC and other financial assets such as the T-Bills, repo agreements, etc.

Meanwhile, a ‘cashless (or digital) society’ makes it possible to keep all the money in the banking or the financial system. Hence, policy analysis (data assessment and observation) would be much easier. After all, cash holdings limit the effectiveness of central bank policy shocks (e.g. decreasing efficacy of negative rates). Eliminating cash from the financial system and the economy would, hence, increase the power and control of the central banks over the money supply, the financial system, and the economy.

CBDCs may also help create a ‘bigger money multiplier’ and hence a much more effective monetary base. This is (as in equation one - E1- below) considering ‘c=0’ such that the money multiplier (or the financial accelerator) is much bigger (also see footnote 46). After all, almost any monetary or macro textbook likes to point out that one problem with the efficacy of monetary policy is money or cash in circulation, that is ‘c>0.’36

One should also keep in mind that conventional monetary policy has run its course, and to accommodate for changes, modern central banks need to switch to unconventional. However, the new units of account (in this unconventional setup) should also be stable in value. They should possess all the stability features of conventional physical currencies. Unstable instruments are already negatively impacting the financial system.

CBDCs help central banks re-emerge and resume their central and powerful role as the ultimate supplier of the medium of exchange and the money sup- ply. They help central banks regain full control over the money supply and payment systems that was recently lost to cryptos to some extent. They would also increase the central bank’s power over the financial system, as well as turn them into the ultimate center of financial power.

CBDCs may also help ‘maximize the seignior age’ (as in equation two – E2) revenue.37 That is, the cost of printing money would be further decreased. After all, under the current ample reserve regimes, central banks pay little attention to the money supply and amount of reserves (see footnotes 2 and 3). The focus is rather on short-term interest rates. With the CBDCs, on the other hand, the focus is also likely to shift to the amount of the CBDC supplied and its growth.

Furthermore, national central banks may also have different priorities and motivations to issue digital currencies. However, CBDCs should be structured in such a way that they primarily support the two main concerns of central banking: price stability and financial stability objectives. CBDCs help bring back financial stability, the efficacy of monetary policy, and payment system integration by re-directing the demand from nonbank financial systems and cryptocurrencies.

They help central banks regain control over the money supply and payment systems that is lost to cryptos to some extent, decreasing bureaucracy and in- creasing monetary policy efficiency. They could also provide an opportunity to ‘avoid constraints such as the ZLB,’ which the 2008 crisis has once again reminded us of.38 Via negative rates and helicopter money, central banks can help overcome the ELB issue. However, as interest rates go further down into negative territory, it should be expected that deposits and savings in banks and other financial institutions would also recede.39 People would be much more likely to use cash directly instead of checks, credit cards, or other deposit accounts linked to negative interest-paying banks and other financial institutions. Banks could even eventually be dysfunctional.40

‘Safety’ is another huge plus on the part of CBDCs. The earlier quasi-digital monetary system or the electronic money that was used in the past few decades was backed by physical central bank money at bank accounts. And it always had the risk of being lost either due to bankruptcy, heist, or other forms of robbery or laundering. Governments would provide guarantees for just certain limits of that money. CBDCs, on the other hand, are much safer digital currencies and are backed by central banks like conventional physical currencies. Digital currencies allow you to keep your money in a much safer digital form, either with you or at the bank. They are also used safely for digital payments and transfers.

Block chain technologies decrease office costs and provide a much safer environment as a distributed ledger

Moreover, ‘price stability’ (as a building block of modern monetary economics) is another crucial potential benefit of CBDCs (see foot- note 35). After all, the cryptocurrency revolution and the DeFi trends lack price stability, regulation, and supervision. Hence, they have negatively affected price stability, as well as macro and financial stability.41 Replacing physical cash and the elimination of currently highly volatile crypto currencies will therefore make it easier to achieve macro goals such as financial stability, macroeconomic stability, and price stability.

‘Monetary policy efficacy’ is another priority that should not be missed. As digital currencies increase their share in financial transactions, and as the use of physical currencies and cryptocurrencies go down, central banks should be expected to increase the power and efficiency of their monetary policy. All transactions will be under control, access to the data will be easy, and therefore control, management, supervision, and guidance of the financial system by the central bank will be much easier. Financial flows will be further under central banks’ control, as will their ability to supervise and regulate all the financial data and management. Data-driven policy approaches will increase the efficacy of policy-making. Monetary policy will hence be much more effective.

Implementation of monetary policy is also a critical factor that differentiates advanced and emerging economies in their motivation for CBDCs, with emerging economies having a higher motivation for monetary policy implementation. It is also much easier, less costly, faster (less bureaucracy), and more secure to issue digital currencies, compared to conventional physical currencies. World economies are therefore nowadays looking for ways to effectively use cryptocurrencies, stable coins, and digital currencies that would allow economies to go fully digital.

Accordingly, digitalization in currencies is expected to strengthen central banks and the efficacy of monetary policy. Their hegemony and power over monetary policy should be expected to amplify and transform them further into the ultimate center of financial power. This process is also a necessity in the era of digital transformation. It lets policy-making processes accommodate the new trend of innovative technologies.

‘More efficient payment systems’ is another potential benefit. The current payment systems, in particular the cross-border payments, are limited by the shortcomings such as concurrent business hours, complexities due to the transaction sequences or chains, and the accruing costs of transactions. CBDCs could potentially address these issues. CBDCs could also enable a new platform of cost-efficient and faster international payments. They could make cross-border payments and transfers more affordable, much easier, faster, and cheaper.42

Cryptocurrencies and stable coins were surely a great potential challenge to the monopoly of central banks, their legal fiat currencies, and their control over monetary policy and money supply in the market

They would hence make payment systems much more efficient. Block chain technologies decrease office costs and provide a much safer environment as a distributed ledger. Wholesale CBDCs, in particular, focus more on cross-border payment efficiency, both in advanced economies and emerging economies. They could help deal with many cross-border frictions, including the long transaction chains and the limited operating hours in conventional financial systems.

Digital currencies could also help avoid conversion commissions and spreads in exchange rates. This was also one of the reasons for switching to a common currency in the euro area (see footnote 14). They could also increase the efficiency of fiscal transfers (during the pandemic, for example) and decrease black market activities. Payment options could also be diversified, made more efficient, and accessible to the public. ‘Macro-financial stability’ concerns have also stepped during the period after the 2008 crisis and the pandemic of 2020. Together with the gradual elimination of currently highly volatile cryptocurrencies, it will be much easier to achieve macro goals such as financial, macro-economic, and price stability.

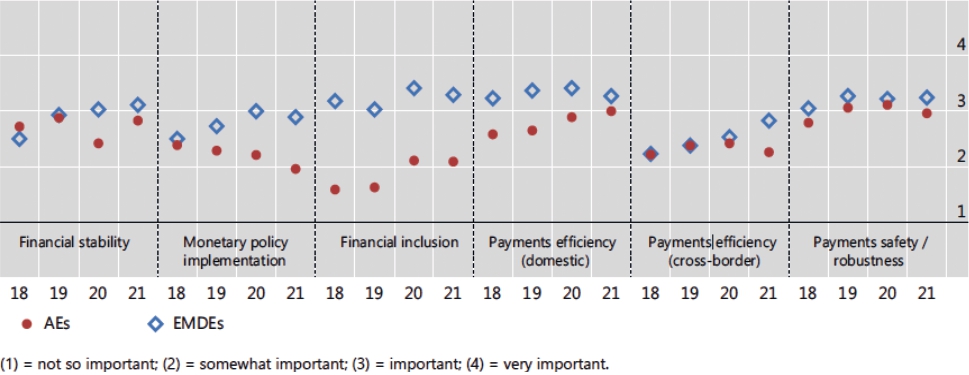

Graph 2: Motivations to Issue a Retail CBDC

Source: 2021 BIS central bank survey on CBDCs and digital tokens.43

Source: 2021 BIS central bank survey on CBDCs and digital tokens.43

Digital currencies could make critical contributions to financial stability as well. A safe and secure, easily accessible as well as liquid (fast conversion to the other forms of money) CBDC could also lead to runs on financial institutions.44 Such severe shifts could have disastrous effects during financial crises. Deposit holdings of private banks may ultimately become less stable and cost issues could step in. Therefore, new digital currencies should have features to prevent bank runs during financial turbulence.45 After all, flight-to-safety is potentially the most critical issue to be addressed, in particular during financial turmoil.46

Cryptocurrencies and stable coins were surely a great potential challenge to the monopoly of central banks, their legal fiat currencies, and their control over monetary policy and money supply in the market. They could also let national economies avoid current volatilities and speculative motivations over the cryptocurrencies, the sister currencies of digital currencies. CBDCs could limit the expansion of stable coins and cryptocurrencies and hence increase financial stability.

In particular, retail CBDCs aim to increase financial stability and improve the efficacy and safety of payment systems. This tendency is even higher in advanced economies, especially considering the increased use of cryptocurrencies and the systemic risk they may cause. In that sense, increased us- age of cryptocurrencies has actually accelerated efforts toward more stable CBDCs.

‘Improved financial inclusion’ is another potential benefit of CBDCs and the accompanying digitalization.47 Access to financial products, banking services, and financial services, in general, will be much easier, especially in remote areas. Low-income, underserved individuals and rural residents will have access to more affordable and secure savings, banking, investment and payment options. As the 2021 BIS central bank survey on CBDCs and digital tokens demonstrates, in addition to the financial stability and efficacy of payment systems, financial inclusion is another critical instrument for the recent re-emerging interest in retail CBDCs, especially in emerging markets (EMDEs or the blue symbols on Graph 2). Furthermore, EMDEs (blue symbols) seem to be more concerned about financial inclusion than the AEs (Advanced Economies or the red dots on Graph 2), over time.

The ZLB Constraint and the NIR Policy

The ZLB was a critical limitation to the conventional policy measures in central banks’ efforts to deal with modern recessions. Central banks should be able to deal with modern issues such as the effective lower bound.48 Along with the invention of non-standard policies (QEs), the recent central bank negative rates on certain deposits and negative rates on bonds have resulted in the historic case of negative nominal interest rates. The ZLB was no longer a lower bound.

Monetary policy should not, at its core, be restricted by physical cash and other monetary issues related to physical currencies. In that line, economists have been suggesting much lower negative rates, even below the zero bound. Negative interest rates were an instrument to overcome the weak demand problem. They stimulate weak demand, encourage borrowing and spending, and decrease the tendency to save. They were effectively implemented in some cases, as in the central bank loans or the long-term safe bonds but were usually not accepted by the public.

However, negative interest rates are also very likely to damage commercial banks and other modern financial institutions. This is because their profits are also directly affected by the rate moves. Therefore, the main criticism of the NIRP was also from the financial institutions. Critics were claiming that neither inflation nor growth rates would rise and that even productivity would go down with the NIRP.

For instance, if deposits are taxed with negative interest rates, then nobody would deposit their savings into bank accounts. In such cases, a move toward alternatives to the physical central bank currency (gold, silver, or even crypto) or even toward digital currencies will increase their popularity.49 Alternatively, the trend could even be toward a barter economy. However, capital markets are deepening, and the role of banks is already decreasing, so the negative impact (of negative rates) on banks may not be that critical.

Moreover, as of the spring of 2022, central banks in Sweden, Denmark, Switzerland, the eurozone, and Japan (almost a quarter of the world economy) have all implemented negative rates, below the ZLB. Central banks cut the policy interest rates to the negative territory in an effort to discourage cash holdings (at the central banks for instance) and force the financial institutions to lend out more, increase economic activity and help raise the inflation rate to the target levels (in particular in deflation prone advanced economies).

All in all, the ZLB is not a law of nature. And it is always possible to go way beyond the zero-lower bound. Indeed, there is even a set of tools that makes it possible to go deep into the negative territory without huge administrative costs. Taxation is just one of these tools.

After the 2008 crisis and the pandemic of 2020, QEs were used instead of the then-inapplicable negative interest rates. Now is the time to go unconventional and use new instruments such as taxes.50 This process could even be much easier with the introduction of digital currency. After all, a negative interest rate is, indeed, indirect taxation of physical money holding. Digital currencies would enable a very easy process of taxation of currencies and hence create the much-needed negative interest rate. Central bank digital currencies will also, in that line, make it easier to directly charge a tax or negative interest on the public’s cash holdings.

The world is moving toward digital, cashless societies

On the other hand, banks could also impose some fees for cash withdrawals or cash holdings (maybe something equivalent to the negative interest the ECB used to charge on borrowing). These fees would prevent flight-to-cash, in particular in large cash demand cases. Indeed, similar policies are already in effect today in physical gold withdrawals from bank accounts in Türkiye. However, it is also crucial to understand how it works in policymaking.

Critical Analysis

The world is moving toward digital, cashless societies. Credit cards, pay and pass systems, touch-free systems, etc. have all transformed finance and payment systems. Given the level of current developments in communication, payment systems, and electronic equipment infrastructures, the CBDC is an easily accessible electronic form of safe and liquid central bank money. However, regulatory processes, cybersecurity risks, and bank run risks should all be carefully analyzed before issuing one. The need for more regulation and financial stability is also more evident today.

Meanwhile, an important result of the geopolitical tensions and modern sanctions (e.g. due to the war in Ukraine) has been a pursuit of alternatives to the Swift system, an increase in the tendency toward trade with national currencies, and the accelerating trend that is experienced in the transition to accepting cryptocurrencies such as Bitcoin or to the new national digital currencies.51

In that sense, CBDCs may also help world economies deal with hegemonies of the all-powerful intermediary payment systems of the West. A digital currency could help skip international messaging systems and communication mechanisms such as Swift and costly cross-country money travels. In that sense, it could also negatively affect conventional sanctions. CBDCs could also potentially allow every country or region to have its own reserve currency or clearing system, just as in Keynes’ ICU, and hence create its own Bretton-Woods systems. China’s digital renminbi (e-yuan or e-CNY) could also potentially have such ambitions.

Looking forward, central banks should be expected to regain more control over the money supply and payment systems they have partly lost to crypto currencies. Other significant is- sues related to physical money and cash in circulation will also be dealt with, as everything will be digitalized. The disadvantages of CBDCs, however, can be avoided with more regulation. Hence, a good balance between regulation and innovation is needed.

CBDCs could contribute to financial stability and increase monetary policy efficacy

By replacing physical cash and supporting the elimination of currently highly volatile cryptocurrencies, it will be much easier to achieve macro goals such as financial stability, macroeconomic stability, and price stability. Financial flows will be under central banks’ control. Potential negative implications for financial stability should be noted though. They could pose some risks to the financial sector and its market structure. Impacts on credit markets (the cost and availability) should all be well assessed.

The CBDCs are central bank liabilities as opposed to the electronic money transfers used in the old-fashioned commercial bank liability form. Therefore, with the CBDC, deposit holdings of private banks may also ultimately become less stable. After all, banks rely on individual deposits for funding. The amount of deposits in bank accounts affects credit availability, the cost of loans, and expenses (as well as profitability) of banks. Thus, the CBDCs, by replacing or substituting commercial bank money, could potentially affect the profitability of commercial banks.

Without an innovative mechanism to prevent panic moves, bank runs could also potentially be inevitable. There should, therefore, be a way to prevent bank runs during financial turbulence. After all, a safe and secure, easily accessible as well as liquid (fast conversion to other forms of money) CBDC could lead to runs on financial institutions. An interest-bearing CBDC, in particular, could affect the markets and other financial instruments and even fundamentally alter the financial system. Potential effects on monetary policy and its efficacy are also noteworthy. There are certain difficulties regarding a cashless economy and the changing financial market structure as well.52

One thing is for sure, though, digital currency still does not hold all the significant properties of a common physical currency. Lack of access to financial markets on some citizens’ side is one critical issue. Another issue is being totally dependent (total dependence) upon energy or electricity for any payment or transfer. Disadvantaged groups and those living on a continuous payment cycle may also face issues such as the inability to keep a bank account or an up-to-date payment instrument.

CBDCs should be designed as innovative new tools. Hence, they should not turn into attractive assets leading to financial firm runs. They should rather focus on the trend toward cashless societies, enabling negative interest rates, being a safe digital instrument, helping deal with conventional restrictions of a cash-based economy, and helping deal with modern restrictions and limitations of the payment systems.

Conclusion

At first, it was the inflationary taxes that led to the interest in other forms of payment instruments such as the cryptos. Then, it was the monopolistic (and sometimes oligopolistic) structure and power concentration in the financial system that led to anger, mistrust, and a search for alternative instruments. Even credit card payment systems that intermediate payments between stores and financial institutions are dominated by a few international players today. And then there were cryptocurrencies increasing financial volatilities and the ZLB limitation for monetary policy.

After the 2008 crisis and the pandemic of 2020, along with innovations such as the all-new cryptocurrencies and stable coins, many central banks have voiced an interest in the introduction of their own digital money. Such a move is expected to increase the influence of central banks and policy-makers further. They will once more be gaining much greater power over the money supply and its control, reinforcing their central power and position in the financial system.

CBDCs could contribute to financial stability and increase monetary policy efficacy. There will certainly be a need for more regulation and supervision for private cryptos too. CBDCs will also increase the popularity of and the trust for cryptocurrencies and block chain-backed financial technologies in general.

They should be expected to replace stable coins and other private venture cryptocurrencies for payment. Cryptocurrencies, on the other hand, are likely to be forced to serve specific objectives, in unique areas and niche markets. They will potentially transform into special-purpose instruments in gaming and other related virtual reality areas. Looking forward, there will also probably be more need to integrate other cryptocurrencies into the world of CBDCs.

Geopolitical, geo-economical, and geostrategic implications and consequences of having a CBDC should be re-evaluated and well-assessed. In particular, China’s leadership and its standard-setting advantages could have much longer and enduring strategic implications for the new era. China has already created its own digital currency, and the historic U.S.-China rivalry may also force the U.S. to retaliate by issuing its own CBDC.

To sum up, physical currencies will inevitably be digitalized, one way or the other. So, why not embrace the trend and the new technology, regulate and then make sure digital currencies satisfy all the functions of a regular conventional physical currency? Central banks seem to unavoidably be heading toward or converting to this innovation in the near future. Meanwhile, many central banks have already voiced their willingness to use such a new policy tool. That being said, like the transformation from cash to credit cards, the e-money revolution will also (most probably) be a very natural transition.

Endnotes

1. “Major Central Bank Balance Sheets (Total Assets Less Eliminations from Consolidation),” FRED, Federal Reserve Bank of St. Loui, retrieved from https://fred.stlouisfed.org/series/WALCL, on May 24, 2022.

2. See, among others, John Maynard Keynes, A Treatise on Money, (London: Macmillan, 1930); Jacques Le Bourva, “Money Creation and Credit Multipliers,” Review of Political Economy, Vol. 4, No. 4 (1992), pp. 447-466; Basil J. Moore, “The Endogenous Money Supply,” Journal of Post Keynesian Economics, Vol. 10 No. 3 (1988), pp. 372-385.

3. See, among others, William Mitchell, L. Randall Wray, and Martin Watts, Macroeconomics, (London: Red Globe Press, 2019); Stephanie Kelton, “The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy,” Public Affairs, (2020); L. Randall Wray, Understanding Modern Money, Vol. 11, (Cheltenham: Edward Elgar, 1998); Thomas I. Palley, “The e-Money Revolution: Challenges and Implications for Monetary Policy,” Journal of Post Keynesian Economics, Vol. 24, No. 2 (2002), pp. 217-233; Thomas I. Palley, “Endogenous Money and the Business Cycle,” Journal of Economics, Vol. 65, (1997), pp. 133-149; Thomas I. Palley, “Money, Fiscal Policy, and Interest Rates: A Critique of Modern Monetary Theory,” Review of Political Economy, Vol. 27, No. 1 (2015), pp. 1-23.

4. Bilal Bağış, “Güney Asya’nın ‘Ilk Günahı’ ve Borç Krizi,” Anadolu Agency, (August 23, 2022).

5. Finn E. Kydland and Edward C. Prescott, “Rules Rather than Discretion: The Inconsistency of Optimal Plans,” Journal of Political Economy, Vol. 85, No. 3 (1977), pp. 473-491; Kenneth Rogoff, “The Optimal Degree of Commitment to an Intermediate Monetary Target,” Quarterly Journal of Economics, Vol. 100, No. 4 (1985), pp. 1169-1189; Carl Walsh, “Optimal Contracts for Central Bankers,” The American Economic Review, Vol. 85, No. 1(1995), pp. 150-167.

6. CBDCs are digital central bank liability that are expected to replace the physical currency currently used. They are digital forms of paper money, a country’s fiat currency; Bilal Bagis, “Central Banking in the New Era,” Eurasian Journal of Economics and Finance, Vol. 5, No. 4 (2017), pp. 197-225.

7. “Stablecoins: Implications for Monetary Policy, Financial Stability, Market Infrastructure and Payments, and Banking Supervision in the Euro Area,” European Central Bank (ECB) Occasional Paper Series, (September 2020); “Report on Stable coins,” Treasury Department (President’s Working Group on Financial Markets, the Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency), (November 2021), retrieved from https://home.treasury.gov/system/files/136/StableCoinReport_Nov1_508.pdf.

8. Digital renminbi. May also be called ‘digital RMB’, e-Renminbi, e-RMB and e-CNY. Or the ‘Digital Currency Electronic Payment (DCEP)’, as it is officially called.

9. Raghuram G. Rajan, “Has Financial Development Made the World Riskier?” 2005 Economic Policy Symposium Proceedings, (2005), pp. 313-369.

10. Modern private venture cryptocurrencies run on a distributed-ledger technology called block chains. In this setup, a number of devices distributed around the world need to verify the accuracy of any transaction. Stable coins, however, are a new form of cryptocurrency that is pegged to a reserve asset, a fiat currency, or a commodity. They aim to keep a stable value. Examples include Tether, USD Coin, Libra, and DAI; See, “COVID-19, Crypto, and Climate: Navigating Challenging Transitions,” International Monetary Fund (IMF) Global Financial Stability Report, (October 2021), retrieved from https://www.elibrary.imf.org/view/books/082/465808-9781513595603-en/465808-9781513595603-en-book.xml; Francesca Carapella and Jean Flemming, “Central Bank Digital Currency: A Literature Review,” FEDS

Notes, (November 9, 2020), retrieved from https://www.federalreserve.gov/econres/notes/feds-notes/central-bank-digital-currency-aliterature-review-20201109.htm.

11. Raphael Auer, Giulio Cornelli, and Jon Frost, “Rise of the Central Bank Digital Currencies: Drivers, Approaches and Technologies,” BIS Working Papers, No. 880 (August 2020); Klaus Lober and Aert Houben, “Central Bank Digital Currencies,” BIS Report, Committee on Payments and Market Infrastructures, (March 12, 2018).

12. “COVID-19, Crypto, and Climate: Navigating Challenging Transitions,” International Monetary Fund (IMF) Global Financial Stability Report; Carapella and Flemming, “Central Bank Digital Currency: A Literature Review”; Auer, et al., “Rise of the Central Bank Digital Currencies: Drivers, Approaches and Technologies”; Sergio Luis Náñez Alonso, Javier Jorge-Vazquez, and Ricardo Francisco Reier Forradellas, “Central Banks Digital Currency: Detection of Optimal Countries for the Implementation of a CBDC and the Implication for Payment Industry Open Innovation” Journal of Open Innovation: Technology, Market, and Complexity, Vol. 7, No. 72 (2021); Linda Schilling, Jesus Fernandez-Villaverde, and Harald Uhlig, “Central Bank Digital Currency: When Price and Bank Stability Collide,” NBER Working Paper, No. 28237 (2020).

13. Negative interest rate (NIR) means that keeping deposits, reserves, or cash in any account requires an interest payment to the bank (to a conventional bank or a central bank). This is, in a way, another way of telling banks (or depositors) that liquid assets such as cash are costly and that it is a privilege that requires some tax payment by the cash holder.

14. John M. Keynes, “Activities 1940-1944: Shaping the Post-War World – The Clearing Union,” in Donald Moggridge (ed.), The Collected Writings of John Maynard Keynes, (London: Macmillan, 1980).

15. Barry Eichengreen, Exorbitant Privilege: The Rise and Fall of the Dollar and the Future of the International Monetary System, (Oxford: Oxford University Press, 2010).

16. Gary Gorton, “Reputation Formation in Early Bank Note Markets,” Journal of Political Economy, Vol. 104, No. 2 (1996).

17. Walter Engert, Ben S. C. Fung, and Scott Hendry, “Is a Cashless Society Problematic?” Bank of Canada Staff Working Paper, Vol. 12, (2018); Janet Hua Jiang and Enchuan Shao, “The Cash Paradox,” Review of Economic Dynamics, Vol. 36, (2020), pp. 177-197.

18. “Assessment of Risks to Financial Stability from Crypto-Assets,” Financial Stability Board (FSB), retreived February 28, 2022, from https://www.fsb.org/2022/02/assessment-of-risks-to-financial-stability-from-crypto-assets/.

19. “COVID-19, Crypto, and Climate: Navigating Challenging Transitions.”

20. Jiang and Shao, “The Cash Paradox.”

21. Náñez Alonso, et al., “Central Banks Digital Currency: Detection of Optimal Countries for the Implementation of a CBDC and the Implication for Payment Industry Open Innovation.”

22. Anneke Kosse and Ilaria Mattei, “Gaining Momentum – Results of the 2021 BIS Survey on Central Bank Digital Currencies,” BIS Papers, No. 125 (May 2022).

23. “Central Bank Digital Currency Tracker,” Atlantic Council Research, retrieved May 25, 2022, from https://www.atlanticcouncil.org/cbdctracker/.

24. “Central Bank Digital Currency Tracker,” Atlantic Council Research; Igor Mikhalev, KajBurchardi, Igor Struchkov, Bihao Song, and Jonas Gross, “White Paper,” CBDC Tracker, retrieved January 31, 2021, from https://cbdctracker.org/cbdc-tracker-whitepaper.pdf.

25. In Türkiye, the Dijital Türk Lirası İş Birliği Platformu was created by the CBRT in 2021 (together with Tubitak-Bilgem, Aselsan ve Havelsan) to promote research, development, and coordination efforts regarding digital currencies.

26. Countries with a CBDC project canceled or decommissioned (Red), countries where the first explanatory CBDC research project is conducted (Green), those in an advanced research stage and have published a CBDC proof of concept (Purple), countries that have developed and tested a CBDC in a real environment (Orange), and countries that have a CBDC officially launched (Blue). Mikhalev, et al., “CBDC Tracker.”

27. Kosse and Mattei, “Gaining Momentum – Results of the 2021 BIS Survey on Central Bank Digital Currencies.”

28. “Central Bank Digital Currencies: Foundational Principles and Core Features,” Bank for International Settlements (BIS), retrieved October 30, 2022, from https://www.bis.org/publ/othp33.pdf.

29. Kosse and Mattei, “Gaining Momentum – Results of the 2021 BIS Survey on Central Bank Digital Currencies.”

30. “Money and Payments: The U.S. Dollar in the Age of Digital Transformation,” Board of Governors of the Federal Reserve System, retrieved January 21, 2022, from https://www.federalreserve.gov/publications/money-and-payments-discussion-paper.htm.

31. “Ensuring Responsible Development of Digital Assets,” The White House Executive Order, retrieved March 9, 2022, from https://www.whitehouse.gov/briefing-room/presidential-actions/2022/03/09/executive-order-on-ensuring-responsible-development-of-digital-assets/.

32. Mohamed A. El-Erian, The Only Game in Town: Central Banks, Instability, and Avoiding the Next Collapse, (New York: Random House, 2016).

33. Maurice Obstfeld and Kenneth Rogoff, Foundations of International Macroeconomics, (Cambridge, MA: MIT Press, 1996).

34. Jiang and Shao, “The Cash Paradox.”

35. Milton Friedman, “The Role of Monetary Policy,” American Economic Review, Vol. 58, No. 1 (1968), pp. 1-17; Carl E. Walsh, Monetary Theory and Policy, 3rd ed., (Cambridge, Mass: MIT Press, 2010); Jacques Le Bourva, “Money Creation and Credit Multipliers,” Review of Political Economy, Vol. 4, No. 4 (1992), pp. 447-466.

36. In E1, ‘m’ is the money multiplier, ‘r’ is required reserve ratio, ‘c’ is currency in circulation and ‘e’ is excess reserve ratio. In the best-case scenario, ‘c’ and ‘e’ are expected to be equal to zero such that money multiplier would be equal to:".

37. In E2, ‘St’ represents the seignior age, ‘Mt’ represents money supply and ‘Pt’ represents the price level, all at time t. Walsh, Monetary Theory and Policy.

38. Paul Krugman, “It’s Baack! Japan’s Slump and the Return of the Liquidity Trap,” Brookings Papers on Economic Activity, Vol. 29, No. 2 (1998), pp. 137-187.

39. Schilling, et al., “Central Bank Digital Currency: When Price and Bank Stability Collide.”

40. Douglas W. Diamond and Philip H. Dybvig, “Bank Runs, Deposit Insurance, and Liquidity,” Journal of Political Economy, Vol. 91, No. 3 (1983), pp. 401-419; Mark Gertler and Nobuhiro Kiyotaki, “Banking, Liquidity, and Bank Runs in an Infinite Horizon Economy,” American Economic Review, Vol. 105, No. 7 (2015), pp. 2011-2043.

41. Douglas Arner, Raphael Auer, and Jon Frost, “Stable Coins: Risks, Potential and Regulation,” BIS Working Papers, No. 905 (November 2020).

42. “Central Bank Digital Currencies for Cross-Border Payments,” Committee on Payments and Market

Infrastructures (CPMI), retrieved July 30, 2021, from https://www.bis.org/publ/othp38.pdf.

43. Kosse and Mattei, “Gaining Momentum – Results of the 2021 BIS Survey on Central Bank Digital Currencies.”

44. David Tercero Lucas, “Central Bank Digital Currencies and Financial Stability in a Modern Monetary System,” Working Papers GEAR, (May 26, 2022); Gertler and Kiyotaki, “Banking, Liquidity, and Bank Runs in an Infinite Horizon Economy.”

45. Diamond and Dybvig, “Bank Runs, Deposit Insurance, and Liquidity;” Lucas, “Central Bank Digital Currencies and Financial Stability in a Modern Monetary System.”

46. Ricardo J. Caballero and Arvind Krishnamurthy, “Collective Risk Management in a Flight to Quality Episode,” Journal of Finance, Vol. 63, (2008), pp. 2195-2230; Ben Bernanke, Mark Gertler and Simon Gilchrist, “The Financial Accelerator and the Flight to Quality,” Review of Economics and Statistics, Vol. 78, (1996), pp. 1-15.

47. Raphael Auer, Holti Banka, Nana Yaa Boakye-Adjei, Ahmed Faragallah, Jon Frost, Harish Natarajan, and Jermy Prenio, “Central Bank Digital Currencies: A New Tool in the Financial Inclusion Toolkit?” FSI Insights Paper, No. 41 (April 2022); Lober and Houben, “Central Bank Digital Currencies.”

48. Krugman, “It’s Baack! Japan’s Slump and the Return of the Liquidity Trap;” Michael Woodford, Interest and Prices: Foundations of a Theory of Monetary Policy, (Princeton: Princeton University Press, 2003).

49. Gorton, “Reputation Formation in Early Bank Note Markets.”

50. Silvio Gesell, The Natural Economic Order, translated by Philip Pye, (London: M.A., 1958); John M. Keynes, The General Theory of Employment, Interest and Money, (London: Macmillian and Co Ltd, 1961).

51. Bilal Bağış, “Savaş, Kripto Ekonomi veDijitalleşme,” Anadolu Agency, (March 31, 2022).

52. Walter Engert, Ben S. C. Fung, and Scott Hendry, “Is a Cashless Society Problematic?” Bank of Canada, retrieved October 30, 2018, from https://www.bankofcanada.ca/wp-content/uploads/2018/10/sdp2018-12.pdf.