Introduction

Russia is Europe’s largest natural gas and crude oil supplier. Russia’s gas exports to Europe began to increase after the Second World War, starting with Poland in the 1940s, and Russia mostly met Europe’s gas needs -notably with pipelines passing through Ukraine. The Urengoy-Pomary-Uzhgorod Pipeline, also known as the Brotherhood Pipeline, has been operational since 1967 and pumps 100 billion cubic meters (bcm) per year across a 4,500 km-long distance. It passes through Ukraine, Slovakia, then flows in two directions to Germany and several former Yugoslavian countries. Almost 40 percent of the European Union’s (EU) total gas import comes from Russia.1 Nearly three-quarters of that gas transmission is carried out via pipelines to Europe running through Ukraine.2 Russia’s dependence on the European market is also very high. As of 2015, the European market accounted for 60 percent of Russia’s total gas exports.3 Although Ukraine had been a reliable transit country for Russia’s European natural gas transmission for a long time, conflicts of interest arose between the two countries in the 2000s, endangering this secure line of natural gas transmission. As a result of the political crisis in 2006, Russia cut off the flow of gas to Ukraine, which negatively affected Europe.4

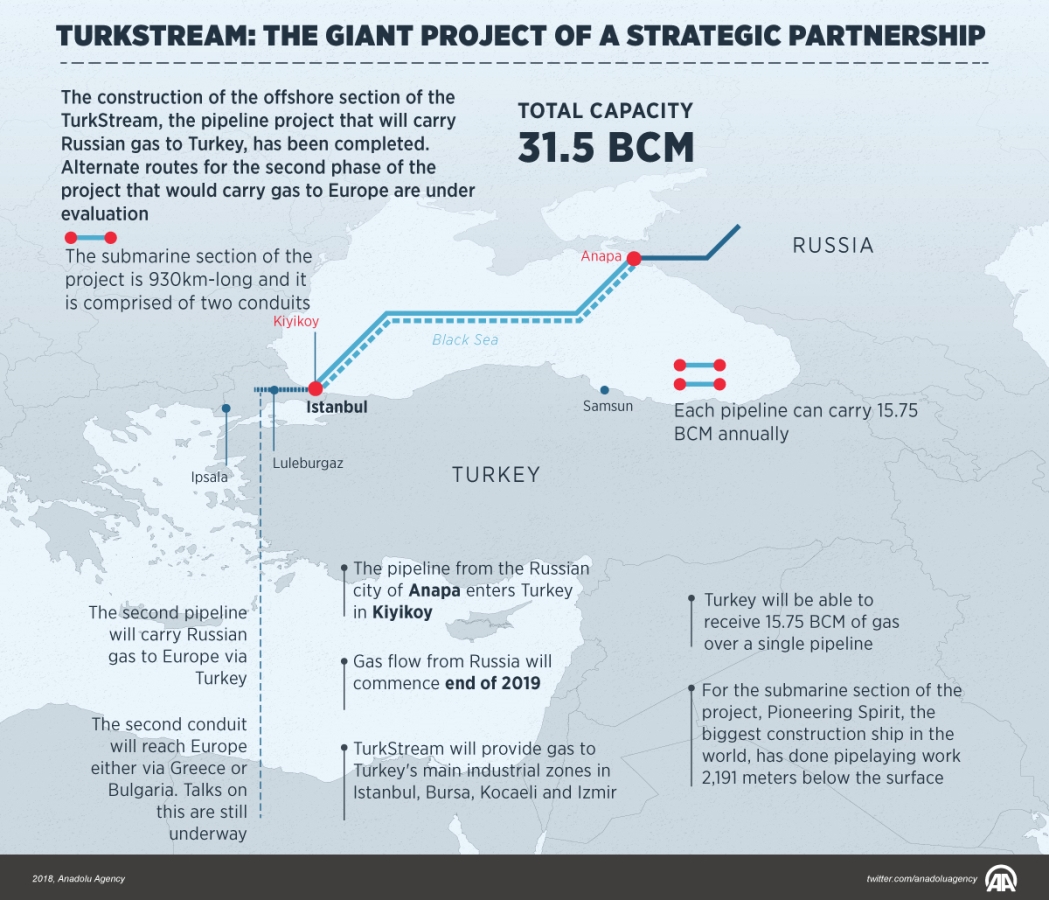

As the Ukraine crisis deepened, Russia began to look for new routes that would allow it to transmit natural gas to Europe and bypass Ukraine. Russia’s natural gas export diversification strategy was based on bypassing Ukraine via three new routes: northern, central, and southern lines. One of these steps would bypass Ukraine via the southern corridor. The South Stream project was first announced in 2007 and planned to transport gas to Europe via Bulgaria and Romania under the Black Sea. The project aimed to establish a new route to bypass Ukraine and compete with projects such as the Trans-Anatolia Natural Gas Pipeline (TANAP), which supplies gas from Central Asia to Europe. Nonetheless, Russia surprisingly decided to change the project’s route along with its name and transfer the gas to Europe via Turkey under a new name: TurkStream.

Russia started to use the TurkStream pipeline project to export its natural gas to Europe through Turkey in 2019, thus clearly intending to bypass Ukraine. Although Turkey is a critical partner in the TANAP project –the southern energy corridor5– it has also taken a prominent position on the North-South line in energy transport to Europe as a part of the TurkStream project, passing under the Black Sea. The TurkStream project’s initial route was planned through the Black Sea to Bulgaria and then Serbia, Hungary, and Slovenia, and further to Austria. However, in the following period, Russia gave up this route and decided to include Turkey in the project and transfer natural gas to Europe via Turkey by renaming the project TurkStream.

A Brief Literature Review

In his study measuring the negotiating powers of Russia and Turkey in the emergence of the TurkStream project, Dastan claims that Turkey had superior negotiating power compared to Russia and obtained a price reduction as a result of negotiation.6 Noting the surprise emergence of TurkStream project, Hafner and Tagliapietra draw attention to the lack of sufficient studies that address the project’s economic and geographical aspects and analyze its long-term results. Their study argues that the TurkStream project needs a grand strategy covering its vast geography, which includes the Caspian, Middle Eastern, and Eastern Mediterranean regions, in terms of reliable and flexible gas supply.7 In their analysis, Karagöl and Kızılkaya assert that the project can play an essential role in strengthening Turkey’s relations with the EU.8

Russia surprisingly decided to change the project’s route along with its name and transfer the gas to Europe via Turkey under a new name: TurkStream

Examining the Blue Stream project and the TurkStream project, a similar project partnership of Turkey with Russia, Kaynak claims that the TurkStream project differs in terms of Turkey’s dependence on Russian natural gas compared to the Blue Stream project. He points out that the TurkStream is different from the Blue Stream and that only one of the two strings is intended to meet Turkey’s needs, while the second string is aimed at the European market.9 Roberts, on the other hand, analyzes the impact of the project on the southern corridor and explains that it has the potential to threaten the southern corridor, but that the two projects together would contribute significantly to Europe’s energy security if Russia were to establish a connection link to the South Stream.10 In this regard, Winrow states that although Turkey is involved in the TurkStream project, it must take utmost care not to disturb Europe and Azerbaijan so that the project will not harm its role in the southern corridor.11 Shlapentokh also expresses that the future of the second string of the project, shipping the gas to Europe, has remained ambiguous due to Russia and Turkey’s problems and differences of opinion on regional issues, especially in Syria, and the uncertainty of Europe’s position.12 Interestingly, Cohen, supporting this argument, also claims that TANAP and the Trans-Adriatic Pipeline (TAP), the two significant projects that constitute the southern corridor, are a better alternative to the TurkStream in terms of bringing gas to Europe.13

An in-depth analysis by Vygon et al. addresses the potential risks of the TurkStream project for Turkey and Russia and explores different scenarios for the project’s future.14 Gustafson states that the project received support primarily from the countries through which it passed and to which provided gas supplies, although some were already supplied by the Nord Stream 2. However, he also alleges that Russia would continue to need Ukraine’s transit since the two projects are insufficient to meet Europe’s daily needs.15 Although Raszewski claims that the project has had beneficial effects on Turkish-Russian relations,16 Varol expects no improvement in Turkish-Russian relations with the signing of the project, and notes that Russia’s visa exemption export sanctions were not fully lifted.17

Despite the significant studies in the literature that analyze the TurkStream in different aspects, none directly address the following crucial questions: Why did Russia need to change the route and the name of the project? Which determinants of Russia’s preferences led to the inclusion of Turkey in the project and the decision to make the European connection through Turkey? Why did Turkey, already heavily dependent on Russia in natural gas and trying to reduce this dependence with projects like TANAP, become involved in the project? To date, these questions remain unanswered when examining the existing literature on the new Russia-Turkey energy partnership, the TurkStream project.

In order to fill this gap, this article aims to reveal the background of both countries’ decisions to establish new energy cooperation and to tally their gains. The article consists of four sections. The first discusses the Russia-Ukraine natural gas crisis, which caused Russia to bypass the European gas pipeline through Ukraine from the Soviet Union. The second outlines the Russian South Stream project’s historical background by focusing primarily on its detail and capacity. The third section explicates Russia’s strategic step of abandoning the previously scheduled route and renaming the project in order to re-route the gas to Europe via Turkey, and explores the factors that contributed to Turkey’s involvement in the project as a European junction. The fourth section explains the ways in which the project is win-win for both countries, and offer a strategic approach to better understanding their new energy cooperation in terms of the TurkStream project. The article argues that both countries benefited from the new energy cooperation, identifying it as win-win, with Russia gaining significant tariff advantages by operating outside of EU rules and establishing a sustainable natural gas transmitting line through Turkey, and with Turkey achieving strategic superiority over European countries in gas transfer and ensuring continued gas supply from Russia.

The Russia-Ukraine Natural Gas Crisis

Russia and Ukraine have a lengthy and sustained historical background of cooperation in the transport of Russian natural gas to Europe, yet their longstanding cooperation did not prevent them from becoming embroiled in severe conflict and dispute over gas supply, tax, and price issues at the beginning of the 21st century. The first crisis erupted in 2005 when Russia accused Ukraine of failing to pay for natural gas, and on January 1, 2006, Russia cut all gas supply to Ukraine for the first time. Three days later, on January 4, the gas flow was restored after an agreement was reached.18 In the 2006 crisis, Russia accused Ukraine of “siphoning off transit gas intended for Europe.”19 After a quiet 2007, Russia cut off the gas again in early 2009, reducing the gas flow due to rising tensions in 2008 between Naftohaz, the Ukrainian Gas Company, and Russia’s Gazprom. While the short-lived crisis in the two countries in 2006 did not affect the European market, the gas shortage in 2009 deeply affected Europe. Romania, Bulgaria, and Greece were the countries most affected by the three-week cut-off crisis.

Although Ukraine enjoyed lower gas prices –and received transition fees from Russia accounting for between 1.4 and 3.9 percent of the country’s total GDP and between 8 to 10 percent of the country’s budget– the gradual increase in the price of gas from Russia reached a crisis point in the 2000s

The issue of price lies in the background of the crisis. Russia and Ukraine, both members of the former Soviet Union, had set lower prices in their gas supply agreement than were paid by the European countries. Although Ukraine enjoyed lower gas prices –and received transition fees from Russia accounting for

between 1.4 and 3.9 percent of the country’s total GDP and between 8 to 10 percent of the country’s budget– the gradual increase in the price of gas from Russia reached a crisis point in the 2000s. Following the 2009 cut-off, then Russian President Dmitry Medvedev and Ukrainian President Viktor Yanukovych reached an agreement to lower gas prices by 15 percent per year until 2015.20 Ukraine also agreed to extend the lease agreement for Russia’s Black Sea fleet in Crimea to 25 years, in exchange for reducing natural gas prices with the deal.21 The agreement was interpreted as “the final nail in the coffin of the Orange Revolution of 2004.”22 In 2013, Russia offered Ukraine a $15 billion loan and a thousand cubic meters of natural gas to reduce the sale price from $400 to $268 in return for its refusal to accept an association agreement with the EU.23 Although Yanukovych initially accepted the offer, he was forced to leave the country due to the protests that erupted, and in an election in May 2014, Petro Poroshenko was elected president of Ukraine following Russia’s annexation of Crimea.

Throughout the crisis period, Russia remained one of Ukraine’s major gas suppliers, and Ukraine remained a critical transit country for Russia’s gas supply. Indeed, a substantial portion of Ukraine’s gas imports came from Russia until 2014. Nonetheless, the country reduced the amount of natural gas it received from Russia by almost half in 2014 and cut it entirely in 2016. In terms of specific figures, Ukraine received 92 percent of the 27.9 bcm of natural gas it imported in 2013 from Russia, but dramatically reduced its total natural gas imports and reduced Russia’s share of imports in 2014. By 2014 figures, total natural gas imports were 19.5 bcm, while Russia’s share declined to 74 percent. In 2015, Russia’s share of Ukraine’s total natural gas imports dropped to 37 percent, and by 2016, Ukraine had wholly cut its supply of natural gas from Russia and had started to import all of its natural gas needs from European suppliers.24 “[S]ince 2015, Ukraine no longer imports gas directly from Russia, getting gas instead from Poland, Hungary, and Slovakia (ironically, much of this gas is Russian gas exported to Central Europe, from where it is exported back to Ukraine).”25

The Nord Stream project, Russia’s first diversification project to be implemented in the 2000s, is designated to deliver natural gas directly from Russia to Germany

The rising political risks threatening its gas flow alarmed the EU, which was highly dependent on Russia,26 and led the EU to substitute Russian gas with alternative natural gas resources. While Ukraine had managed to end its direct dependence on Russia for natural gas, Russia’s 60 percent dependence on selling its gas supply to Europe through Ukraine remained a fundamental reality.27 As Pifer asserts, Russia has thus sought to maintain its gas flow to Europe via Ukraine through short-term agreements until its newly built lines could begin full capacity operation. Russia plans to completely cancel the Ukraine line when the alternative pipelines start operating at full capacity. This would mean that the flow of natural gas indirectly supplied to Europe by Ukraine would cease. In the meantime, European energy concerns and the necessity of maintaining uninterrupted gas flow from Russia to the European market have forced Russia and Ukraine to agree on the continued use of existing lines to ensure energy security and sustainable natural gas supplies. Despite efforts to extend the deal on gas transit to Europe between Russia and Ukraine (it was due to expire at the end of 2019) by ten years to ensure Europe’s energy security, Russia first intended to extend it only for a maximum period of one year, since its new alternative routes were planned to be active in 2020.28 However, one day before the existing agreement was to expire, Russia and Ukraine reached an agreement, and the gas transit to Europe through Ukraine was extended for the last time for five years at the end of 2019. Under the deal, Russia was to ship 65 bcm of natural gas in 2020 and 40 bcm annually between 2021 and 2024 via Ukraine.29 Both the U.S. sanctions on Nord Stream 2 and the TurkStream played an essential role in bringing Russia to the bargaining table with Ukraine extending its agreement until 2024. Alarmingly for Russia, the increasing of Russia’s dependence on Ukraine with this agreement has brought pipeline diversification to its agenda again to bypass Ukraine and maintain its hold on the European market by establishing safe and sustainable alternative routes.

Russian Pipeline Diversifying Strategy: Bypass Ukraine

Russia’s policy of diversifying its natural gas export pipelines dates back to the 1990s. With two new projects on the northern and southern lines in 1990s, one through Belarus and the other under the Black Sea, Russia bypassed Ukraine and shipped gas to Europe and Turkey, its major markets. On the northern line, the Yamal-Europe Pipeline project, constructed in 1994, enabled Russian gas to be delivered to Western Europe via Belarus and Poland instead of Ukraine. The Yamal-Europe Pipeline supplies almost thirty-three bcm of natural gas annually to Germany, which starting to operate at full capacity in 2006. The EU considered the Yamal-Europe Pipeline project a high-priority investment as part of the Trans-European Network (TEN). Indeed, the EU recognized it “as a key project for the establishment of major trans-border transportation capacities aimed at ensuring sustainable development and energy security.”30

On the southern line, the Blue Stream project was built under the Black Sea to convey gas exports to Turkey, which was seen as another critical Russian market. The project started construction in 1997 and began operating at full capacity in 2013.31 It has an annual capacity of 16 bcm and meets approximately one-third of Turkey’s gas needs.

Following the natural gas crisis with Ukraine in the 2000s, Russia renewed its diversification strategy and implemented three new projects: Nord Stream, Nord Stream 2, and South Stream to bypass Ukraine. With the full operation of these lines, Russia ultimately aims to end the Ukraine crossing. The Nord Stream project, Russia’s first diversification project to be implemented in the 2000s, is designated to deliver natural gas directly from Russia to Germany. In addition to the Yamal-Europe, the EU delineated the Nord Stream project as the top priority investment project carried out under the Trans-Europe Network (TEN) in 2000, and the construction of the two-line project began in 2010. Fifty-five bcm of natural gas has been shipped directly to Germany per year across the Baltic Sea through these two strings since the project was completed in 2012.32

Another project, the Nord Stream 2 pipeline, inspired by the Nord Stream, exists explicitly to supply Germany. It runs under the Baltic Sea, and its annual capacity is projected to be 55 bcm per year through twin strings, with a length of about 1,200 km. Nord Stream, operational since 2011, with a 55 bcm annual capacity through two adjacent lines at a length of 1,224 km, making it the longest sub-sea pipeline in the world. Construction of the Nord Stream 2 began in 2018; although its exit points from Russia are different, the two projects -Nord Stream and Nord Stream 2- follow the same route under the Baltic Sea. The project, which Russia had planned to complete in mid-2020, drew harsh criticisms from the United States, and Donald J. Trump decided to impose sanctions against Russia. The U.S. sanctions target companies that own the ships laying pipelines under the sea, and will delay the completion of the project for some time.33 The Swiss contractor for the project, Allseas Group, ended its work on the project due to the U.S. sanctions. Russia aimed to complete the project by bringing its own pipe-laying vessels from the South China Sea to the Baltic Sea, and by the beginning of 2020, 94 percent of the project had been completed, despite the U.S. sanctions. However, the project is seen as a threat to Ukraine’s energy security, and it believes the project will be stopped. With the complete bypass of Ukraine, the Nord Stream 2 project will almost double Europe’s dependence on Russia for natural gas; this is seen as a precarious situation -even an existential threat- for many European countries.34 However, while the U.S. may be justifiably concerned about the EU’s energy security, the main reason behind the American concern is the fact that the U.S. and Russia are competing for the European market. The U.S. intends to challenge Russian dominance in the region by increasing its own Liquefied Natural Gas (LNG) exports to Europe. In this regard, the Russian natural gas exports to Europe, both via pipeline and LNG, pose a threat to the U.S.

The final project of the Russian diversification strategy, the South Stream, is designated to transport 63 bcm of natural gas annually under the Black Sea to Europe via Bulgaria, with four pipes carrying 15.75 bcm each per year.35 In addition to bypassing the Ukraine route, another goal of the project was to compete against projects such as Nabucco (now TANAP), which envisioned transporting gas from the Caspian region to Europe as an alternative to Russian gas. In 2007, the signing of a Memorandum of Understanding (MoU) was first announced between Italian energy company Ente Nazionale Idrocarburi (ENI) and Russian energy giant Gazprom. Bulgaria participated in the project in 2008; Serbia, Croatia, and Greece were subsequently included. Russia, Italy, Bulgaria, Serbia, and Greece signed the South Stream project agreement in 2009.36 In August of the same year, Turkey became involved in the project by allowing a feasibility analysis to be carried out in its exclusive economic zone (EEZ) and in 2011 allowing the pipeline to pass through its territorial waters in the Black Sea.37 The European Parliament expressed its opposition to the project in a non-binding resolution to Russia’s annexation of Crimea in 2014, advising Europe to seek alternative gas sources. Another point to highlight is that the European Commission (EC) demanded third-party access (TPA), –“idea that in certain circumstances economically independent undertakings operating in the energy sector should have a legally enforceable right to access and use various energy network facilities owned by other companies”38– because of concerns that the project would significantly increase Europe’s dependence on Russia. Russia complained to the World Trade Organization (WTO) about the EU’s energy market laws, introduced in 2009, alleging that they violated WTO regulations by forcing Russia to allow third parties to access the project.39

Russia canceled the project at the end of 2014 due to a crisis of confidence, the TPA dispute, and the sanctions imposed against Russia by the EU

The EC had applied a TPA exemption for new natural gas investments in Europe in the past. For instance, the TAP project supplies gas from Azerbaijan to Europe, opening up the southern gas corridor and diversifying European energy resources connected with the TANAP passing through Greece, Albania, and finally Italy; TAP had obtained the advantage of a full TPA exception. Another example is the OPAL (Nord Stream’s onshore extension), which had, for 22 years, enjoyed a 50 percent TPA exemption. However, on the South Stream project, the EC did not take a similar stance and did not make a TPA exemption for the project, as it would undesirably increase the EU’s dependence on Russia for natural gas.40 The EC preferred to offer TPA exemptions for projects that would reduce dependence on Russia instead of doing it a favor.

Neither Turkey, which is a port to Europe in the project, nor Serbia, which is a member of the European Community Regulatory Board and a distribution point within Europe but has not yet fully implemented the IEM rules, are full members of the EU

Russia canceled the project at the end of 2014 due to a crisis of confidence, the TPA dispute, and the sanctions imposed against Russia by the EU.41 During a visit to Turkey in December 2014, Russian President Vladimir Putin announced that they would instead be building the TurkStream, and that a Turkish route would replace the South Stream project.

Reversing the South Stream: TurkStream as a New Energy Cooperation between Russia and Turkey

The TurkStream project replaced the South Stream after Russia scrapped it in 2014. The new project aims to provide an annual 31.5 bcm natural gas to Turkey via two strings, each with the capacity to transport 15.75 bcm annually. While the previous project had aimed to deliver gas to Europe, the first string of the TurkStream was intended for Turkey’s market, where it would compensate for the West line and flows from Ukraine, Romania, and Bulgaria. The second string is planned for shipping gas to Southern and Southeastern Europe, as the South Stream project was to have done.42 Another vital part of the TurkStream project, with more than half of its routes in the same corridor as the previous project, is the use of Turkey instead of Bulgaria as a port to Europe. By canceling the South Stream because Bulgaria failed to meet its commitments and the EU resisted the project through its TPA regulations, Putin sent a message to Europe: “we sell gas in Turkey; the rest is up to you.”43

Following the signing of the agreement between Turkey and Russia in 2016, the contract was signed with the contractor firms to construct the first string of the project offshore at the end of the same year. In 2017, the second string contract was signed and the line’s construction began in the same year. A year later, in November 2018, the project’s phase of laying a pipeline under the sea was completed. One controversial issue in the second string of the project was which country would have a European connection after Turkey. After serious competition between Greece and Bulgaria, it was decided to ship the gas to Europe via Bulgaria instead of Greece.44 One reason why Bulgaria, which had been criticized for failing to meet its obligations in the previous project, was preferred over Greece as the entry point to Europe in the TurkStream may be the future scenarios in Russia’s energy policies. By choosing Bulgaria, Russia could foreseeably re-route the line to Bulgaria in the event of a political dispute with Turkey in the near future. While this prospect may seem costly, the TurkStream project uses a broadly similar route to the South Stream, with almost a third of the route being replaced by the laying of a new offshore pipeline. If Greece had been preferred in the TurkStream project, this contingency would have been quite impossible.

Meeting of Turkish (C-R) and Russian (C-L) Presidents, Foreign Ministers, and Defense Ministers following the launch of the TurkStream pipeline, İstanbul, Turkey, January 8, 2020. MURAT ÇETİNMÜHÜRDAR /AA

Meeting of Turkish (C-R) and Russian (C-L) Presidents, Foreign Ministers, and Defense Ministers following the launch of the TurkStream pipeline, İstanbul, Turkey, January 8, 2020. MURAT ÇETİNMÜHÜRDAR /AA

The TurkStream project, which runs under 930 km of the Black Sea, was inaugurated on January 8, 2020, at a ceremony in İstanbul attended by Russian President Vladimir Putin and Turkish President Recep Tayyip Erdoğan, and the gas flow through Turkey began. The leaders of Bulgaria and Serbia also attended the opening ceremony. Putin said that the TurkStream project was an indicator of “interaction and cooperation for the benefit of our people and the people of all Europe, the whole world” in his speech at the opening ceremony.45

The TurkStream project empowers Russia to continue its dominant role in Europe’s natural gas market despite the EU’s sanctions due to its annexation of Crimea

Despite Putin’s description of the project as a development that benefits Europe, at the beginning of 2019, the EU stated that there would be no EU Internal Energy Market (IEM) rules and TPA exemption for the TurkStream, adopting the same stance they had taken toward the South Stream. Yet although the EU asserts that the project is subject to both IEM rules and TPA regulations, it differs from previous projects. Neither Turkey, which is a port to Europe in the project, nor Serbia, which is a member of the European Community Regulatory Board and a distribution point within Europe but has not yet fully implemented the IEM rules, are full members of the EU. As such, it is controversial whether these rules can be applied to the two countries.46 Different views have been presented in this debate, raised by amendments to the EU Gas Directive of 2009 in 2017. For instance, Hancher and Marhold, both experts in European Law, are of the view that the EU Gas Directive –including its 2017 amendments– can only be applied to transmission lines within the territories of EU member states and cannot be applied to non-EU countries or offshore natural gas pipeline projects such as Nord Stream and Nord Stream 2.47

While the TurkStream project strengthens Turkey’s role as an energy corridor,48 Turkey –like Ukraine and other European countries– will continue to depend heavily on Russia for natural gas supply. For this reason, Turkey and other countries that are partners of the project are likely to face a gas cut-off crisis similar to that endured by Ukraine. And Russia would be able to compete effectively with the transportation of Azerbaijan gas to Europe.49 Moreover, in addition to the energy dilemma, there are conflicts and differences of opinion between Russia and Turkey. In this context, Turkey may have to act cautiously. For instance, Larabbe et al. argue that Russia and Turkey have been in a hostile relationship in the historical process, although they have expanded their cooperation in particular in the field of energy.50 Moreover, they draw attention to the past wars in which these countries have been embroiled, and especially to their conflict of interest in Syria, given the Caspian region’s energy competition. They also claim that positive relations between the two countries could not be long-term because of their conflict areas and differences of opinion. Conversely, Öniş and Yılmaz have emphasized that “the major differences in the political orientations of the two states have not undermined their economic partnership forged on the basis of trade and investment linkages constructed over a period of two decades. At the same time, in the absence of common norms, it is extremely difficult to establish a genuine ‘political community’ among such states.” 51

Despite the countries’ asymmetric interdependence,52 their areas of limited cooperation, for example in Syria,53 their conflicts of interest and participation in different, competing projects in energy and their efforts to diversify energy resources/markets, the two countries have been able to forge new energy cooperation. So, the crucial question remains: Why is Turkey participating in a project that will increase its energy dependence on Russia and despite being involved in projects such as TANAP and TAP, which provide gas to Europe as an alternative to Russia? The term win-win can be useful in answering this question, as the TurkStream project brings to both Turkey and Russia measurable gains.

A Win-Win Approach to TurkStream

Instead of a zero-sum game that results in a win-lose, where one side’s gains are the other side’s losses, the term win-win refers to a situation in which both sides gain in-depth cooperation in international relations. Looking at the current energy cooperation between Russia and Turkey as a win-win approach, based on mutual benefits and interests, it may be argued that both Russia and Turkey have garnered at least six gains in the TurkStream project. In terms of Russian gains, changing the name of the project to ‘Turkish’ instead of ‘Southern’ establishes a positive image and perception among the Turkish public. The name change also signals Russia’s willingness to develop cooperation with Turkey. Second, it was able to skirt the EU rules by selling its gas through a non-EU country instead of shipping it directly to an EU country, which would have subjected it to the EU’s rules. Therefore, Russia did not face EU regulations as in past projects that supplies gas directly to the EU. Third, TurkStream empowers Russia to compete with Azerbaijan gas in the southern corridor as an alternative gas source to Europe, its most important market. Azerbaijan had gained a significant advantage in the European market with the implementation of the TANAP project. With the TurkStream project, Russia can balance the role of Azerbaijan as a gas supplier in Europe. Fourth, it has not lost its most important market, Europe, by building a secure alternative natural gas line through Turkey despite bypassing the traditional supply route in Ukraine. The deepening crisis with Ukraine represented a critical broken link in Russia’s European gas supply chain, yet Russia prevented the Ukraine crisis from putting European gas supplies at risk and retained its role in its most important market. Put simply, thanks to TurkStream, the southern line of the European market was not interrupted. Fifth, Russia has strengthened its role in the Black Sea by implementing a new natural gas project following Crimea’s annexation. Russia’s annexation of Crimea has been met with backlash by the international community. Although it has faced this backlash mainly in the form of economic sanctions, Russia has strengthened its role as an essential energy supplier, especially for the EU, with the TurkStream project. Also, given the potential natural gas discoveries in the Black Sea, Russia’s ownership of a project that provides natural gas to the EU under the Black Sea could make Russia an important player in the region in new supply/gas transmission agreements in the future. Last and foremost, then, the TurkStream project empowers Russia to continue its dominant role in Europe’s natural gas market despite the EU’s sanctions due to its annexation of Crimea. Thanks to the TurkStream project, Russia has been able to build a line that will compensate for the decrease in the gas flow that occurred due to Ukraine’s deactivation.

Turning now to Turkey’s gains, Turkey is now playing a significant role in its goal of becoming an energy hub and has gained an advantage as an energy corridor in the transportation of Russian gas to Europe. Russia’s reshaping of its gas supply route through Turkey has ensured that Turkey is in a key position to provide energy transmission to the EU, not only in the East-West corridor but also in the North-South corridor. Second, Turkey has secured a supply that will compensate for the loss of about 16 bcm of gas per year from the western line, which will be cut off by Russia’s bypassing of Ukraine. The fact that the project will transmit European gas through Turkey has also left no need for Turkey to seek an alternative to the gas it had supplied from Russia via the western line. It would be wrong to interpret this development as a new dependence of Turkey on natural gas from Russia, because Turkey would have acquired the same amount of gas it supplies with the Western line via Ukraine –about half of the gas it receives from Russia– that it will now obtain via the TurkStream project.

The unwillingness of Turkey’s allies to provide political and military support to Ankara, especially on issues such as the fight against terrorism, the migration crisis, and security threats deriving from the Syrian civil war, has been seen by Russia as an important opportunity

Another point to highlight is that Turkey is dependent on Russia for natural gas and Russia is dependent on the price Turkey pays.54 As Turkey needs Russia for its natural gas supply, Russia also needs customers such as Turkey, where it will earn revenue from selling natural gas. Third, the project’s resources have contributed to Turkey’s development, notably Kıyıköy, on the Black Sea coast, the line’s entry point to Turkey. The Kırklareli Kıyıköy region, where the port is located, is relatively underdeveloped compared to the surrounding areas. It can be expected that the project will contribute to the development of the vicinity of Kıyıköy. Fourth, the gas that will be provided to Turkey through the project will replace that which had come to Turkey through the western line through Ukraine, a change that will benefit Turkey in energy security. The construction of a direct pipeline between Russia and Turkey in the TurkStream, without any other country in between, (direct supplier-customer supply line) will eliminate possible risks arising from third countries in gas transmission. Fifth, the project strengthens Turkey’s secure energy transit corridor. Turkey has become a critical and secure energy corridor in the gas transmission to Europe by participating in TANAP, enabling the transportation of Azerbaijani natural gas to Europe, and TurkStream providing the transportation of Russian natural gas to Europe. Finally, the project allows Turkey to have the opportunity to merge Europe’s two energy basins. If an agreement is reached soon, the transportation of Azerbaijan gas to Europe by connecting to the TurkStream may be achieved.

Russia has shown that it can supply natural gas to Europe without Ukraine by means of the TurkStream project, and it has sent an important message to countries that have imposed sanctions on it, especially the U.S. Moscow’s policy toward changing the route and name in the TurkStream project is thus directly related and power competition in regional and global politics. In the face of the security threats and crises facing Turkey, Western countries, especially the U.S., have taken a distant attitude toward Turkey. The unwillingness of Turkey’s allies to provide political and military support to Ankara, especially on issues such as the fight against terrorism, the migration crisis, and security threats deriving from the Syrian civil war, has been seen by Russia as an important opportunity. Turkey’s crisis with Russia in 2015 over the downing of a Russian fighter jet, in the midst of a crisis with the West, had led to a deterioration of relations. Nevertheless, Russia’s positive response to Turkey’s attempt at rapprochement soon led to the normalization of relations. In this context, Moscow and Ankara, which have more recently developed cooperation on regional issues, especially in Syria, have strengthened their economic cooperation by working together on the TurkStream project.

It is worth noting that although the present cooperation between Russia and Turkey is formed on common ground, there are still significant differences between the two countries concerning regional issues. In this aspect, cooperation in the two countries’ energy projects in crisis and conflict environments results from their win-win approach. Russia and Turkey have discussed the areas of crisis and conflict on the global and regional level and have not allowed their differences to obscure the areas where cooperation can be developed. Russia and Turkey have been in political crisis before, but never has the energy sector been affected. Both states have been careful to keep energy out of the conflict. Turkey perceives the TurkStream project, which is a step that will strengthen the role of the energy corridor, as an important advantage.

Another critical achievement of the project from both countries’ perspectives is the ability to lead the two countries to cooperate, especially in contested issues at the regional level. Russia and Turkey are not likely to deepen their differences on regional issues, especially in Syria and Libya, at a level that risks their energy cooperation. Turkey has gained a significant strategic advantage with the TurkStream project in the European market competition between the U.S. and Russia in natural gas. Besides being a key country in the energy corridor, the project will also contribute to Turkey’s vision of being an energy hub. The TurkStream project can also accelerate the conditions that will lead Russia and Turkey to new cooperation, depending on the reserve capacity of the natural gas resource that Turkey has discovered in the Black Sea. If the reserve is ample, the two countries could use their joint venture to deliver this natural gas, along with the Russian natural gas, to Turkey via pipelines and export it to Europe.

Infographic detailing completed and planned sections of the TurkStream project as of November 19, 2018.AHMET TAMKOÇ / AA

Infographic detailing completed and planned sections of the TurkStream project as of November 19, 2018.AHMET TAMKOÇ / AA

However, some issues need to be highlighted regarding the project’s future and the energy partnership developed between Turkey and Russia. The first concern, the sustainability of energy cooperation developed with a win-win approach depends on political relations. In this context, whether Ankara and Moscow continue to address conflictual areas and intensify their cooperation will determine the project’s future. The second concern is whether Russia’s cooperation with Turkey in resolving regional crises –for instance, the Astana process and the Idlib protocol on the Syrian issue– will continue as envisaged. Finally, in the event of Turkey’s discovery of a natural gas reserve in the Eastern Mediterranean similar to that found in the Black Sea, this could be expected to lead Turkey-Russia energy cooperation further. The discovery of natural gas in the Eastern Mediterranean could lead Turkey to reformulate its energy policies and strategy and re-envision its energy cooperation. Nevertheless, in such a scenario, it can be assumed that instead of ending the existing cooperation, Turkey will pursue an attitude that will integrate any new eventualities into its existing energy collaboration with a similar, win-win approach.

Conclusion

This article sought to explain why Russia replaced the South Stream project with the TurkStream and how new energy cooperation was made possible between Russia and Turkey. Although there are many studies on the reasons for the South Stream project’s cancellation, studies questioning the reasons behind the Russia-Turkey cooperation in the TurkStream project are quite limited. To fill this gap, this article analyzed the TurkStream project and the new cooperation between Russia and Turkey by using a win-win approach as an analytical tool.

The natural gas crisis between Russia and Ukraine, formerly reliable partners, caused by price disputes and unpaid debts, has become irreparable due to Russia’s annexation of Crimea and its invasion of Ukraine’s eastern border. During the gas crisis, the cut-off directly affected Europe, so Russia reshaped its conventional gas pipelines to bypass Ukraine. Russia’s strategy of diversifying pipeline routes, circumventing Ukraine, has been explored in this context. Russia, initially sought to bypass Ukraine with its strategy of laying a new, three-legged natural gas pipeline, headed south of Europe with the South Stream project to complement Nord Stream and Nord Stream 2 that supply gas from Russia directly to Germany. Nonetheless, Russia disagreed with the EU on the latter’s rules and, significantly, the TPA regulations, and repealed the South Stream project after it was subjected to EU sanctions following its annexation of Crimea.55 Afterward, Russia announced a new deal with Turkey.

Russia will continue to operate the Ukrainian line until 2024, but when the deadline expires, it will cancel the Ukrainian line as, by then, the TurkStream project will have reached full capacity

The article shows that there are crucial reasons driving Russia’s decision, and mutual benefits arising from its cooperation with Turkey on the project, despite some differences of opinion and conflicts of interest, including Turkey’s involvement in the TurkStream project as well as its essential role in competing projects such as TANAP and TAP. This puzzle can be solved by viewing the cooperation as being motivated by a win-win approach that enabled the two countries to achieve significant gains based on mutual interest: Russia gained crucial advantages by including Turkey in the project by changing the route and name. Russia bypassed Ukraine and established an alternative route, substituting a secure energy line to transport Europe’s gas supplies. The new project also provided a significant tariff advantage to Russia by transmitting natural gas directly to Europe through Turkey, a non-EU member, rather than via an EU member, Bulgaria. For its part, Turkey has become a key country in transmitting Russian gas to Europe and a highly critical supply source for Europe, following up on its success with the TANAP project. The latter helped Turkey play a transit role in the transmission of gas in the Shah Deniz region, Europe’s most critical energy supply area. Moreover, Turkey has had the opportunity to continue its energy supply by compensating for the West line, where half of the natural gas it receives from Russia had previously flowed. Under the agreement reached at the end of 2019, Russia will continue to operate the Ukrainian line until 2024, but when the deadline expires, it will cancel the Ukrainian line as, by then, the TurkStream project will have reached full capacity.

Endnotes

1. Ali Tekin and Paul A. Williams, “EU-Russian Relations and Turkey’s Role as an Energy Corridor,” Europe-Asia Studies, Vol. 61, No. 2 (2009), p. 339. Russia is followed by Norway, Algeria, Qatar, and Nigeria as of 2019. See, “EU Imports of Energy Products-Recent Developments,” Eurostat, (June 2020), retrieved October 9, 2020, from https://ec.europa.eu/eurostat/statistics-explained/pdfscache/46126.pdf.

2. Paul Kirby, “Russia’s Gas Fight with Ukraine,” BBC News, (October 31, 2014), retrieved April 14, 2020, from https://www.bbc.com/news/ world-europe-29521564.

3. Finn Roar Aune, Rolf Golombek, Arild Moe, Knut Einar Rosendahl, and Hilde Hallre Le Tissier, “The Future of Russian Gas Exports,” Economics of Energy & Environmental Policy, Vol. 6, No. 2 (2017), p. 112.

4. Manfred Hafner and Simone Tagliapietra, TurkStream: What Strategy for Europe?, (Milano: Fondazione Eni Enrico Mattei, 2015) pp. 3-6.

5. Gareth M. Winrow, “The Southern Gas Corridor and Turkey’s Role as an Energy Transit State and Energy Hub,” Insight Turkey, Vol. 15, No. 1 (2013), pp. 145-163; Ramazan Erdağ, “Anadolu Geçişli Doğal Gaz Boru Hattı Projesi (TANAP)’nin Küresel Enerji Politikalarına Etkisi Üzerine Bir Değerlendirme,” The Journal of Academic Social Science Studies, Vol. 6, No. 3 (2013), pp. 867-877.

6. Seyit Ali Dastan, “Negotiation of a Cross-Border Natural Gas Pipeline: An Analytical Contribution to the Discussions on TurkStream,” Energy Policy, No. 120 (2018), p. 759.

7. Hafner and Tagliapietra, TurkStream.

8. Erdal Tanas Karagöl and Mehmet Kızılkaya, “The TurkStream Project in the EU-Russia-Turkey Triangle,” Insight Turkey, Vol. 17, No. 2 (2015), pp. 57-65.

9. Bahadır Kaynak, “From Blue Stream to TurkStream: An Assessment of Turkey’s Energy Dependence on Russia,” Journal of Social Sciences, Vol. 3, No. 1 (2018), p. 88.

10. John Roberts, The Impact of TurkStream on European Energy Security and the Southern Gas Corridor, (Washington D.C.: Atlantic Council Global Energy Center, 2015) p. 20.

11. Gareth M. Winrow, “Turkey’s Energy Policy in the Middle East and Caucasus,” in Mehran Kamrava, (ed.), The Great Game in West Asia: Iran, Turkey and the South Caucasus, (Oxford: Oxford University Press, 2016), p. 99.

12. Dmitry Shlapentokh, “The Ankara-Moscow Relationship: The Role of TurkStream,” Middle East Policy, Vol. 26, No. 2 (2019), pp 72-84.

13. Ariel Cohen, Developing a Western Energy Strategy for the Black Sea Region and Beyond, (Washington D.C.: Atlantic Council Global Energy Center, 2015) pp. 5-6.

14. Grigory Vygon, Vitaly Ermakov, Maria Belova, and Ekaterina Kolbikova, TurkStream: Scenarios of Bypassing Ukraine and Barriers of European Commission, (Moscow: Vygon Consulting, 2015), pp.1-45.

15. Thane Gustafson, The Bridge Natural Gas in a Redivided Europe, (Cambridge: Harvard University Press, 2020), pp. 378-388.

16. Slawomir Raszewski, “Russian Energy Projects and the Global Climate, Geopolitics and Development Conundrum,” in Rafael Leal-Arcas and Jan Wouters, (eds.), Research Handbook on EU Energy Law and Policy, (Glos: Edward Elgar Publishing Ltd, 2017), pp. 226-227.

17. Tuğçe Varol, “The Turkish-Russian Relations in the Context of Energy Cooperation,” in Ali Askerov, (ed.), Contemporary Russo-Turkish Relations: From Crisis to Cooperation, (London: Lexington Books, 2018), p. 214.

18. Jonathan Stern, The Russian-Ukrainian Gas Crisis of January 2006, (Oxford Institute for Energy Studies, 2006), p. 9; Vlad Ivanenko, “Russian Energy Policy and Its Domestic and Foreign Implications,” International Journal, Vol. 63, No. 2 (2008) p. 264.

19. Steven Pifer, “Heading for (Another) Ukraine-Russia Gas Fight?” Brookings, (August 30, 2019), retrieved April 16, 2020, from https://www.brookings.edu/blog/order-from-chaos/2019/08/30/heading-for-another-ukraine-russia-gas-fight.

20. Aune et al., “The Future of Russian Gas Exports,” p. 116.

21. The lease expired in 2017. See, Sagatom Saha and Ilya Zaslavskiy, Advancing Natural Gas Reform in Ukraine, (New York, NY: Council on Foreign Relations, 2018), p. 8.

22. Luke Harding, “Ukraine Extends Lease for Russia’s Black Sea Fleet,” The Guardian, (April 21, 2010), retrieved April 12, 2020, from https://www.theguardian.com/world/2010/apr/21/ukraine-black-sea-fleet-russia.

23. “Putin’s Expensive Victory,” The Economist, (December 21, 2013), retrieved April 15, 2020, from https://www.economist.com/europe/2013/ 12/21/putins-expensive-victory.

24. “Gas Imports,” Naftogaz, (2020), retrieved April 10, 2020, from https://www.naftogaz-europe.com/subcategory/en/GasImport.

25. Pifer, “Heading for (Another) Ukraine-Russia Gas Fight?”

26. Anatole Boute, “Energy Efficiency as a New Paradigm of the European External Energy Policy: The Case of the EU-Russian Energy Dialogue,” Europe-Asia Studies, Vol. 65, No. 6 (2013), p. 1025.

27. Aune et al., “The Future of Russian Gas Exports,” p. 117.

28. Pifer, “Heading for (Another) Ukraine-Russia Gas Fight?”

29. Vladimir Soldatkin and Natalia Zinets, “Russia, Ukraine Clinch Final Gas Deal on Gas Transit to Europe,” Reuters, (December 31, 2019), retrieved April 15, 2020, from https://www.reuters.com/article/us-ukraine-russia-gas-deal/russia-ukraine-clinch-final-gas-deal-on-gas-transit-to-europe-idUSKBN1YY1FY.

30. Vygon et al., TurkStream, p. 18.

31. Hafner and Tagliapietra, TurkStream: What Strategy for Europe?, pp. 8-9.

32. Vygon et al., TurkStream, p. 9.

33. “How US Sanctions Could Hit Russia’s Nord Stream 2 Gas Project,” Euractiv, (December 25, 2019), retrieved April 10, 2020, from https://www.euractiv.com/section/energy/news/how-us-sanctions-could-hit-russias-nord-stream-2-gas-project.

34. Jack Laurenson, “Is Nord Stream 2 Now Just a Pipe Dream?” Kyiv Post, (February 20, 2020), retrieved April 15, 2020, from https://www.kyivpost.com/business/is-nord-stream-2-now-just-a-pipe-dream.html?cn-reloaded=1.

35. Csaba Weiner, “Central and Eastern Europe’s Dependence on Russian Gas, Western CIS Transit States and the Quest for Diversification through the Southern Corridor,” in Ahmet O. Evin, Emre Hatipoğlu, and Peter Balazs, (eds.), European Energy Studies Volume IX: Turkey and the EU-Energy, Transport and Competition Policies, (Deventer: Claeys & Casteels Law Publishing, 2016), p. 32.

36. Antto Vihma and Umut Turksen, “The Geoeconomics of the South Stream Pipeline Project,” Journal of International Affairs, Vol. 69, No. 1 (2015), pp. 41-45.

37. URS Infrastructure and Environment UK, South Stream Offshore Pipeline-Turkish Sector Non-Technical Summary, Report on behalf of South Stream Transport B.V, (2014).

38. Alexander Kotlowski, “Third-Party Access Rights in the Energy Sector: A Competition Law Perspective,” Utilities Law Review, Vol. 16, No. 3 (2007), p. 101.

39. “Russia Takes EU Energy Rules to WTO Arbitration,” Euractiv, (May 2, 2014), retrieved April 10, 2020, from https://www.euractiv.com/section/ trade-society/news/russia-takes-eu-energy-rules-to-wto-arbitration/.

40. Vygon et al., TurkStream, pp. 6-18.

41. Simon Pirani and Katja Yafimava, Russian Gas Transit Across Ukraine Post-2019: Pipeline Scenarios, Gas Flow Consequences, and Regulatory Constraints, (Oxford: The Oxford Institute for Energy Studies, 2016), pp. 10-15; Tomas Maltby, “Between Amity, Enmity and Europeanisation: EU Energy Security Policy and the Example of Bulgaria’s Russian Energy Dependence,” Europe-Asia Studies, Vol. 67, No. 5 (2015), p. 824.

42. Martin Jirušek, “TurkStream Is South Stream 2.0-Has the EU Done Its Homework This Time?” Atlantic Council, (February 19, 2020), retrieved April 14, 2020, from https://www.atlanticcouncil.org/blogs/energysource/ turkstream-is-south-stream-2-0-has-the-eu-done-its-homeworkthistime/; Kaynak, “From Blue Stream to TurkStream,” p. 88.

43. Vygon et al., TurkStream, pp. 6-18.

44. Georgi Gotev, “Russia Says Second Leg of TurkStream Will Go via Bulgaria, not Greece,” Euractiv, (July 26, 2019), retrieved April 17, 2020, from https://www.euractiv.com/section/energy/news/russia-says-second-leg-of-turkish-stream-will-go-via-bulgaria-not-greece/.

45. Oleysa Astakhova and Can Sezer, “Turkey, Russia Launch TurkStream Pipeline Carrying Gas to Europe,” Reuters, (January 8, 2020) retrieved April 17, 2020, from https://www.reuters. com/article/us-turkey-russia-pipeline/turkey-russia-launch-turkstream-pipeline-carrying-gas-to-europe-idUSKBN1Z71WP>.

46. Jirušek, “TurkStream Is South Stream 2.0.”

47. Leigh Hancher and Anna Marhold, “A Common EU Framework Regulating Import Pipelines for Gas? Exploring the Commission’s Proposal to Amend the 2009 Gas Directive,” Journal of Energy & Natural Resources Law, Vol. 37, No. 3 (2019), pp. 296-297.

48. Karagöl and Kızılkaya, “The TurkStream Project,” p. 64.

49. Stephen Blank and Younkyoo Kim, “Economic Warfare a la Russe: The Energy Weapon and Russian National Security Strategy,” The Journal of East Asian Affairs, Vol. 30, No. 1 (2016), p. 30.

50. Stephen Larrabee, Stephanie Pezard, Andrew Radin, Nathan Chandler, Keith Crane, and Thomas S. Szayna, Russia and the West After the Ukrainian Crisis: European Vulnerabilities to Russian Pressures, (California: RAND Corporation, 2017), pp. 63-64.

51. Ziya Öniş and Şuhnaz Yılmaz, “Turkey and Russia in a Shifting Global Order: Cooperation, Conflict and Asymmetric Interdependence in a Turbulent Region,” Third World Quarterly, Vol. 37, No. 1 (2016), p. 73.

52. Seçkin Köstem, “The Political Economy of Turkish-Russian Relations: Dynamics of Asymmetric Interdependence,” Perceptions: Journal of International Affairs, Vol. 2, No. 2 (2018), pp. 79-90; Öniş and Yılmaz, “Turkey and Russia in a Shifting Global Order.”

53. Seçkin Köstem, “Russian-Turkish Cooperation in Syria: Geopolitical Alignment with Limits,” Cambridge Review of International Affairs, (2020).

54. Şener Aktürk, “Toward a Turkish-Russian Axis? Conflicts in Georgia, Syria and Ukraine, and Cooperation over Nuclear Energy,” Insight Turkey, Vol. 16, No. 4 (2014), p. 20.

55. Filippos Proedrou, “Russian Energy Policy and Structural Power in Europe,” Europe-Asia Studies, Vol. 70, No. 1 (2018), pp. 75-89.