Introduction 1

In 2013 and 2014, China successively launched the Road One Road and One Belt ”initiative, which gradually became“ the Belt and Road ”initiative (B&R). It became an important platform to guide China's opening up, promote global governance, and build a community with a shared future for humankind. As an important platform for promoting B&R in Europe, + 16 + 1 Cooperation ”plays an important role in promoting Chinese enterprises to“ go global ”and promote China-EU connectivity. Since the launch of the “16 + 1 Cooperation 2012 in 2012, China's infrastructure, energy, industry capacity, and other projects have been initiated in the Balkans. Typical examples are: China's Hegang Group's acquisition of the Serbian Smederevo steel mill; China Road and Bridge Corporation (CRBC) building the Hungarian-Serbia Railway; COSCO Group's acquisition of the Greek port of Piraeus; China Communications Construction Group building the highway in Montenegro; China Road and Bridge Company's successful bid for the Croatian Peljesac Bridge project is financed by the EU; Shanghai Dongfang Electric building thermal power station project in Bosnia and Herzegovina; and the North Macedonian highway project undertaken by Power Construction Corporation of China.

China's technology, manpower, and capital to move to Europe and enhance the competitiveness in the global market and gain greater market benefits.

China's Basic Policies for the Balkan Countries

The Balkans has a degree of continuity from the present. Historically, China and Yugoslavia maintained mutual learning, friendly cooperation for a period of time. After the Yugoslavian war, China maintained friendly relations with countries such as Serbia, while it interrupted diplomatic relations with North Macedonia due to the Taiwan issue, but later restored the relationship. In essence, the Balkans is a region one country, one policy ”tradition. The core of the Chinese policy is to maintain each other in the region, while actively promoting economic, trade, and investment cooperation. This policy is largely expected in the long-term future. Moreover,

In essence, the Balkans is a region one country, one policy ”

Since 2012, China has begun to have a platform for cooperation in the Balkans. It has developed relations with the Balkan countries under the “16+1 Cooperation” and “the Belt and Road” initiatives. “16+1 Cooperation” aims to build a platform for cooperation between China and 16 countries in Central and Eastern Europe to promote two-way trade, investment, and cultural exchanges. B&R is mainly based on connectivity with Europe. As the Balkans is located in a critical and important position in Europe, it has the potential to play a greater role. Driven by the above two initiatives, China’s investment activities in the Balkans have increased significantly, and cultural exchanges have become increasingly popular.

Progress, however, in investment cooperation between China and the Balkan countries has been limited. Following the disintegration of Yugoslavia, due to the continuous conflict in the Balkans and the deterioration of the business environment, China’s investment in this region has been relatively small. At the same time, Chinese companies did not focus on the Southeast European market, but in Western, Northern, and Southern Europe, where they have a good technical base and a developed industrial chain. Chinese companies still attach more importance to their investments in developed markets and have only seen significant growth in infrastructure and energy projects in the Balkans.

The aim of actively promoting infrastructure enterprises is to “go global” and promote connectivity within the Balkan region. The significant increase in investment by Chinese infrastructure companies in the Balkans is related to national policy priority and business needs. China’s equipment manufacturing industry has experienced more than 30 years of reform and opening up, accumulating technological advantages and first-mover advantages, but these are mainly in the domestic market, lacking international experience, and being unfamiliar with the international market. Therefore, infrastructure enterprises want to “go out,” testing themselves in new overseas markets, sharing the “cake” of the international market, and promoting the internationalization of enterprises. After B&R was put forward, it provided a broad space for infrastructure construction and trade between countries and regions along the route, and also set up a new cooperation platform for Chinese enterprises to “go global” bringing new markets space. According to the 2017 and 2018 assessments of B&R National Infrastructure Development Report, the Central and Eastern European countries are clearly at the forefront of B&R countries, regardless of actual demand, business environment or development potential.2 Of course, this is also related to the greater demand for infrastructure in the Balkan countries. Due to the war damage and the sluggish economic development, most of the Balkan countries have poor infrastructure conditions and urgently need to improve this in order to develop industries and tourism. Taken together, China’s infrastructure investment mainly focuses on the comparative advantages of the Balkan countries. Although the risks are not small, the investment value is higher in the medium and long term.

Rationale to Chinese Policy in the Balkans

There are a number of reasons as to why China has chosen to increase its activity in the Balkans. The first is the market advantage of the Balkans. Although most of the Balkan countries have not joined the EU yet, they are backed by and deeply embedded in the EU market in terms of systems and rules, facilitating trade, and investment. The geographical location is also very important with some countries in the Balkans being important transit points to Europe, the Middle East, and even Africa. For example, when Chinese companies invest in Serbia, they do so knowing that the products that are produced in Serbia can easily reach the markets of the European Union, Russia, Turkey, and Africa.

Secondly, the cost of production in the Balkan countries is more competitive. Although the region has recently experienced war, it is basically calm and there is a low possibility of another major war. Admittedly, there are sporadic regional low-intensity conflicts, however the possibility of wide-spread regional conflict is low and the business environment is improving.

Thirdly, compared with other markets, the Balkan infrastructure market has an important role as an emerging market with large investment opportunities. Government governance and legal regulations in the Balkan countries are moving closer to EU standards. Chinese companies operating in the Western Balkans can familiarize themselves with EU market rules and gain market access, accumulating experience to enter the EU market.

Investment of Chinese enterprises in the Balkan region not only solves the problem of the survival of industry enterprises, but also promotes local employment and local economic development

Therefore, promoting China’s high-quality and advantageous industry capacity to “go global” and serve the local economy is in China’s interests. The “go global” of China’s industrial capacity, represented by steel, coal, and electricity, is a reaction to domestic and international conditions. Since the outbreak of the global financial crisis in 2008, domestic and international market demand has tightened, and China’s “overcapacity” problem has surfaced and is increasingly becoming a problem. China’s steel and other production capacity has increased year by year, but the utilization rate of domestic and foreign markets is declining. At the same time, the expansion of industrial capacity is gradually hampered by the pressure on energy consumption and environmental protection and the increase in production costs per unit of labor in China. In 2012, China’s Central Economic Working Conference proposed four batches, namely: digesting, integrating, eliminating, and transferring a batch. The main goal of transfer is to go out and expand international cooperation. In 2013, the State Council of China issued a document clearly stating that the focus of the steel industry is to resolve overcapacity.

In 2016, the State Council put forward a clear requirement in the “13th Five-Year Plan” for the development of the iron and steel industry to reduce the surplus capacity, which is to reduce the steel industry capacity by 100 million tons to 150 million tons in three to five years. Considering the large demand for foreign infrastructure, the demand from emerging markets especially continues to be strong, using B&R and the supply-side structural reforms, the steel companies actively “go out” and carry out international industrial capacity cooperation.3

Chinese Investment’s Advantages to the Balkans

Driven by B&R and “16+1 Cooperation,” China’s advantages and high-quality industry capacity have also landed in the Balkans. It should be emphasized that the investment of Chinese enterprises in the Balkan region not only solves the problem of the survival of industry enterprises, but also promotes local employment and local economic development. A good example is China Hegang’s acquisition of the Serbian Smederevo steel mill, which was in a state of bankruptcy. After the Chinese company took over the management, it not only activated the old factory, but also solved the employment issues of nearly 5,000 people. Business operations have turned losses into profits within one year. The Stanari Thermal Power Station built by Shanghai Dongfang Electric in Bosnia and Herzegovina also produces clean energy that meets EU environmental standards and provides for local electricity demand as well as employment. The project of the B plant of the Kostolac Power Station in Serbia, built by China Machinery, not only brought new technology and improved the original backward production capacity of the enterprise, but also guaranteed the livelihood of the local people, drove the development of the country’s power industry, and ensured Serbia’s Power supply.

Financing of Chinese Enterprises

China’s financial support to enterprises has undergone change and adjustment. From concessional loans to direct investment to winning the tender from EU projects, it shows that the progress and competitiveness of Chinese enterprises, and the popularity in the Balkans has also increased.

In the early stage of Chinese enterprises’ investment in the Western Balkans, most of the projects used concessional loans provided by Chinese financial institutions. These funds, which are large in number, have favorable interest rates and a long repayment period, which is attractive for the Western Balkan countries. However, due to the generally small economic scale of the members in the region, the recipient of Chinese loans has caused the public debt of some countries to rise, raising concerns of the European Union and the International Monetary Fund.

China expects the Balkan countries to join the EU as soon as possible to ensure that investments in the Balkans become “potential stocks.” Whether it is doing business with the candidate countries or doing business with the EU, China benefits from the stability and prosperity of the EU’s single market

According to the situation, Chinese companies have partially adjusted their financing approaches, from concessional loans to direct investment, or adopting public and private partnership (PPP), even obtaining grants from the EU. For example, in 2018, Shandong Linglong Tire’s investment of $994 million in the Serbian Free Trade Zone to build 13.62 million sets of high-performance radial tire projects is a typical representative of direct investment, and China Zijin Mining’s merger and acquisition of Serbian mining is also a model of direct investment. The Croatian Peljesac Bridge project undertaken by Chinese companies and funded by the EU is the indication that Chinese companies are increasingly rich in financing approaches and also showing their own competitiveness.

Long-term Strategy of Chinese Involvement in the Balkans

In the discussion among the current European think tanks, there is a more popular view that China’s investment will undermine the potential integration of the Western Balkans into the EU and lead to the downfall of the aspirations of Western Balkan countries. In fact, this understanding is not correct and does not fully understand China’s investment motives.

Firstly, China’s investment in Balkan infrastructure and connectivity are in fact mainly focusing on the EU’s single market, through the investment in the EU’s peripheral market, so hoping to eventually gain greater benefits from those countries entrance into the EU. Therefore, in essence, China expects the Balkan countries to join the EU as soon as possible to ensure that investments in the Balkans become “potential stocks.”

Secondly, whether it is doing business with the candidate countries or doing business with the EU, China benefits from the stability and prosperity of the EU’s single market. If there is turmoil in this market, it will undermine China’s business. There is a sober analysis of European think tanks. “When discussing China’s influence in Europe, many think tanks believe that China will exert the same influence as Russia. This is an incorrect assumption. Unlike Russia, China benefits from the continued integration and stability of Europe because the EU is China’s largest trading partner.”4 The business environment is sound only if the EU is united and stable allowing China to benefit. Based on these two reasons, China is a supporter of Western Balkans integration into the EU, and hopes to gain more benefits through the continuing stabilization process. So far, China’s investment in infrastructure and energy projects in the Western Balkan countries has helped to boost regional economic growth, promote regional connectivity, and ultimately improve the local business environment, thereby providing assistance for these countries to finally join the EU.

Summary and Analysis of Chinese Investment Cases

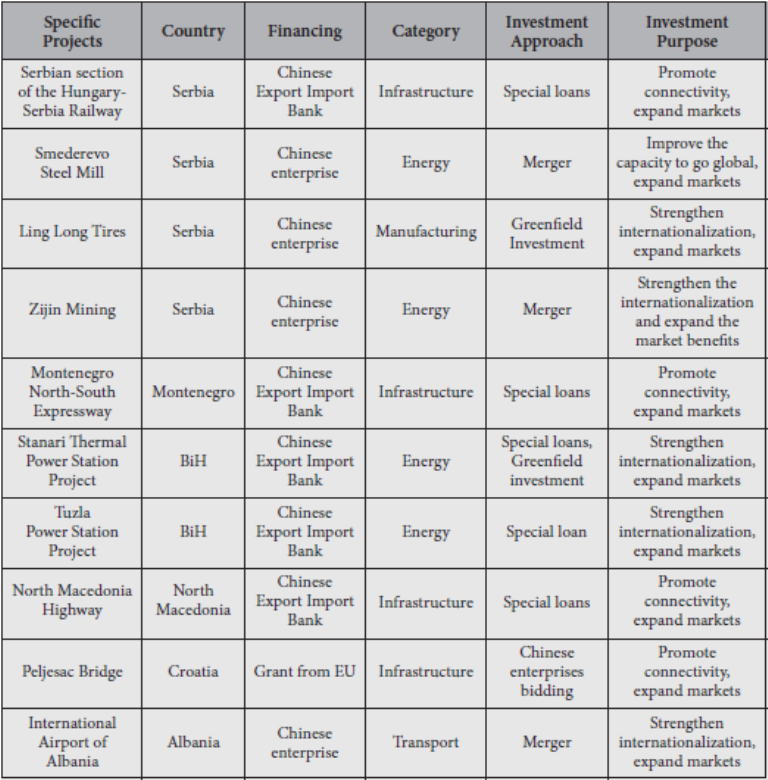

There is an increase in the number of Chinese investment cases in the Balkans, such as the China-Europe Land and Sea Express and Three Sea Harbors Cooperation amongst other large-scale energy, infrastructure, and industry capacity projects. Some typical examples of Chinese investment are provided below, all of which are included in field studies by the author.

Table 1: Typical Cases of China's Investment in the Balkans

By examining these cases, we can see the situation and characteristics of Chinese companies investing in the Balkans and clarify some misunderstandings. The nature of Chinese investments in the Balkans can be understood through the following eight policies and practices:

Profit is paramount: Through research and interviews, the author finds that the primary goal of most Chinese companies is to maximize profits by acquiring EU project funding. For some Chinese infrastructure investment companies, the Balkan market is relatively unfamiliar, and Chinese companies are not well known in the area. Therefore, companies must have an initial investment in order to gain a foothold in this market, accumulate the necessary experience and qualification certification, and finally to chase the EU projects. From the above facts, it can be seen that the support for national financing or special loans is only one of their choices, followed by direct investment. The EU’s grant schemes (especially the support of structural funds) are attractive, so obtaining EU projects is the main financing target for Chinese companies. By conducting interviews in several companies, it has been found that they are very eager to obtain EU-funded projects in the EU market, and this is therefore the target of their initial investment. This is quite obvious in China’s infrastructure enterprises. They want to actively participate in projects funded by the EU’s pan-European transport network framework and receive EU grants, which would not only enhance the competitiveness of enterprises, but also integrate well into the EU’s wider market leading to greater profits.

Financing risk is high: China promotes enterprises to “go global” by providing special financial support. There are three main types of international loans in China: non-repayment loans, interest-free loans, and concessional loans. Among them, the free loans and interest-free loans are provided by the Chinese government, and the concessional loans are provided by the Export-Import Bank of China, designated by the Chinese government. The main way for China to invest and finance the Western Balkan countries is to attract more Chinese companies by issuing special loans as a driving force. China’s concessional loans are mainly used to help the Balkan countries to build production capacity projects, with economic and social benefits, and large and medium-sized infrastructure, or to provide complete sets of equipment, mechanical and electrical products, technical services, and other materials. The principal of the concessional loan is raised by the Export-Import Bank of China based on the market rules. The loan interest rate is lower than the benchmark interest rate announced by the People’s Bank of China.

The resulting interest difference is subsidized by the Chinese government. At present, the annual interest rate of concessional loans provided by China is generally two percent to three percent, and the term is generally 15 to 20 years (including the grace period of five to seven years). Now, China can only give, but not grant, concessional loans to the EU member states or candidate countries. Therefore, compared with the EU’s financing methods, China’s investment competitiveness is relatively weak. This is not only reflected in the fact that the financing provided by the EU does not need to be repaid, but also reflected in the financing interest rate in China, even if the government provides subsidies, it is still high in the European market. In investing in the Balkan region, EU investment is dominant and provides regulatory restrictions on the winning bidders. Since China’s financing methods are relatively less competitive than the EU, China has to choose some high risks in the Balkans which the EU is less interested in. For example, the Montenegro North-South highway project has been considered by European assessment agencies to be difficult to implement, with low return on investment and this has led to the failure to find financial support within Europe.

Now, China can only give, but not grant, concessional loans to the EU member states or candidate countries. Therefore, compared with the EU’s financing methods, China’s investment competitiveness is relatively weak

China tries to seek complementarity with the EU: China’s investment in the Balkans is complementary to the EU, and also satisfies local development; therefore, it is a win-win outcome whether for the EU, the Balkans, or China. This is concentrated in the field of thermal power. In China, thermal power has occupied more than 70 percent of the electricity market for a long period of time, and Chinese firms have accumulated rich experience in technology, operation, and development, ensuring that enterprises are more competitive. However, in Europe, thermal power lacks a market supply, and the EU does not fund thermal power industries and sectors. For many countries in the Balkans, there are high market demands, an opportunity which Chinese companies are looking to capitalize upon. For example, the Stanari region has local coal mines; however, due to its remote location and difficult conditions for transportation, Chinese companies have built thermal power stations locally to fully utilize the coal resources. This has both solved the local employment problem, while at the same time generating power to solve the problem of local power deficits. It has also earned profits for local owners by selling electricity into the EU market. China’s thermal power generation technology is advanced and holds a leading level in the world market, therefore, it has well met the EU’s environmental protection, labor, and other technical standards, bringing opportunities for local economic development. At present, many thermal power investment companies in China are looking for opportunities in the Balkans, and there are currently many projects under negotiation in this region.

Competitive pricing: The peer competition between Chinese enterprises is an important factor leading Chinese companies to engage in low-price bidding in the Balkans. Chinese companies are globally more competitive in infrastructure and energy, and the industrial capacity at home is also surplus to needs. Therefore, Chinese enterprises originating from different regions often face competition from each other, and with a lack of coordination between them in the bidding process, they are forced to lower the prices to win the projects. Low-price bidding does not mean that Chinese enterprises have no technical ability, but a specific reflection of domestic competition spilling over into the international market. According to the author’s investigation, the bidding “battles” of several thermal power companies and infrastructure enterprises of China in the Balkans are not caused by international companies, but by price competition amongst Chinese companies. Therefore, once Chinese companies are familiar with the local situation, and the coordination between enterprises is strengthened, the era of low-price bidding is expected to end.

Chinese enterprises are in pursuit of the cycle effect: The cyclical investment spillover effect of enterprises is also the reason why Chinese companies can invest at lower prices. This is more obvious in infrastructure companies. Many of China’s infrastructure projects are concentrated in the Balkans, because companies have put equipment into this area, facilitating the flow of equipment to neighboring countries within the region, and the cost is naturally reduced. Repurchasing equipment for an infrastructure project will result in very high costs, which Chinese companies must evade. Therefore, it can be argued that the international media’s criticism of China’s low-price bidding does not take into consideration the specificities of the situation. The low investment price in China is essentially a manifestation of competitiveness and the result of recycling equipment.

Chinese enterprises obey the rules and regulations: Chinese companies are newcomers in the region and were not initially familiar with local policies and regulations in the Balkans. However, with the increase in investment, they now actively aim to meet the EU rules. In the Western Balkans, with the exception of Croatia which joined the European Union in 2013, countries are currently actively seeking accession and are working to link their systems to the EU standards. At present, Chinese enterprises are mostly based on the principle of localized management, respecting local construction, labor, environmental protection, and tax laws, and actively matching the relevant systems and norms of the Balkan countries, and where necessary, the European Union.5 Although the international media’s criticism of China’s non-compliance with EU rules continues, in fact, the degree and intensity of Chinese enterprises’ compliance are relatively high.

Although the international media’s criticism of China’s non-compliance with EU rules continues, in fact, the degree and intensity of Chinese enterprises’ compliance are relatively high

Chinese companies actively participate in fair competition in the international market to obtain benefits. Take the “Peljesac Bridge” project won by CRBC as an example. This project is the first large-scale infrastructure project implemented by Chinese infrastructure enterprises in the EU market. CRBC strictly abided by relevant EU laws and regulations throughout the bidding process. Ultimately, it relies on excellent professional skills, low construction cost, advanced management experience, and rich international experience to defeat other competitors such as Orbag’s well-known construction firm Strabag. The other projects financed by China, such as the Zemun Bridge in Serbia and the North-South highway in Montenegro, are mainly won through a bidding process. In the process of design, budget, construction, procurement, and subcontracting, the supervision and evaluation of the local engineering teams are used, in accordance with relevant local laws and regulations.

Localization is improved: After investing in a specific project, Chinese companies have paid more attention to fulfilling their social responsibilities, actively providing employment opportunities to local people, and retaining local work teams. For example, Hegang’s acquisition of the Serbian Smederevo Steel Mill and Shanghai Dongfang Electric Company’s investing in Stanari Thermal Power Station are among other similar projects. These companies basically employ local people and have created many jobs in the local areas. China’s acquisition of the Albanian International Airport is also a case in point; the Chinese company not only retained the local management team, but actively pursued internationalization. Among the 10 investment cases investigated by the author, the localization work has been significant and won the welcome of local people.

China is promoting third-party cooperation: Chinese companies are also actively seeking third-party cooperation to pursue mutual benefits and obtain win-win results. It is important to cooperate with third parties for China to enter the international market. For example, the Albanian International Airport, although acquired by Chinese companies, employs a German management team forming third-party cooperation and ensuring the optimum operation of the project.

China exerts economic influence in the Balkan countries, and at the same time promotes B&R to integrate with the European market and compensate for China’s economic slowdown

Chinese enterprises not only comply with the local laws and related systems, but also use these systems to protect their legitimate rights and interests. In the face of unexpected factors such as government land acquisition delays and extreme weather during the construction process, CRBC actively communicated with the local government, and used the FIDIC contract terms to legally safeguard corporate interests, and ensure the company’s profitability goals.

Analysis of China’s Investment Influence in the Balkans

Regarding China’s influence in the Balkans, there are various views reflecting in the international media. An objective analysis of China’s influence in the Balkans will help China’s stakeholders to ensure better cooperation with the countries in the region. Based on the perspective of a number of think tanks, the author gives some basic assessment of China’s investment influence.

China is the natural partner for the EU on Western Balkans’ European Integration. China does not aim to be involved in the ambitious process of state-building of the Western Balkan countries like the EU, nor does it want to keep its military presence in the Balkans like NATO or the United States, nor will it be an influential force like Russia in the energy, infrastructure, and culture. China’s aim is to find political friendship through bilateral pragmatic cooperation to repair the broken infrastructure of the Balkans. In this way, China exerts economic influence in the Balkan countries, and at the same time promotes B&R to integrate with the European market and compensate for China’s economic slowdown.

Some European countries hold a contradictory view on China’s role in the Western Balkans. Although there is competition with European countries, China’s investment in this region will benefit the economic modernization, competitiveness, economic growth, and regional connectivity of the Western Balkan countries. Therefore, China is more likely to be a “stabilizer” in the region as it supports the integration of the Western Balkan countries into the EU system.

A picture taken on April 8, 2019, shows the construction of the section of Bar-Boljare highway which will connect Serbia with Montenegro’s main seaport and which is being constructed by CRBC, a state-owned Chinese company. SAVO PRELEVIC / AFP / Getty Images

A picture taken on April 8, 2019, shows the construction of the section of Bar-Boljare highway which will connect Serbia with Montenegro’s main seaport and which is being constructed by CRBC, a state-owned Chinese company. SAVO PRELEVIC / AFP / Getty Images

It is not necessary to exaggerate China’s presence in the region for a number of reasons. Firstly, China still cannot exert its influence in the same way as the West due to its limited economic, political, and cultural involvement. On the contrary, if B&R is fully implemented, it will shorten the geographical distance between Beijing and the Balkans, and will help the EU to promote EU-China connectivity. Secondly, although China is looking for business and cooperation opportunities, it does not want to be involved in local competition and disputes. China remains silent in all regional disputes and it supports the decisions made by the EU. Thirdly, China is not interested in undermining the Balkan countries’ accession to the EU. Instead, it encourages this process because China believes this will make its own investment safer and believes that participation in the Balkans is a way to promote relations with the EU. Balkan leaders should not fall into the trap of seeing China as an alternative to the EU.6

Finally, in spite of China’s investment growth, the Balkan countries are more economically dependent on the EU than China. The European Union’s investment in the region considerably exceeds that of China. As the recent report of the European Bank for Reconstruction and Development pointed out, despite the increase in Chinese investment, the Balkans are “still firmly rooted in Europe.” The EU still has greater influence in the Balkans, remaining as the largest trading partner of the region, accounting for 76 percent of all trade. The cultural and social ties between the Balkan countries and the EU countries are also much stronger than China, as is to be expected by the geographical proximity.

To be frank, although China’s influence in the Balkans should not be exaggerated, it is now higher than ever before. China has become more active in the Balkans, with investment in infrastructure and energy sectors in particular growing rapidly, and this has attracted widespread attention from the EU and other Western countries.

Both China and Europe should recognize the need for co-operation and respect each other’s development patiently and objectively

As far as China is concerned, just a few years ago it was largely invisible and its importance in the Balkans was small. This situation changed only after the B&R and the “16+1” initiative were proposed. The reason why Chinese companies favor the Balkans is that China believes that the region is the gateway to the EU market and the land bridge between China’s Piraeus port and Central Europe. In this context, China began to increase bilateral trade with countries in the region and invested in the development of transportation and energy infrastructure. The Western Balkan countries have little reservations about China because they are the least developed countries in Europe, and rely on seemingly favorable financing opportunities and direct investment.

China’s political influence is also under discussion. This discussion is not decided by China but the EU itself. As one European think tank argues, China may not export any ideology, but the state-led model of each large-scale project will spillover, and in the Balkans with its history of communist governance, this increases the risk of undermining the EU reform agenda.7

Washington, Brussels, and Berlin worry that China’s economic participation may not be as simple as it appears, because such investment could lead China to exert greater political influence in the region in the future. There are still some questions about China’s long-term goals and intentions because the focus of the EU’s concerns is not only stability but also the promotion of democracy, market economy, and good governance. China’s economic practices often fail to meet European standards, threatening the EU’s conditional and regulatory standards and increasing the overall vulnerability to corruption in the region. The acceptance of loans for major infrastructure projects, mainly provided by the Export-Import Bank of China, also poses a risk of financial dependence and imbalance. In the long run, China’s growing economic power may also lead to an increase in political influence. The EU has already had differences in matters concerning China, which is another challenge that the EU needs to face.8

In this respect, it can be said that there should be more political mutual trust between China and the EU. The Chinese government has tried to differentiate the government policy and enterprises’ behaviors and invite these businesses to develop their own experience, and capacity abroad. During the process, the government should not decide everything for the private sector firms as they are market actors, not government supported bodies. In summarizing, the influence of China in the Balkans is a matter which requires astute handling. Both China and Europe should recognize the need for co-operation and respect each other’s development patiently and objectively.

Endnotes

- The Balkans discussed in this article are mainly concentrated in the former Yugoslavia countries such as Serbia, Montenegro, Bosnia and Herzegovina, North Macedonia, Croatia, and Albania. Greece and other countries are also included in the discussion.

- “‘One Belt, One Road’ National Infrastructure Development Index Report 2018,” China Foreign

Contractors Association, (2018), retrieved from https://max.book118.com/html/2018/0923/

6142055210001220.shtm. - Zhao Wenbao and Li Ying: “‘Going Global’ to Resolve Overcapacity in the Steel Industry,” Journal of Hebei University of Economics and Business, No. 3 (2018). It should be pointed out that China’s excess capacity is not inferior capacity, but it still has strong international competitiveness.

- Matej Šimalčík, “China in the Balkans: Motivations behind Growing Influence,” Institute of Asian

Studies, (October 19, 2018), retrieved from https://www.euractiv.com/section/china/opinion/china-

in-the-balkans-motivations-behind-growing-influenc/. - According to the Serbian office of China Road and Bridge Corporation, since 2010, Serbia has made many revisions to its legal system, and has basically achieved full integration with EU law. Among them, the construction method was changed seven times, the planning law was changed twelve times, and the labor laws changed every year. This poses a challenge for companies to adapt to the frequently changing standards in this country.

- Vuk Vuksanovic, “The Unexpected Regional Player in the Balkans: China,” War on the Rocks, (November 29, 2017), retrieved from https://warontherocks.com/2017/11/unexpected-regional-player-balkans-china /.

- Michal Makocki, “China in the Balkans: The Battle of Principles,” Clingendael Spectator , Vol. 71, (2017), retrieved from https://spectator.clingendael.org/pub/2017/4/china-in-the-balkans/.

- Vuksanovic, “The Unexpected Regional Player in the Balkans: China.”