Introduction

The exploration and exploitation of hydrocarbons resources in the Eastern Mediterranean have played an important role in regional dynamics for several reasons.1 First, the Eastern Mediterranean holds substantial natural gas potential. The total volume of discovered gas reserves in the region is similar to that of Norway. Around half of that volume, which is equivalent to Azerbaijan’s current gas reserves, was discovered in the past decade. When the assessments for undiscovered resources are also considered, the region’s total gas potential is equivalent to that of the North Sea, making the Eastern Mediterranean region an exciting exploration frontier.

Second, the exploitation and utilization of the region’s gas potential have brought various benefits and challenges with it. In addition to contributing to the economy of the region, the discovered reserves have changed the entire energy picture in Egypt and Israel. Now, these gas producers face the risk of oversupply and competitive prices within the region. Third, having supplied their immediate neighbors, they are in need of reaching distant but lucrative markets; the lack of sufficient gas export infrastructure in place is a major obstacle. All of the options on the table face several commercial, security, legal and political challenges.

Resolving the longstanding disputes in the region, particularly those related to maritime boundaries, remains the most difficult conundrum. Without a viable export route to distant markets, the future of exploration, production, and field development activities in the region look bleak. Unfortunately, instead of paving the way for collaboration and cooperation to help improve prosperity, natural gas has further complicated the already complex dynamics of the region and become a tool for shaping new alignments and alliances. All of these issues will be discussed throughout this article through a critical lens and some recommendations for a possible way forward will be offered.

Brief Overview of Natural Gas Developments in the Eastern Mediterranean

More than 5,000 billion cubic meters (bcm) of natural gas has been discovered in the region since the first gas discovery in Egypt’s Abu Madi gas field in 1967.2 This is more than the total amount of gas discovered in Norway.3 Around half of that volume was discovered in the past decade.4 Some of the discoveries in the Eastern Mediterranean, namely, the Tamar and Leviathan fields in 2009 and 2010 in Israel, Aphrodite in 2011 in Cyprus, and Zohr in 2015 in Egypt were among the world’s largest deep-water gas discoveries.5 Of these, the Zohr field is the largest gas discovery ever made in the Mediterranean Sea.6 Consequently, the Eastern Mediterranean has become one of the most exciting new frontiers of natural gas exploration worldwide. However, this is not the only reason why the region has sparked the interest of major international energy players.

Resolving the longstanding disputes in the region, particularly those related to maritime boundaries, remains the most difficult conundrum

The Eastern Mediterranean region is estimated to have substantial yet-to-be-discovered hydrocarbon resources. Two United States Geological Survey assessments,7 as well as potential estimates by Cypriot, Lebanese, and Israeli officials, have put the region under the spotlight of international energy companies.8 These estimates indicate that the region’s undiscovered potential is twice as much as the total gas discoveries made there so far. When the volume of discovered gas and undiscovered gas potential are combined, the resulting total places in the Eastern Mediterranean region are on par with the whose holdings are divided among Norway, the UK, the Netherlands, and Denmark.

The substantial gas potential of the Eastern Mediterranean has yet to be adequately developed. A large part of the region still remains under- or unexplored, even in Egypt, and the speed of exploration and success have been uneven among the countries involved. Some countries have been successful in attracting foreign companies, others not. In some cases, progress has been interrupted or delayed because of domestic conditions, often related to political, regulatory, and legal issues. A brief account of exploration activities by country is provided below.

Egypt

Egypt has launched numerous international bidding rounds for hydrocarbon exploration and production and has signed dozens of agreements with international companies.9 The demarcation of its maritime borders with Saudi Arabia allowed Egypt to launch its first-ever bid round in 2019 for the untapped area of the Red Sea. Another virgin territory, the offshore West Mediterranean, is currently being directly negotiated with interested companies. After ExxonMobil was awarded a block in the area in early 2020, six more blocks in this zone were awarded to major international oil and gas companies.10 On February 18, 2021, Egypt announced the start of a new round of bids for the exploration and exploitation of oil and natural gas in 24 blocks, nine of which are in the Mediterranean Sea.

In 2014, the Syrian government signed a production-sharing agreement for the exploration and development of one of its blocs, but no activity has been reported yet

There have been several large onshore and offshore natural gas discoveries in Egypt in the past five decades. Of these, the most important one was the Zohr field, which is regarded as a geological game-changer for exploration in the Mediterranean.11 It is important to note that both ExxonMobil and Chevron entered the Egyptian upstream sector in 2019. Moreover, after acquiring Noble Energy (operator of the Tamar and Leviathan fields in Israel and the Aphrodite field in Cyprus) in 2020, Chevron has become one of the most important actors in the Eastern Mediterranean.

The GASC

The Greek Administration of Southern Cyprus (GASC) held three offshore licensing rounds for hydrocarbon exploration in 2007, 2012, and 2016 and has awarded nine blocks to foreign companies. Three offshore gas discoveries have been made to-date–Aphrodite in 2011, Calypso in 2018, and Glaucus in 2019. Of these, only the Aphrodite field discovered by Noble Energy was declared commercial in 2015.12

Israel

Israel has been exploring hydrocarbons for decades, albeit without much success. The first commercial gas discovery, the offshore Mari-B field, took place in 2000. A decade later, two giant offshore gas reserves were discovered –the Tamar field in 2009 and the Leviathan field in 2010. Other, smaller discoveries followed. Israel expanded its offshore exploration opportunities after the government adopted a new gas sector framework in 2015 and 2016. Since 2016, licenses for hydrocarbon exploration offshore have been granted via a competitive process. Israel held three international offshore bid rounds in 2016, 2018, and 2020 for natural gas and oil exploration, and awarded numerous blocks.13 In February 2021, the Israeli Ministry of Energy announced plans to launch a fourth offshore bidding round for exploration licenses for 25 blocks to be grouped into six clusters.

Lebanon

Lebanon has launched two international licensing rounds for offshore oil and gas exploration. The first, in 2012, was postponed several times due to the political deadlock and lack of consensus in the country. Finally, in 2017, the licensing round was relaunched, and two blocks were awarded to a consortium of three companies: TOTAL, ENI, and Novatek. The consortium failed to find a commercial reservoir in its first exploration well in block 4, which was drilled in early 2020. The drilling activities in the other block (block 9) are expected to commence in 2021. In the second offshore licensing round, launched in 2019, five blocks were offered. However, the deadline for submitting bids has been postponed three times due to the global COVID-19 pandemic and its economic repercussions.14 The government expects to complete the round in 2022.

Palestine

In Palestine, limited exploration activities have been undertaken. Only one small gas field, the Gaza Marine field, was discovered by British Gas (now Shell) in 1999 on the Palestinian coast.15 The field remains undeveloped due to the continued blockade of Palestine’s access to the gas field by Israel and the political divisions among the Palestinians.

Syria

Syria’s offshore is truly a frontier area of exploration, as no wells have been drilled offshore Syria. The first offshore bidding round was held in 2007, but no licenses were awarded. The second Syrian international offshore licensing round, held in 2011, received no bids, as war broke out in the country soon thereafter. In 2014, the Syrian government signed a production-sharing agreement for the exploration and development of one of its blocs, but no activity has been reported yet.16 Due to the ongoing crisis in the country, no significant development in upstream activities is likely in the near future.

Turkey

Turkey’s offshore hydrocarbon exploration activities in the Mediterranean gained momentum following the announcement of its new national energy and mining policy in 2017. Unfortunately, none of the 18 wells drilled to date in the Mediterranean have contained commercial quantities of hydrocarbons. It should be noted that the Turkish Republic of Northern Cyprus (TRNC) issued offshore licenses to Turkish Petroleum (TPAO) for hydrocarbon exploration in seven blocks in September 2011.

Currently, both Egypt and Israel are net gas exporters. If one or more of its existing discoveries are converted into production capacity, the GASC will also become a gas exporter

Several exploratory and appraisal drilling campaigns were expected to take place in the Eastern Mediterranean in 2020, but many of them have been deferred as companies curtailed their upstream capital expenditures due to the COVID-19 pandemic. This was especially the case for the drilling activities in the GASC and Lebanon. The pandemic has also had an impact on licensing plans in the region. Compared to other countries, however, Egypt’s upstream activities and plans are the least affected.

The Eastern Mediterranean Has Become a Gas Exporting Region

Discoveries make sense if they are converted into production capacity, which necessitates selling the produced gas to domestic and/or international markets with a favorable profit margin. Selling the gas to domestic markets was rather easy because all the countries in the region were hungry for natural gas, the least polluting fossil fuel. Using domestically produced gas has brought not only environmental but also economic benefits since it has helped reduce dependence on imported fuels, mostly coal and petroleum products.

For all these reasons, the produced gas has easily found its way to the domestic market. In Egypt, for instance, most of the discovered fields were put into production quite quickly, which allowed the country to switch from oil to gas in power generation. Instead of being consumed in the domestic market, the freed-up oil was exported and hence generated revenues for the country. And once domestic gas production exceeded demand, the excess production was also channeled to foreign markets. As a result, Egypt became a gas exporter in 2003. However, during the political uncertainty and civil unrest in the country between 2011 and 2013, gas production could not keep up with booming demand, and consequently, Egypt became a gas importer in 2015. This situation was reversed in 2018, thanks to a series of successful licensing rounds for hydrocarbon exploration and production after 2013 and improvements in pricing policy that resulted in multiple discoveries and a tremendous increase in gas production.

In Israel, production from the Mari-B field, which came online in 2003, was not sufficient to meet the domestic demand for gas. Therefore, gas imports commenced in 2005 by pipeline from Egypt, and Liquefied Natural Gas (LNG) imports began in 2013 from international markets. After production from the Tamar field began in 2013, Israel became, first, self-sufficient in gas, and then a net gas exporter.

Currently, both Egypt and Israel are net gas exporters. If one or more of its existing discoveries are converted into production capacity, the GASC will also become a gas exporter. Lebanon might follow if sufficiently large discoveries are made, as is hoped. Natural gas production potential in the region is more than sufficient to meet the regional demand in the short to mid-term. According to the Observatoire Méditerranéen de l’Energie (OME), the total gas export potential of Egypt, Israel, and the GASC could be between 30 bcm to 50 bcm per year by 2030.17 The problem is that the region lacks sufficient physical export infrastructure to export that much gas, particularly to distant markets.

The Lack of Sufficient Export Infrastructure: A Major Challenge to Access to Distant Markets

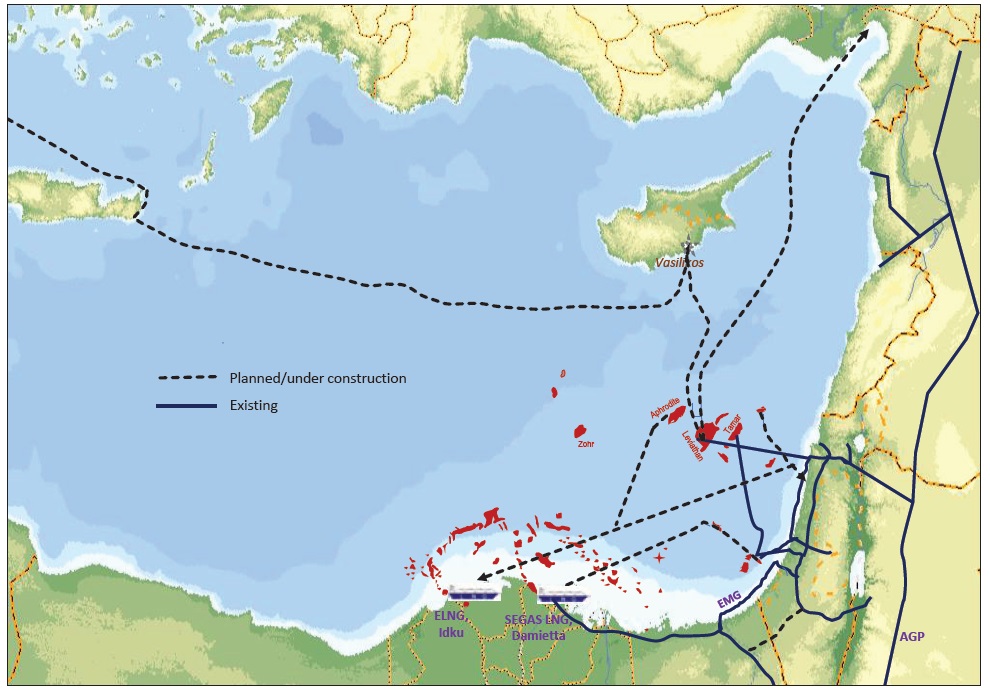

Egypt has a well-established and diversified gas export infrastructure. It has two gas export pipelines: the Arab Gas Pipeline (AGP) connecting Egypt to Syria via Jordan and the Eastern Mediterranean Gas pipeline (EMG), sometimes called the Arish-Ashkelon Pipeline, connecting Egypt’s Sinai Peninsula to southern Israel.

Egypt’s gas exports to Jordan commenced in 2003 through the AGP, which has an annual capacity of 10 bcm.18 Egyptian gas reached Syria in 2008 and Lebanon in 2009. Following the repeated terrorist attacks on its feeder pipelines during the unrest in Egypt in 2011, only small volumes of gas reached Jordan until early 2014. Afterward, gas deliveries stopped completely, and the pipeline remained idle. Egypt resumed gas exports to Jordan in 2019 when the pipeline became operational again. In the past, there were plans to export Egyptian gas to Turkey by extending the section of the AGP in Syria to the Turkish border. Theoretically, this pipeline could be used as a gas collector, for instance taking gas from Israel and from Lebanon if gas were found there, and carrying the gas from the region to Turkey and onward to Europe. However, such an option is currently unrealistic given the ongoing conflict in Syria and the political disputes in the region. The EMG is a subsea pipeline with an annual capacity of 7 bcm.19 It skirts the Gaza Strip and connects the Israeli and Egyptian gas transmission systems. It was originally built to export Egyptian gas to Israel. Gas supply from Egypt to Israel began in 2008 through this pipeline and continued until April 2012 when Egypt terminated its contract with Israel. It currently carries gas in reverse flow, from Israel to Egypt.

In addition to those two pipelines, Egypt has two LNG liquefaction plants, in Idku and in Damietta. Their combined annual capacity is 19 bcm.20 Those facilities allowed Egypt to become an LNG exporter in 2003, but they have remained idle since 2011 when the feed gas was reverted to the domestic market. Exports from the LNG plant in Idku resumed in 2016. Exports from the other LNG plant in Damietta has restarted on February 22, 2021.

Figure 1: Gas Export Infrastructure in Eastern Mediterranean

Source: Compiled by the author

Source: Compiled by the author

Israel started exporting small quantities of gas from the Tamar field in January 2017 to two private companies in Jordan: the Arab Potash Company and the Jordan Bromine Company. In January 2020, gas from the Leviathan field began to flow to the Jordanian National Electric Power Company. Two separate pipelines were constructed to enable the flow of gas from Israel to customers in Jordan. In addition, gas exports from Israel to Egypt through the EMG pipeline started in January 2020.

In the past, there were plans to export Israeli gas to Palestine and to Turkey. Talks about exporting up to 1 bcm of gas per year via a pipeline to feed power plants in Gaza have been going on for years. Reportedly, a major step forward on that path was taken in February 2021. According to news circulating in the media, Israel will sell gas to Gaza under a deal involving the EU, the UN, and Qatar. Gas would come from the Leviathan field, the EU would provide financing to install gas pipelines from the Israeli border to the power plant and Qatar would handle pipe installation on the Israeli side.21 The other project of exporting gas to Turkey, however, has been shelved. It involved building an 8 bcm-per-year capacity pipeline from the Leviathan field (with a possible link to the Tamar field) to Turkey’s Southeastern Mediterranean coast, and possibly from there onward to Europe. Another alternative export route that was under discussion in the past (at least before Noble Energy was acquired by Chevron) and has recently been reconsidered is the export of LNG via a floating LNG facility. A floating LNG facility, or Floating Liquefied Natural Gas (FLNG), could offer more flexibility and freedom for the export of Mediterranean gas to lucrative markets.

The probability of the EastMed gas pipeline and the Turkey-Israel pipeline projects ever materializing is very low. This is partly because both pipelines need to cross disputed maritime zones, which would provoke political tensions

Cyprus has no gas export infrastructure. Since the amount of gas discovered in the Aphrodite field was not sufficient to justify the envisioned LNG plant at Vassilikos commercially viable, at present the building of a subsea pipeline from the field, either to Europe or to Egypt, is being considered. The pipeline to Europe is the EastMed project, with an annual transport capacity of 10 bcm. It seeks to link Israel and the GASC to Greece.22 The three countries signed an inter-governmental agreement about this project in January 2020. Its extension to Italy is known as the IGI Poseidon pipeline. The pipeline is envisaged to be completed by 2025. Despite the optimism and political support, questions remain about the project’s commerciality, profitability, and financing especially since, after touting the EU’s ‘Green Deal’ vision, the EU’s Connecting Europe Facility has abandoned financing hydrocarbon projects. The other project, to Egypt, aims at constructing a pipeline from Cyprus to Egypt. It is not yet clear whether the gas is intended for the Egyptian domestic market or for re-export via the Idku LNG plant in Egypt or both. The GASC and Egypt signed an inter-governmental agreement concerning this project in September 2018. Nevertheless, none of the above-mentioned projects have registered any tangible progress. This is partly due to the uncertainties concerning the development of the Aphrodite field caused by the absence of a unitization agreement with Israel, bureaucratic delays concerning the field’s development plans, and the lack of sufficient feed gas. In the northern part of the island, there have been negotiations to build a gas pipeline in parallel to the existing water pipeline between the TRNC and Turkey. If realized, this project could facilitate the gasification of the island. Moreover, by reversing the direction of the flow, it could, at least in theory, provide an export route for GASC and potentially also Israeli gas to Turkey and from there onward to Europe.

According to some analysts, the probability of the EastMed gas pipeline and the Turkey-Israel pipeline projects ever materializing is very low.23 This is partly because both pipelines need to cross disputed maritime zones, which would provoke political tensions. Therefore, they can be considered as a realistic option only if the Cyprus problem is resolved.

Commercial Challenges Facing Eastern Mediterranean Gas

Exporting the Eastern Mediterranean gas faces several commercial challenges.24 The competitiveness of the region’s gas at export destinations, both within and outside the region, is one of those challenges. This mainly concerns the Israeli gas. Around 3 bcm of gas per year is committed to Jordan from the Tamar and Leviathan fields.25 In addition to that, in 2019, the partners in the Tamar and Leviathan fields signed a gas sales and purchase agreement with Dolphinus Holdings, a private company in Egypt. Exports to Egypt are expected to reach 7 bcm per year at plateau level and will last until 2034.26 In sum, the total quantity of annual gas exports from Israel to Egypt and Jordan amounts to 10 bcm for more than a decade. How the contracted quantities of gas with uncompetitive prices could be absorbed, especially by the Egyptian market, is an important issue that needs to be questioned.

Israeli regulation prohibits the sale of gas to foreign markets cheaper than the domestic market. In the first three quarters of 2020, the average sale price of Tamar and Leviathan gas to customers in the domestic market was above $5/MMBtu, as indicated in the financial statements of Delek Drilling. Imported gas from Israel, which is estimated to be around $6/MMBtu, assuming a Brent oil price in the range of $60-70 per barrel, is understood to be consumed in industry.27

However, the price of gas for industrial use in Egypt was reduced to $4.5/MMBtu by the government in March 2020 to combat the COVID-19 pandemic.28 If the Egyptian government announces further reductions in gas prices as expected, it will be very difficult for Israeli gas to compete in the Egyptian market. On the other hand, the shrinking domestic gas demand due to the COVID-19 pandemic, coupled with the very low LNG prices, forced Egypt to limit production in some fields. Later, Egypt decided to halt LNG exports between March to October 2020 altogether in order to avoid exporting LNG at a loss. This was understandable, as LNG prices at export destinations were too low compared to the price Egypt was paying to the domestic producer–$2.65/MMBtu for the bulk of onshore production and to up to $5.88/MMBtu for the deep offshore.29 When the LNG prices recovered, those restrictions were eased and LNG exports resumed in October 2020. Almost all of this LNG was sold to Asian markets, due to the attractiveness of its price. It should be noted that the benchmark price for spot-delivered LNG to North-East Asia rose to an all-time high of $32.50/MMBtu on January 13, 2021, after plunging to a record low of $1.825/MMBtu on April 28, 2020.30 The record spot LNG prices observed in January 2021 would make even re-exporting of Israeli gas through the LNG facilities in Egypt profitable. However, this price hike was an exception, not a norm. When the costs of imported gas from Israel, liquefaction in Egyptian LNG plants, and shipment to foreign markets are added together, in general, the landing price in the destination market is unlikely to be competitive, particularly in Europe. The case is similar for Egyptian gas when the average LNG netbacks are calculated.31

Although there are varying views about when the world LNG markets will be rebalanced, recent estimates indicate that it is unlikely to happen soon

The discussion above indicates that the Egyptian market is likely oversupplied with gas at uncompetitive prices. It seems that a similar situation is also the case for Jordan, which has pipeline gas supply contracts with Egypt and Israel. When gas supplies from Egypt stopped in 2012, Jordan embarked on aggressive investments in renewable energy. Today, the country produces nearly 20 percent of its electricity from renewable resources, compared to only 1 percent in 2012. This share is expected to reach 30 percent in 2030.32 The current oversupply of both natural gas and electricity is likely to force the Jordanian government to introduce radical measures, such as deferring or suspending some of the solar and wind projects and perhaps paying compensation to independent power producers to reduce or cease generating electricity. The 470 MW Attarat oil shale plant, which was expected to commence operations in early 2021, might also be shelved.

The Israeli market is not very different. Production from Energean’s Karish field is expected to start in late 2021 and from the Tanin field soon thereafter. Israel’s gas demand is forecasted to more than double between 2020 and 2040, exceeding 25 bcm. This forecast takes into account the complete phaseout of coal by the end of 2025 and the increasing share of renewables in electricity generation from 8 percent in 2020 to 30 percent by 2040.33 Even though Israeli gas demand will continue increasing in the future, however, the market share of natural gas might not grow fast enough, as is forecasted due to rapidly growing electricity generation from renewables saturating energy demand. This could put pressure on companies, especially the Leviathan and Tamar partners, that wish to double the production in both fields with second-phase development plans. Unless access to export markets is secured, this scenario would also discourage exploration activities.

All these issues point to a likely oversupply of relatively expensive gas in the region. As a matter of fact, from time to time it could make more sense for Egypt and Jordan to import competitively priced LNG from international markets rather than pipeline gas from Israel, at least until the oversupply in the world LNG market disappears. Although there are varying views about when the world LNG markets will be rebalanced, recent estimates indicate that it is unlikely to happen soon.34

Turkey has shifted toward pursuing a more assertive policy, including the Mavi Vatan, or Blue Homeland Naval Doctrine announced in 2006

World LNG demand is estimated to double by 2040, and two-thirds of the increase in LNG imports are expected to occur in Asia35 where, in the future, LNG prices (both spot and oil-linked) are expected to remain above European gas prices.36 Moreover, some 40 percent of the currently active LNG contracts will expire by 2030.37 Therefore, there will be fierce competition between LNG exporters to gain a market share in Asia. The Eastern Mediterranean gas producers will face major challenges to compete in the Asian market. Since only Egypt has LNG export facilities in the region, naturally these facilities will prioritize exporting gas produced in Egypt. It is usually assumed that gas production in Egypt will not be able to meet domestic demand in the mid-to-long-term, and hence that there will be plenty of spare capacity in the Egyptian LNG plants. This is a strong assumption to which the author of this article does not subscribe. Rather, it is the gas producers in Israel who will likely face more difficulties in finding markets for their gas. To reiterate, if additional export outlets are not secured, exploration and development activities in Israel will be under severe stress.

Maritime Boundary Disputes: A Major Obstacle to Exploration and Exploitation of Gas in the Region

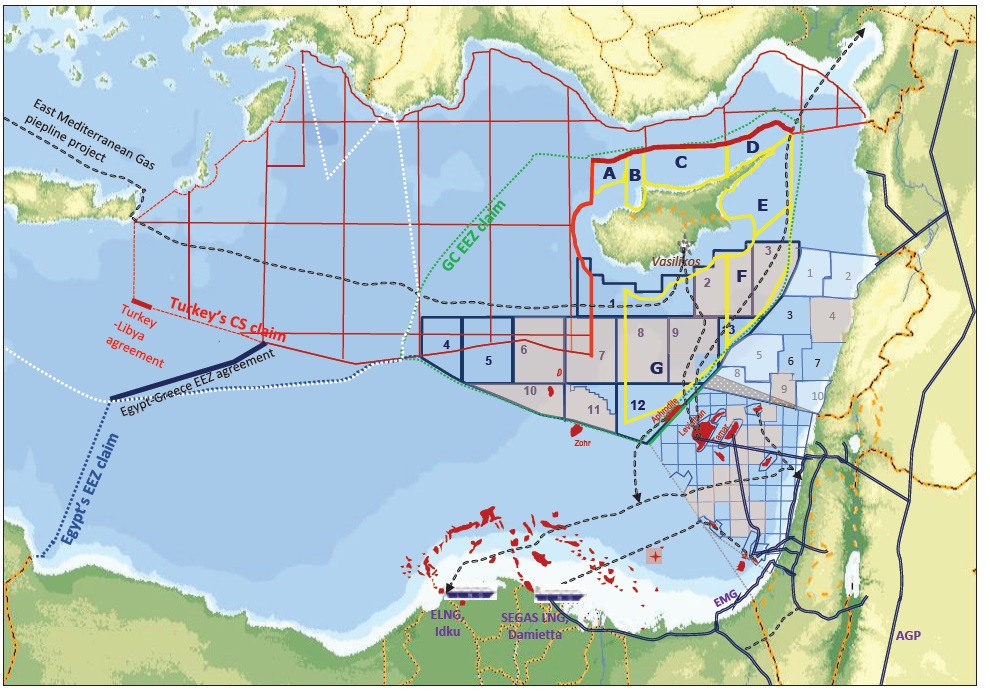

At present, the majority of maritime boundaries in the Eastern Mediterranean are not demarcated, e.g., between Greece and Turkey, the GASC and Turkey, the GASC and Syria, Israel and Lebanon, Israel and Palestine. And those that have been agreed upon bilaterally are contested by other countries in the region.38 The lack of unified agreement and maximalist approaches pursued by the parties in their respective claims is a major obstacle to gas exploration, exploitation, and commercialization in the region.

The discovery of the Tamar and Karish fields in Israel has fueled a maritime boundary dispute between Israel and Lebanon. This has added further complexity to the already troubled relations between the two countries. The area of overlap in the Exclusive Economic Zone (EEZ) claims between the two countries is about 855 km2. Tensions escalated in 2013 when the Lebanese government included the disputed area to the blocks it offered in its first offshore hydrocarbon exploration bidding round. Over the years, both Lebanon and Israel have threatened to use force against each other to protect their claims. In October 2020, Israel and Lebanon entered negotiations, hosted by the UN with the U.S. as mediator and facilitator, regarding the demarcation of their disputed maritime border.39 However, when the Lebanese delegation pushed for an additional 1,430 km2 of sea farther south, which includes part of the Karish field, to be included in Lebanese territory, Israel presented a countermeasure of its own, and hence negotiations to settle the border issue were suspended.40

The maritime boundary dispute between Turkey, the GASC, and Greece is more challenging because of the ‘Cyprus Problem,’ which has a multilateral dimension. Cyprus has been de facto partitioned since 1974, separated by a buffer zone known as the ‘Green Line.’ The North of the island is under the control of the TRNC and the South is under the control of the GASC. Turkey does not recognize the GASC nor, therefore, its proclaimed EEZ.

Hydrocarbon exploration activities have been another reason for conflict between Turkey and the GASC. Turkey maintains that the GASC’s awarding of hydrocarbon exploration blocks to energy companies disregards the Turkish Cypriots’ legitimate rights.41 Moreover, Turkey’s continental shelf claim overlaps partly with those of the GASC’s proclaimed EEZ (specifically parts of the GASC’s blocks 4, 5, 6, and 7). Furthermore, two of the TRNC’s blocks, awarded to TPAO (blocks F and G), overlap with GASC blocks 2, 3, 8, 9, 12, and 13.

Figure 2: Exploration Blocks, Gas Export Infrastructure, EEZ/CS Claims, and Agreements in the Eastern Mediterranean

Source: Compiled by the author

Source: Compiled by the author

The maritime border dispute between Turkey and Greece is very complex. It not only concerns their overlapping maritime boundary claims in the Mediterranean, but also the maritime boundaries of the Greek islands adjacent to Turkey in the Aegean and the Mediterranean Sea. The nature of the dispute between the two NATO members mostly involves national security grounds that are beyond the scope of this article.42 However, in the past few years, hydrocarbon exploration activities have become part of the security dimension. Since Greece rarely conducts exploration activities in the Eastern Mediterranean, it is the intensifying activities of TPAO that are usually blamed for the escalation of tensions in the region. Various actions and threats by the EU and some other major powers emanating from their biased policies, which include some form of sanctions, have not dissuaded Turkey. On the contrary, Turkey has shifted toward pursuing a more assertive policy, including the Mavi Vatan, or Blue Homeland Naval Doctrine announced in 2006.43

Even though national security concerns are at the core of the maritime boundary disputes between the countries in the region, natural gas exploration activities have often been accused of exacerbating the frictions. Sometimes those frictions have gone beyond diplomatic protests. For instance, in February 2018, the Turkish navy blocked a drillship hired by ENI from reaching its drilling target in the GASC’s block 3, to which the TRNC also lays claim. Another example involved the TPAO’s seismic survey ship in July 2020 near the Greek island of Kastellorizo (Meis), in an area of the Mediterranean Sea claimed by Turkey and Greece. German Chancellor Angela Merkel’s intervention prevented a military confrontation between the two NATO members. Lastly, just a few days after the signing of the Greece-Egypt EEZ agreement in August 2020, Turkey sent a seismic survey ship, escorted by Turkish navy vessels, into the disputed zone. This move put the Greek military on high alert. In support of Greece, France dispatched fighter jets and a naval frigate to the area. On August 14, 2020, a Greek and a Turkish warship were involved in a mild collision. These examples are evidence that the highly volatile situation could easily spiral out of control.

International Law as a Potential Means of Conflict Management and Resolution

The Eastern Mediterranean maritime boundary disputes not also threaten the peace and security of the region but also constitute a key impediment to the exploration, exploitation, transport, and export of its hydrocarbons. The question is, which international law could be used to overcome the disputes–and how? 44

The broad principles of international law concerning hydrocarbon exploration and exploitation, as well as maritime boundary delimitation, are set out in the provisions of the United Nations Law of the Sea Convention (UNCLOS), an international treaty adopted in 1982.45 UNCLOS is regarded as a reflection of customary international law (CIL). In principle, even if a country is not a party to UNCLOS, it is bound by these rules and accordingly, any breach thereof could amount to a breach of CIL. However, a country that has established a persistent objection to CIL principles may have the ability to opt-out of a CIL rule.

Bilateral maritime delimitation agreements typically do not map the whole boundary between two countries, in order not to presuppose their boundaries with third countries

If the concerned parties cannot reach an agreement, they are required to “make every effort to enter into provisional arrangements of a practical nature” until a final delimitation is agreed upon. The guiding principle, according to UNCLOS, is to achieve an equitable solution. The equidistant method, adopted by most countries in the region, can be used as a starting point, but the resulting line should be adjusted to reach an equitable solution. The final boundary demarcation line should not give disproportionate areas to the parties compared to the lengths of their coasts. This in fact is the view that Turkey supports.

Bilateral maritime delimitation agreements typically do not map the whole boundary between two countries, in order not to presuppose their boundaries with third countries. This approach reflects the general principle of international law of res inter alios acta, meaning that a maritime boundary delimitation agreement cannot adversely affect the rights of a country that is not a party to it. In short, international law tells us that unilateral EEZ/CS claims and bilateral maritime boundary delimitation agreements in the Eastern Mediterranean are not worth much if they do not consider the interests of third parties.

As soon as political relations between Turkey and Israel, and Turkey and Egypt became frosty, Greece and the GASC began to successfully pursue high-level diplomacy with Egypt and Israel

Countries party to UNCLOS are required to submit their dispute to certain resolution procedures, such as conciliation and arbitration. However, countries not party to UNCLOS, such as Turkey, cannot be referred to those procedures. On the other hand, all members of the United Nations (UN) are required to settle their international disputes by peaceful means and make every effort to participate in provisional arrangements of a practical nature. There are two common methods for such provisional arrangements: a moratorium on all activities in disputed areas and the establishment of joint development zones through joint development agreements. In the latter, two states agree to develop and share jointly, in equal or in arranged proportions, the hydrocarbons resources within the overlapping maritime boundary claims.46 In this sense, a joint administration and revenue-sharing agreement between the Turkish and Greek Cypriots could be the best way to exploit Cyprus’ gas resources. Establishing a mutual trust fund, for instance under UN supervision, could help facilitate such an option. A similar approach could be applied to the Lebanon-Israel dispute.

Furthermore, under customary international law, countries do not have the unilateral right to exploit hydrocarbon resources in disputed maritime areas, because such an act would violate the rights of the other state. Whether this extends to exploration activities as well is not clear.47 In any case, inclusive dialogue and negotiating in good faith are a must to overcome the challenges posed by maritime boundary disputes. Unfortunately, diplomatic relations have hardly been normal in the Eastern Mediterranean. As politics shifted, so did the alliances and alignments.

Eastern Mediterranean Gas and Shifting Regional Geopolitical Dynamics

Changing national interests and opportunities linked to the exploration and exploitation of natural gas have contributed to the shaping of a new power balance in the Eastern Mediterranean and have altered the region’s geopolitical landscape.48 Several factors have played a role in shifting alignments in the Eastern Mediterranean. These include the deterioration of political relations between Turkey and Israel after the 2008-2009 Gaza War and the 2010 Mavi Marmara incident; between Turkey and Egypt since the ousting of Morsi’s government in 2013; and between Turkey and the EU, particularly since 2016.

As soon as political relations between Turkey and Israel, and Turkey and Egypt became frosty, Greece and the GASC began to successfully pursue high-level diplomacy with Egypt and Israel. Their trilateral summits and high-level meetings later evolved to include Lebanon and Jordan as well. The center of gravity in those meetings was natural gas. It was clear that the creation of a regional alignment was underway and that the exploitation and transport of hydrocarbons was being used as a tool to shape it.

The result was the establishment of a multinational framework for cooperation on gas matters –the EastMed Gas Forum (EMGF)– in January 2019.49 Egypt, the GASC, Greece, Israel, Italy, Jordan, and Palestine were the founding members. With the encouragement of the U.S. and the EU, a Cairo-based international organization was set up in September 2020. It will come into force in March 2021. France has already requested to join as a full member. The EU and the U.S. are seeking observer status. In December 2020, the United Arab Emirates (UAE) joined as an observer. The forum includes a Gas Industry Advisory Board, created in November 2019, to help monetize the gas reserves. So far, Syria, Lebanon, and Turkey have not been involved in the EMGF due to political reasons.

The goal of the EMGF is to increase cooperation on natural gas matters by establishing a structured policy dialogue that would lead to the development of a regional gas market and unlock the region’s gas potential. However, the involvement of the UAE in the EMGF and the recent normalization of relations between Israel and several Arab countries may lead to an expansion of the initial aims of the Forum to other areas, especially electricity. Currently, there are two electricity interconnection projects underway in the Eastern Mediterranean: the first one is the €2.5 billion EuroAsia Interconnector electricity cable project, which aims to connect the electricity grids of Israel, the GASC, and Greece through an undersea cable. The other is the EuroAfrica Interconnector project, which aims to link Egypt, the GASC, and Greece.50 Regional integration of electricity markets would not only create another avenue for cooperation but also provide opportunities for more gas use to generate electricity, hence helping to reduce some of the challenges of commercializing natural gas and of exporting the generated electricity to countries in the Middle East and Africa.

The joint announcement of a political process of full normalization of relations signed by the heads of states of the U.S., Israel, and the UAE on August 13, 2020, also called the Abraham Accords, has caused geopolitical shifts in the Middle East and Eastern Mediterranean. Afterward, Bahrain (in September 2020), Morocco (in December 2020), and Sudan (in January 2021) signed the Accords and have established full diplomatic relations with Israel. The Abraham Accords could pave the way for commercializing natural gas in the form of electricity to the Gulf states. After signing the Abraham Accords, the UAE and Israel agreed to go ahead with concrete developments in the field of energy. The Israeli state company, the Europe-Asia Pipeline Company (EAPC), and a newly formed UAE-Israeli joint venture signed a binding Memorandum of Understanding on October 20, 2020, for collaboration in the storing and transfer of crude oil and petroleum products through the EAPC pipeline network, hence bypassing the Suez Canal and Egypt’s Sumed pipeline.51 If other Middle Eastern producers follow suit, utilizing those pipelines would mean a loss in transit revenues for Egypt.

According to the U.S. Congressional Research Service, Israeli normalization with Arab states could intensify, dwindle or fluctuate in countering Iran and perhaps even Turkey and Qatar.52 Moreover, the Abraham deal may pose strategic challenges and headaches for Jordan, which has been arguing that Israel can only enjoy normalization with Arab countries if it agrees to a two-state solution in Palestine.53 The case is similar for Qatar, which has long taken the position that it would normalize ties with Israel after the Palestinian conflict is resolved. However, as explained previously, when it comes to the natural gas business, both Jordan and Qatar have taken a pragmatic approach in dealing with Israel. In the meantime, on January 5, 2021, Qatar, Egypt, and the Gulf Cooperation Council (GCC) signed the al-Ula Declaration, which ended the dispute within the Gulf and the boycott of Qatar. In the wake of the Abraham Accords and the al-Ula Declaration, it is yet to be seen whether the Palestine issue will remain a priority or even a concern of the Arab countries.

Another important development took place on February 11, 2021, in Athens. Egypt, Greece, the GASC, the UAE, Bahrain, Saudi Arabia, and France decided to establish a framework to discuss issues of common interest and concern under a new Forum, called the Philia Forum. In a joint statement, they explicitly referred to International Law, territorial integrity, UN Security Council Resolutions, and the UNCLOS.54 Interestingly, Israel did not participate. The joint statement mentioned that the Forum is open to other countries of the region and beyond that share the same values and principles. This is in fact almost identical to statements made at the EMGF meetings and declarations.

One common feature of the EMGF, the Abraham Accords, and the Philia Forum is that Turkey, Lebanon, and Syria appear in none of them. Because of their systematic exclusion from almost all high-level multilateral gatherings, calls have often been raised in those countries, at least in the Turkish and Lebanese media, for the need to develop a counter forum. Given these countries’ diverging national interests, this would surely not be easy; thus, no tangible action has been taken yet on that front.

Concluding Remarks

There is no doubt that the Eastern Mediterranean has substantial natural gas potential. A series of major natural gas discoveries since 2009 and great prospects for the discovery of additional hydrocarbons beneath the Mediterranean waters have presented a rare window of opportunity to help improve energy security and economic prosperity in the region. So far, Egypt and Israel have benefited most from the region’s potential. Currently, their markets, as well as their common export outlet, Jordan’s market, are oversupplied with gas. Without access to distant and lucrative markets, the commercialization of the existing and future discoveries in the region will be difficult. The problem is that the region lacks sufficient gas export infrastructure. Only Egypt has a well-established and diversified gas export infrastructure in the form of pipelines and LNG facilities. Therefore, Egypt is in a relatively comfortable situation, but the competitiveness of Egyptian LNG, especially in European markets, is questionable. Gas producers in Israel will likely face even more difficulties in finding markets for their excess gas. If additional export outlets are not secured, exploration and development activities in Israel will fall under severe stress.

It appears that the regional alignments in the Eastern Mediterranean are moving away from energy-based gatherings toward security- and politics-related formations to send signals to perceived adversaries

If the Eastern Mediterranean were a normal place, Turkey would be a suitable outlet for Israeli gas. There are three reasons for that: first, Turkey is one of the largest gas markets in the Euro-Mediterranean region and almost all of its gas demand is met by imports; second, many of Turkey’s long-term gas contracts are due to expire within the next five years; and finally, the gas prices set by BOTAŞ (Boru Hatları İle Petrol Taşıma Anonim Şirketi) are higher than those in Europe. However, several challenges prevent Israeli gas from reaching the Turkish market.

As presented in this article, the exploration, exploitation, and commercialization of natural gas necessitate overcoming numerous commercial, technical, and legal challenges, all of which have geopolitical implications. Countries in the region need to plan with realism and pragmatism if they are to make the best use of the region’s hydrocarbons potential.55 A pragmatic approach, undertaken through constructive and candid dialogue, especially regarding the contested maritime boundaries, is necessary to convert challenges into opportunities and to help turn controversies into cooperation.

As stated in the Charter of the UN, countries are obliged to settle their international disputes by peaceful means in such a manner that international peace, security, and justice are not endangered. Moreover, they should make every effort to enter into provisional arrangements of a practical nature until a maritime boundary delimitation agreement has been reached. Creating joint development zones in overlapping maritime zones (for instance, around the island of Cyprus and in the disputed zone between Israel and Lebanon) and the joint development of new gas export infrastructure (for instance, a pipeline carrying Israeli gas, or better with the gas from GASC to Turkey via Cyprus) or the joint use of existing infrastructure (i.e. the Arab Gas Pipeline) could be an option to consider. Creating a virtual gas hub in the region could also be considered for fostering cooperation and for marketing the region’s gas.56 Establishing a mutual trust fund, for instance under UN supervision, could help facilitate those options. If pursued, those actions could facilitate the overcoming of differences and the creation of interdependencies. The absence of diplomatic relations between the relevant countries, however, will not make that easy.

Unfortunately, instead of being used as a means for cooperation and collaboration for the benefit of all and an axis for stability and prosperity, natural gas has been turned into a tool for conflict. What’s more, new alignments and alliances have helped to escalate rather than reduce the tensions in the region. It appears that the regional alignments in the Eastern Mediterranean are moving away from energy-based gatherings toward security- and politics-related formations to send signals to perceived adversaries. It is remarkable that while Greece, the GASC, Egypt, and the UAE have been at the center of all of the recent, high-level, multilateral gatherings in the region, such as the EMGF, the Abraham Accords, and the Philia Forum, (even if their co-existential harmony and future is questionable), Turkey, Lebanon and Syria are kept away. The task of finding a unifying common denominator and reformulating the regional order in this increasingly polarized environment is becoming more and more urgent, and at the same time more complicated.

If not managed with wisdom, if not developed in a cost-effective and timely manner, the gas bonanza in the region will be remembered as another opportunity lost in the history of the Eastern Mediterranean

Sooner or later, the countries in the Eastern Mediterranean will realize that the road to regional prosperity, energy security, and a peaceful future needs to pass through Turkey. For its part, Turkey should formulate strategies and policies to best serve its long-term national interests and implement them. A reset in political relations with Israel and Egypt could also help. No opportunities should be lost, as happened in the past. For instance, if Turkey and Egypt could have signed an EEZ agreement during the Morsi era (July 2012-July 2013), perhaps much of the current friction regarding maritime boundaries in the region would never have occurred. Moreover, Turkey should be involved in the region’s energy and gas markets as an active player. In this sense, TPAO could participate, preferably jointly with Qatar Petroleum and SOCAR, in the exploration bidding rounds in Lebanon, Israel, and Egypt. Turkey’s possible involvement in the development of the Gaza Marine field in Palestine could be another avenue to consider.

What the future will bring is unknown, but for the long-term benefit of all, it will be necessary to look beyond short-term political gains. As one expert put forward, solving the region’s complex geopolitical puzzle will require a diplomat’s touch, an admiral’s intuition, and an economist’s foresight.57 A pragmatic model for regional cooperation gathering all the countries in the region together will require a united effort. It will be difficult, but not impossible, as long as there is political will on all sides. In conclusion, if not managed with wisdom, if not developed in a cost-effective and timely manner, the gas bonanza in the region will be remembered as another opportunity lost in the history of the Eastern Mediterranean.

Endnotes

1. The Eastern Mediterranean in this research article consists of Egypt, Palestine, Israel, Lebanon, Syria, the TRNC, the GASC, and Turkey.

2. For a detailed analysis, see Sohbet Karbuz, “Doğu Akdeniz’de Ne Kadar Doğal Gaz Var,” Bilkent Enerji Notları, 12 (July 2019), retrieved December 22, 2020, from https://drive.google.com/open?id=1DLMx9kmHcB2P2cTz73jp7yEmooehSDj9/. The estimate in that study, which covers the period until the end of 2018, was close to 4,900 bcm. Since then, 30 gas fields, some modest (such as Nour and Swan East in 2019) and some major (such as Bashrush in 2020), were discovered offshore Egypt as reported in various issues of Egypt Oil and Gas Magazine, in addition to upgrades to reserves in the Tamar, Leviathan, and Karish fields in Israel as announced by their operators.

3. Discovered gas resources in Norway were equivalent to 4,736 bcm at the end of 2019. See, “Resource Accounts for the Norwegian Shelf as of December 31, 2019,” Norwegian Petroleum Directorate, (April 6, 2020), retrieved February 1, 2021, from https://www.norskpetroleum.no/en/petroleum-resources/resource-accounts/.

4. Aditya Saraswat, “Fun in the Sun for Club Med Upstream Oil and Gas Operator,” GEO ExPro, Vol. 16, No. 3 (August 2020), retrieved December 20, 2020, from www.geoexpro.com/articles/2019/06/fun-in-the-sun-for-club-med-upstream-oil-and-gas-operators.

5. Michael Gardosh and Eli Tannenbaum, “The Petroleum Systems of Israel,” in Lisa Marlow, Christopher C. G. Kendall, and Lyndon A. Yose (eds), AAPG Memoir 106: Petroleum Systems of the Tethyan Region, (United Kingdom: American Association of Petroleum Geologists, March 2014), pp. 179-216; Andrea Cozzi, A. Cascone, L. Bertelli, F. Bertello, S. Brandolese, M. Minervini, P. Ronchi, R. Ruspi, and H. Harbyet, “Zohr Giant Gas Discovery: A Paradigm Shift in Nile Delta and East Mediterranean Exploration,” presentation at Discovery Thinking Forum, AAPG/SEG International Conference & Exhibition, (October 16, 2017).

6. Andrea Cozzi et al., “Zohr Giant Gas Discovery.”

7. “Assessment of Undiscovered Oil and Gas Resources of the Levant Province, Eastern Mediterranean: Fact Sheet 2010-2014,” S. Geological Survey, (March 2010), retrieved December 27, 2020, from https://pubs.er.usgs.gov/publication/fs20103014; “Assessment of Undiscovered Oil and Gas Resources of the Nile Delta Basin Province, Eastern Mediterranean: Fact Sheet 2010-2027,” U.S. Geological Survey, (May 2010), retrieved December 27, 2020, from https://pubs.er.usgs.gov/publication/fs20103027.

8. “Country Analysis: Lebanon,” S. Energy Information Administration (EIA), (March 2014), retrieved January 2, 2021, from https://www.eia.gov/international/analysis/country/LBN; “Oil and Gas in Lebanon,” BankMed, (2014), retrieved February 1, 2021, from https://www.bankmed.com.lb/BOMedia/subservices/categories/News/20150515170326030.pdf; “Natural Gas Reserves in Cyprus’ Licensed Blocks Estimated at 39 tcf, KRETYK Chairman Says,” GreekNews Online, (September 19, 2013), retrieved February 1, 2021, from https://www.greeknewsonline.com/natural-gas-reserves-in-cyprus-licensed-blocks-estimated-at-39-tcf-kretyk-chairman-says/.

9. For a detailed history of exploration activities, licensing rounds and discoveries, see, “Mediterranean Energy Perspectives: Egypt,” Observatoire Méditerranéen de l’Energie (OME), (June 2011); “Egypt’s Petroleum Sector: A Journey of Success,” Egypt Oil and Gas, (March 2020); and various annual reports of Egyptian Natural Gas Holding Company and The Egyptian General Petroleum Corporation.

10. “Exxon Looks to Partner Up in Egypt,” MEES, Vol. 64, No. 4 (January 29, 2021), pp. 2-3; “Egypt Oil and Gas Concession Map,” Egypt Oil and Gas, (December 2020), retrieved December 27, 2020, from https://egyptoil-gas.com/maps/egypt-oil-and-gas-concession-map-december-2020/.

11. Zohr is the first discovery within carbonate targets, in contrast to the conventional sandstone formations observed in the discoveries made so far in the region.

12. More information on the licensing rounds and exploration activities can be found on the GASC Ministry of Energy, Commerce and Industry’s Hydrocarbons Service website, retrieved from http://www.mcit.gov.cy/mcit/hydrocarbon.nsf/index_en/index_en.

13. The third offshore bid round, launched in June 2020, offered a single block. Successful bids were expected to be announced in October 2020, but were postponed due to the ongoing maritime demarcation talks with Lebanon. For more on the exploration history and bid rounds in Israel, see the dedicated website of the Ministry of Energy, retrieved from https://www.energy-sea.gov.il/English-Site/Pages/HomePage.aspx.

14. For details on the licensing rounds, see the Lebanese Petroleum Administration website, retrieved from https://www.lpa.gov.lb/english/home.

15. Tim Boersma and Natan Sachs, “Gaza Marine: Natural Gas Extraction in Tumultuous Times?” Brookings Institution, No. 36 (February 2015), retrieved February 12, 2021, from https://www.brookings.edu/wp-content/uploads/2016/06/gaza-marine-web.pdf.

16. “Minerals Yearbook Area Reports: International Review 2013 Africa and the Middle East,” The US Geological Survey, Vol. 3, (2017), p. 603.

17. “Mediterranean Energy Perspectives 2018,” Observatoire Méditerranéen de l’Energie (OME), (December 2018), retrieved from https://www.ome.org/mep-2018-2/.

18. For descriptive details, see, “Arab Gas Pipeline,” Hydrocarbons Technology, retrieved February 19, 2021, from https://www.hydrocarbons-technology.com/projects/arab-gas-pipeline-agp/.

19. For a general description of the pipeline, see, “Mediterranean Energy Perspectives: Egypt.” For the technical details and current ownership structure, see, “Delek Drilling – Limited Partnership: The “Partnership,” Delek Drilling, (September 27, 2018), retrieved February 12, 2021, from https://www.delekdrilling.co.il/sites/default/files/media/document/field_rp_pdf/Engagement%20in%20agreements%20for%20the%20purchase%20of%20EMG%20shares%20and%20the_0.pdf.

20. For technical details and ownership structure, see, “LNG Industry GIIG Annual Report 2020 Edition,” International Group of Liquefied Natural Gas Importers, (April 2020), retrieved from https://giignl.org/system/files/publication/giignl_-_2020_annual_report_-_04082020.pdf, p. 41.

21. See, for instance, “Israeli Company Agrees to Supply Natural Gas to the Gaza Strip,” Britain Israel Communications and Research Centre, (February 15, 2021), retrieved February 16, 2021, from https://www.bicom.org.uk/news/israeli-company-agrees-to-supply-natural-gas-to-the-gaza-strip/; “Qatar, EU Oversee Israeli Gas Deal with Gaza,” Energy Voice, (February 16, 2021), retrieved on February 16, 2021, from https://www.energyvoice.com/oilandgas/middle-east/pipelines-middle-east/299656/israel-qatar-

gas-gaza.

22. Both the EastMed and Poseidon gas pipeline projects are being developed by Depa and Edison. For more details, see, “Contributing to European Security of Gas Supply,” IGI Poseidon, retrieved from http://www.igi-poseidon.com/en.

23. For instance, see, Emre İşeri and Ahmet Çağrı Bartan, “Turkey’s Geostrategic Vision and Energy Concerns in the Eastern Mediterranean Security Architecture: A View from Ankara,” in Zenonas Tziarras (ed.), The New Geopolitics of the Eastern Mediterranean: Trilateral Partnerships and Regional Security, (Oslo: Peace Research Institute, 2019), pp. 111-124; Nikos Tsafos, “Can the East Med Pipeline Work?” CSIS, (January 22, 2019), retrieved February 19, 2021 from https://www.csis.org/analysis/can-east-med-pipeline-work; Thedoros Tsakiris, Sinan Ülgen, and Ahmet K. Han, “Gas Developments in the Eastern Mediterranean: Trigger or Obstacle for EU Turkey Cooperation?” FEUTURE Project, (May 25, 2018), retrieved February 16, 2021, from https://ec.europa.eu/research/participants/documents/downloadPublic?documentIds=080166e5c26c8e0b&appId=PPGMS.

24. For a detailed discussion, see, Ana Stanic and Sohbet Karbuz, “The Commercial Challenges Facing Eastern Mediterranean Gas,” OGEL Special Issue on Changing LNG Markets and Contracts, (2020), pp. 1-18.

25. For more on the gas contracts with Jordanian customers see, “Tamar Gas Field,” Delek Drilling, retrieved February 19, 2021, from www.delekdrilling.com/natural-gas/gas-fields/tamar, and, “Leviathan Gas Field,” Delek Drilling, retrieved February 19, 2021,from www.delekdrilling.com/natural-gas/gas-fields/leviathan.

26. For gas sales agreements for the Tamar and Leviathan fields, see, “2019 Annual Report,” Delek Drilling, (2020), retrieved from https://www.delekdrilling.com/sites/default/files/media/document/field_rp_pdf/Delek%20Drilling%20FS%202019_0.pdf.

27. Charles Ellinas, “Challenges to Israel’s Gas Exports,” Cyprus Mail,(September 15, 2019), retrieved February 16, 2021, from https://cyprus-mail.com/2019/09/15/challenges-to-israels-gas-exports.

28. “Egypt Reduces Energy Prices for Industrial Users During Covid-19,” Offshore Technology, (March 20, 2020), retrieved February 16, 2021, from www.offshore-technology.com/comment/egypt-covid-19.

29. MEES, Vol. 63, No. 15 (April 10, 2020), p. 8; MEES, 64, No. 1 (January 8, 2021), p. 6.

30. “Infographic: Dissecting this Winter’s Asian LNG Price Rally,” S&P Global Platts, (February 18, 2021), retrieved February 19, 2021, from https://www.spglobal.com/platts/en/market-insights/latest-news/natural-gas/021821-infographic-dissecting-this-winters-asian-lng-price-rally.

31. Leila R. Benali and Ramy al-Ashmawy, “MENA Gas & Petrochemicals Investments Outlook 2020–2024,” The Arab Petroleum Investments Corporation (APICORP), (October 2020), retrieved from https://www.apicorp.org/wp-content/uploads/2020/10/MENA-Gas-Petrochemical-Investment-Outlook-2020-2024_EN_Final.pdf, p. 23.

32. MEES, Vol. 64, No. 4 (January 29, 2021), p. 14.

33. “Israel Natural Gas Demand Forecast 2020–2040,” BDO, (July 26, 2020), retrieved from https://www.delek-group.com/wp-content/uploads/2017/09/BDO-Gas-Market-Forecast-2-07-2017-for-Delek-Group-with-final-letter-1.pdf.

34. “World Energy Outlook,” International Energy Agency (IEA), (October 2020), pp. 275-276; “Gas 2020,” International Energy Agency (IEA), (June 2020), p. 54.

35. “Shell LNG Outlook 2020,” Shell Global, (February 2020), p. 32.

36. “Commodity Markets Outlook: Data Supplement,” World Bank, (October 2020), retrieved from https://openknowledge.worldbank.org/handle/10986/34621#:~:text=Almost%20all%20commodity%20prices%20recovered,declines%20earlier%20in%20the%20year.&text=Oil%20prices%20are%20expected%20to,percent%2C%20respectively%2C%20in%202021; “Global Oil and Gas Prices in 2020 Set to Fall Short of Earlier Forecasts as Coronavirus Spreads,” Rystad Energy, (February 27, 2020), retrieved February 15, 2021, from www.rystadenergy.com/newsevents/news/press-releases/global-oil-gas-prices-in-2020-set-to-fall-short-of-earlier-forecasts-as-coronavirus-spreads.

37. “Global Gas Security Review 2020,” International Energy Agency, (October 2020), pp. 13-14.

38. GASC and Egypt were the first countries in the region to sign an agreement in 2003, delimiting their EEZs. The GASC signed an agreement with Lebanon in 2007 and with Israel in 2010. Turkey signed an EEZ agreement with the TRNC in 2011, and with Libya at the end of 2019. Most recently, Egypt and Greece signed an EEZ agreement in August 2020.

39. “Israel-Lebanon Maritime Boundary Negotiations—Some Unique Aspects,” Jerusalem Center for Public Affairs, (October 12, 2020), retrieved December 10, 2020, from https://jcpa.org/article/israel-lebanon-maritime-boundary-negotiations-to-begin/.

40. “Lebanon Demands Extra 1,430 sq. km. in US-brokered Talks with Israel,” Al Arabia, (October 28, 2020), retrieved December 10, 2020, from https://english.alarabiya.net/News/middle-east/2020/10/28/Lebanon-demands-extra-1-430-sq-km-in-US-brokered-talks-with-Israel-; “Lebanon Oil and Gas Sector 2021: A Hope of Revival,” Lebanon Gas & Oil, (February 6, 2021), retrieved February 10, 2021, from https://lebanongasoil.com/2021/02/06/lebanon-oil-and-gas-sector-2021-a-hope-of-revival/.

41. For the role of natural gas in the Cyprus problem, see, “The Cyprus Hydrocarbons Issue: Context, Positions and Future Scenarios,” Peace Research Institute Oslo, (2013), retrieved from https://www.prio.org/Global/upload/Cyprus/Publications/Hydrocarbons_Report-ENG.pdf, pp. 61-72; “Aphrodite’s Gift: Can Cypriot Gas Power a New Dialogue?” International Crisis Group, (2012), retrieved from https://www.crisisgroup.org/europe-central-asia/western-europemediterranean/cyprus/aphrodite-s-gift-can-cypriot-gas-power-new-dialogue, pp. 12-17.

42. For an evaluation of these issues within the context of hydrocarbons, see, Zekiye Nazlı Kansu, “An Assessment of Eastern Mediterranean Maritime Boundary Delimitation Agreement Between Turkey and Libya,” Science Journal of Turkish Military Academy, Vol. 30, No. 1 (June 2020), pp. 51-84.

43. For a detailed analysis, see, Cihat Yaycı, Doğu Akdeniz’in Paylaşım Mücadelesi ve Türkiye, (İstanbul: Kırmızı Kedi Yayınları, 2020).

44. For an extensive discussion on this, see, Ana Stanic and Sohbet Karbuz, “The Challenges Facing Eastern Mediterranean Gas and How International Law can help Overcome Them,” Journal of Energy & Natural Resources Law, (October 30, 2020), pp. 1-35.

45. “United Nations Convention on the Law of the Sea,” United Nations, (December 10, 1982), retrieved from www.un.org/depts/los/convention_agreements/texts/unclos/unclos_e.pdf. For an overview of these rules, see, James Crawford, Brownlie’s Principles of Public International Law, 9th, (Oxford: Oxford University Press, 2019). pp. 315-350.

46. For a discussion of different examples of JDA, see, Ana E. Bastida, Adaeze Ifesi-Okoye, Salim Mahmud, James Ross, and Thomas Walde, “Cross-Border Unitization and Joint Development Agreements: An International Law Perspective,” Houston Journal of International Law, 29, No. 2 (January 2007), pp. 358-359.

47. For those different views, see, David M. Ong, “Joint Development of Common Offshore Oil and Gas Deposits: “Mere” State Practice or Customary International Law?” The American Journal of International Law, (October 1999), Vol. 93, No. 4, pp. 771-804; Rainer Lagoni, “Interim Measures Pending Maritime Delimitation Agreements,” The American Journal of International Law, (April 1984), Vol. 78, No. 2, pp. 345-368.

48. Sohbet Karbuz, “Geostrategic Importance of East Mediterranean Gas Resources,” in Andre Dorsman, Volkan Ediger and M. B. Karan (eds.), Energy, Economy, Finance and Geostrategy, (Cambridge: 2018), pp. 237-255.

49. “Cairo Declaration Establishing the East Mediterranean Gas Forum,” Ministry of Petroleum and Mineral Resources of Egypt, (January 14, 2019), retrieved February 10, 2021, from https://www.petroleum.

eg/en/media-center/news/news-pages/Pages/mop_14012019_01.aspx.

50. For more on this, see the projects’ website, EuroAfrica Interconnector, retrieved from https://euroasia-interconnector.com and https://www.euroafrica-interconnector.com.

51. “Israel and UAE Eye Prosperity as Relations Thaw,” Middle East Energy Survey, (October 23, 2020), pp. 11-12.

52. “Israel: Background and U.S. Relations in Brief,” Congressional Research Service, (January 27, 2021), retrieved February 13, 2021, from https://fas.org/sgp/crs/mideast/R44245.pdf.

53. Hassan A. Barari, “The Abraham Accord: The Israeli—Emirati Love Affair’s Impact on Jordan,” Friedrich-Ebert-Stiftung, (September 2020), retrieved February 13, 2021, from http://library.fes.de/pdf-files/bueros/amman/16505.pdf.

54. “Joint Statement Philia Forum,” Hellenic Republic Ministry of Foreign Affairs, (February 11, 2021), retrieved from https://www.mfa.gr/en/current-affairs/statements-speeches/joint-statement-of-the-ministers-for-foreign-affairs-of-the-republic-of-cyprus-the-arab-republic-of-egypt-the-hellenic-republic-the-kingdom-of-bahrain-the-french-republic-the-kingdom-of-saudi-arabia-and-the-minister-of-state-for-international-coopera.html.

55. “Hydrocarbon Developments in the Eastern Mediterranean: The Case for Pragmatism,” Atlantic Council, (2016), retrieved February 14, 2021, from www.atlanticcouncil.org/in-depth-research-reports/report/hydrocarbon-developments-in-the-eastern-mediterranean, p. 28.

56. Michael Tanchum, “Gas for Peace,” Foreign Policy, (May 28, 2019), retrieved December 20, 2020, from https://foreignpolicy.com/2019/05/28/gas-for-peace/.

57. Gabriel Mitchell, “The Eastern Mediterranean Gas Forum: Cooperation in the Shadow of Competition,” The Israeli Institute for Regional Foreign Policies, (September 2020), retrieved February 13, 2021, from https://mitvim.org.il/wp-content/uploads/Gabriel-Mitchell-The-Eastern-Mediterranean-Gas-Forum-September-2020.pdf.