The global energy market fundamentals, coupled with the increasing price of oil and natural gas, have prompted further development of local production and use of alternative resources. These changes have also entailed liberalization in energy markets aimed at establishing a competitive energy market on a cost-based pricing mechanism.

The Turkish electricity market has also gone through fundamental regulatory changes, moving away from its past of an entirely state controlled system. Some regulatory changes introducing the participation of the private sector were made after 1984. These changes – especially with the enactment of the Electricity Market Law, dated February 20th, 2001 and numbered 4628 (the “Electricity Law”) – paved an essential way for private sector investments, terminating the state monopoly over the electricity market.

Three years after the enactment of the Electricity Law, the Supreme Planning Council announced the Electricity Sector Reform and Strategy Paper on March 17, 2004 with its decision numbered 2004/3 (the “Strategy Paper”). The Paper essentially stated that the liberalization of the energy sector would continue. The Electricity Law and Strategy Paper aimed to restructure and liberalize the electricity market and improve competition in the market.

With the enactment of the Electricity Law in 2001, the electricity market was restructured

Turkey is highly dependent on foreign energy resources, such as natural gas and oil mostly purchased from Russia and Iran. Despite these imports, supply of electricity is still not sufficient to meet the current demand. Therefore, investments in the electricity market, especially in the renewable energy sector, are crucial to decrease the level of dependency on foreign resources. Furthermore, encouraging local and foreign investments is vital for Turkey to provide supply security and establish a competitive and transparent market on par with its energy providing neighbors.

Keeping in mind Turkey’s current state of affairs regarding its electricity market as well as its future expectations, this article aims to evaluate various issues under the current system, which may either hinder or facilitate investments. In conclusion, certain recommendations that most effectively attract the attention of local and foreign investors will be outlined.

General Overview and Structure of the Turkish Electricity Market

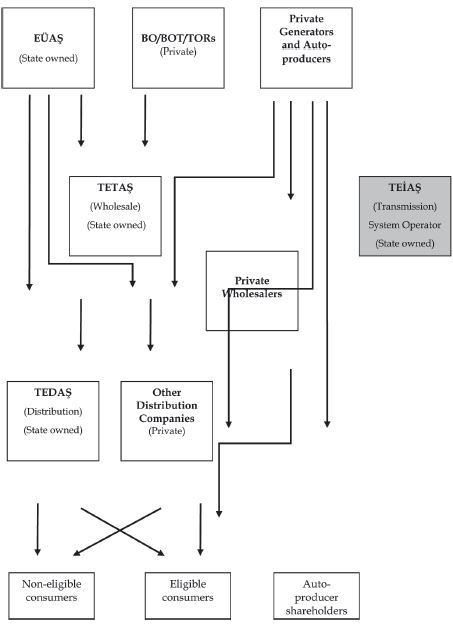

Until 1984, the Turkish electricity market was entirely controlled by the state owned electricity company, Türkiye Elektirik Kurumu (“TEK”). Between the years 1984 and 1993, although the market was still controlled by TEK, it was possible to observe private sector involvement in the forms of build-operate-transfer (“BOT”), build-own-operate (“BOO”) and Transfer of Operation Rights (“TOR”). In 1993, TEK was divided into two companies as TEAŞ (generation, transmission and wholesale company) and TEDAŞ (distribution company). With the enactment of the Electricity Law in 2001, the electricity market was restructured and TEAŞ was divided into three companies: EÜAŞ (generation company), TEİAŞ (transmission company), and TETAŞ (wholesale company). As a significant step in becoming a well established market, the Electricity Law also provided the establishment of the Energy Market Regulatory Authority (“EMRA”), which would be responsible for the supervision of the market with the authority to issue licenses, determine tariffs and regulate competition within the market.

With the promulgation of the Electricity Law, the previous monopolistic market system was removed and a new system where private sector companies could engage in the electricity generation, distribution and sale activities under the supervision of EMRA was established. However, TEIAŞ still has a monopoly over the market guaranteeing the security of the transmission lines.

According to the Strategy Paper, TEDAŞ was included in the privatization process. Although many delays occurred, privatization of various regions was completed between the years 2007 and 2010. Privatization for the rest of the regions is either ongoing or is expected to start in 2010. In addition, the Strategy Paper decided that generation portfolios, yet to become private, would be determined. The Electricity Sector and Supply Security Strategy Paper passed by the Supreme Planning Council on May 18, 2009 with its decision numbered 2009/11 (the “Supply Security Strategy Paper”) provided that determination of generation portfolios will be finalized and privatization of those will start in 2009.

In light of the above, the current electricity market structure is demonstrated below:

Despite the efforts to liberalize and privatize the Turkish electricity market, current circumstances show that state owned companies are still dominant in the market. For instance, in 2008, 49 percent of the total electricity was generated by EÜAŞ. This percentage decreased to 46 percent in 2009. TEDAŞ and its state owned subsidiaries have a significant market share in relation to their distribution activities. However, it is evident that the private sector involvement in the sector will increase by virtue of the privatizations to be carried out by the Privatization Administration regarding EÜAŞ and TEDAŞ this year. Furthermore, privatizations will continue to be implemented until full market liberalization is accomplished by the target date of 2012.

Although the current system has a lot of advantages for investors, there are certain drawbacks as well

The Current System: Obstacle or Facilitator for New Energy Investments?

No legislation is flawless. Based on the decision to liberalize the energy sector, Turkey has taken rapid steps to amend legislation pertaining to the energy sector. Overall, the amendments made to the legislation have been successful. Although the current system has a lot of advantages for investors, there are certain drawbacks as well. In this section, the most salient drawbacks and advantages of the current system will be briefly explained.

Disclosure Requirements

There are certain disclosure requirements set forth under the Licensing Regulation. Investors may be reluctant to make investments in the Turkish energy market due to these disclosure requirements, which will be explained below.

Companies applying to EMRA in order to operate in the electricity market are required to disclose their shareholding structure, including the share percentage and amount of their direct or indirect real person and legal entity shareholders. They are also required to disclose direct or indirect ownerships of all real person or legal entity shareholders who have ten percent or more shares (five percent or more for public companies) separately. In addition, the following information and documents are also requested by EMRA;

- Judicial records obtained within the last six months along with names, titles, and addresses of real person shareholders who have, either directly or indirectly, ten percent or more (five percent or more for public companies) the shares of the applicant company and of the members of the Board of Directors, general manager, deputy general manager, and auditors of the applicant company,

- Documents indicating the financial situation of real or legal person shareholders who have, either directly or indirectly, ten percent or more (five percent or more for public companies) the shares of the applicant company. For legal entities, (i) balance sheets and income tables for the last three years approved by independent auditors or tax authorities, (ii) if any, original or notarized copies of those for the application year; for real persons, last three years’ income tax returns approved by tax authorities, title deeds, and bank account documents.

Legal entities that are required to submit such documents shall have, directly or indirectly, ten percent of the shares of the applicant company. For instance, company A applies for the license and company B is the shareholder of company A. Company B has 80 percent of the shares of company A, directly. Accordingly, company B shall submit the mentioned documents stated above. If company C owns 50 percent of the shares of company B, this would make company C a 40 percent indirect shareholder of company A. Therefore, company C shall also submit such documents.

These documents are also required for share transfers of the license holder companies.

Investment costs of the energy projects require big players who have sufficient capacity to invest in the market. Therefore, Turkey should attract multinational companies or investment funds in order to realize large-scale energy projects. However, the disclosure requirements described above stand as a legal impediment and usually discourage the interest of multinational companies and funds willing to invest in Turkey’s energy market. This is due to their reluctance to declare their shareholding structures, indirect shareholders and/or financial situations of their direct or indirect shareholders, consequently, inhibiting such investors from investing in Turkey’s energy market.

Requirement of Environmental Impact Assessment (“EIA”) and Risk of Cancellation of “EIA Positive” Reports or “EIA not Required” Decisions

According to the Licensing Regulation amended in September 2009, applicant companies must obtain an “EIA Required” or “EIA not Required” decision before EMRA grants a license. The relevant EIA decision must be submitted together with other required documents within 90 days from the date of notification of EMRA regarding its approval of the application. Nevertheless, in case an EIA is required, the company can submit an “EIA Positive” report to EMRA within 300 days as of the said notification date. This requirement is also applicable to license modification applications. Companies which obtained licenses or the application of which was approved before September 30, 2009 must initiate the EIA procedure within 60 days as of this date. These companies must submit their “EIA not Required” decision within 90 days as of 30 September 2009, if their activity is subject to the Selection and Elimination Criteria under the Environmental Impact Assessment Regulation published in the Official Gazette dated July 17, 2008 and numbered 26939 (the “EIA Regulation”). If their activity falls within the scope of Annex 1 of the EIA Regulation, they are required to submit the “EIA Positive” report within 300 days as of September 30, 2009. However, EMRA is entitled to extend such submission periods if a delay arises for reasons not attributable to the applicant company.

Turkey should attract multinational companies or investment funds in order to realize large-scale energy projects

Due to their perceived potential negative environmental impact, there is in some regions a lot of public reaction against hydroelectric power plants. Therefore, in recent years, cases brought to court with respect to the cancellation of “EIA Positive” reports or “EIA not Required” decisions obtained in relation to hydroelectric power plants have increased. Furthermore, re-evaluation of all hydroelectric power plants by a commission to be established by the Ministry of Energy and Natural Resources and State Water Management (“DSİ”) is currently being considered. If the court cancels the EIA Positive report regarding a hydroelectric power plant, this means that all the investments regarding the plant would have to halt until the issue is resolved through either further court action or additional environmental studies.

In the recent past, some investors were not able to start operations in their facilities given that the “EIA Positive” reports or “EIA not Required” decisions regarding such facilities were cancelled after constructions was already completed and they had duly obtained “EIA Positive” reports or “EIA not Required” decisions prior to construction. As a result, these investors incurred substantial losses. In principle, an action regarding cancellation of a decision of an administration is subject to a time limit which is 60 days as of the notification of such decision. However, in relation to cancellation of “EIA Positive” reports or “EIA not Required” decisions, this period starts from the date the claimant has knowledge of the relevant report or decision. It is possible that a cancellation action can be filed even after the completion of the construction of the relevant facility based on the ground that the claimant has just acquired knowledge of the relevant report or decision.

Hence, there is a risk for investors that their “EIA Positive” report or “EIA not Required” decision may be cancelled at a certain stage after they start and/or complete the construction of the plant even if they had previously obtained the “EIA Positive” report or “EIA not Required” decision in due course. Therefore, this does not provide a secure environment for investors. By taking into account the fact that investment costs of hydroelectric power plants are very high, it can be concluded that this risk may stand as an obstacle for investors.

Overlap of Licenses Due to Mining Legislation

This problem may arise given the fact that two different sectors, supervised by two different authorities, namely the General Directorate of Mining Affairs (“GDMA”) and EMRA, are governed by independent regulatory bodies.

There are three types of licenses and permits under the Mining Law dated June 4th, 1985 and numbered 3213, which are (i) exploration licenses, (ii) operation licenses, and (iii) operation permits.

GDMA is responsible for the issuance of mining licenses, whereas the issuance of electricity generation licenses is subject to EMRA’s approval. This sometimes causes an overlap of licenses granted under two different laws. In other words, there may be cases where an electricity generation license and a license or permit regarding mining activities are issued for the same area. This problem is very common in Turkey. GDMA and EMRA often encounter this particular problem. When such licenses overlap, it affects both license holders. On the one hand, the electricity generation license holder needs to construct a facility in order to produce electricity, and on the other, the mining license holder has to perform drilling operations in the earlier stages in order to verify whether there is a mine on such a location. It is clear that construction of an electricity generation facility and performance of drilling operations in the same area are physically impossible. This problem also causes time delays and wasted money for both license holders.

As mentioned above, the reason for this problem is the fact that licenses are issued by different authorities and are subject to different regulations. In such cases, the determination of which of the licenses will dominate over the other will be vital for investors. The type of mining license is crucial in terms of its impact on electricity licenses. Exploration licenses may not give rise to major problems, whereas operation licenses may be a significant obstacle for electricity generation investors. If there is a mining license regarding operation obtained before an electricity generation license is obtained, this may hinder operations of electricity generation investors. In case there is an exploration license, the license of the project, which is likely to have more economic benefits, will continue to be valid whereas the other one will be cancelled. Notwithstanding the fact that the problem could be solved, it remains a problem for investors since it causes delays for the realization of their projects.

Rapid and not well-planned amendments cause chaos and discourage both foreign and local investors who wish to invest in the electricity market with a stable legal environment

Frequent Changes in the Legislation

A stable legal environment is crucial for investors. However, after its enactment in 2001, there have been over 20 amendments made to the Electricity Law. Further, secondary regulations have also been amended numerous times. For instance, the Licensing Regulation, which is the most essential secondary regulation governing the investments in the electricity sector, has been amended 35 times between 2002 and 2009. These rapid and not well-planned amendments cause chaos and discourage both foreign and local investors who wish to invest in the electricity market with a stable legal environment.

A very recent example of this type of problem occurred in the wind energy sector, caused by an EMRA decision, which relied on an amendment made to the Electricity Law. As a result of this decision, 24 wind energy projects, totaling an installed capacity of 1300 MW, have yet to obtain their electricity generation licenses and are now in limbo. The project owners have now taken this decision to court, and the outcome will affect the entire wind energy market. From the perspective of many investors, the reliability and trustworthiness of EMRA and its relevant laws are being questioned.

License Trading

The immature structure of Turkey’s energy market and legislations has created great opportunities for some people who are not actually investors, but opportunists. Especially for the wind and hydroelectric projects, such opportunists find it more profitable to sell the licenses they obtained from EMRA, rather than realize these investments themselves. Unfortunately, the system and the administration were not advanced enough to control the market and its participants. Since the electricity market legislation was not specific, administrators were not able to control the actions of the investors in this market. Due to the reasons mentioned above, it became very common to sell licenses in the electricity market. It was clear that EMRA needed to remedy this situation. In addition, these practices substantially increased market prices, causing disincentives for serious investors.

Even though certain problems for energy investors may arise due to the current competition law rules, the Competition Board has developed an approach providing checks and balances in the energy sector to protect investors

As a result of this situation, electricity market legislation and the license application process has become more detailed and complicated. Also, the sanctions for breach of obligations have reached a point where the licenses can be cancelled and the operation of such license holders in the electricity market can be prohibited for three years. However, these sanctions also affected serious investors. In some cases, even though breach of strict investment schedules and detailed liabilities were not linked to “serious investors,” they were the ones facing the threat of having their licenses cancelled.

Competition Law

The Law on the Protection of Competition dated December 7th, 1994 and numbered 4054 (the “Competition Law”) and the secondary competition law regulations adopted after the enactment of the Competition Law are in line with the EU competition legislation. In fact, this is an environment in which foreign investors are familiar with the regulations of Turkish competition law, since they are compatible with the EU legislation. The Competition Board consists of members who are competent in their area and the board renders its decisions by taking into consideration decisions given by the European Community Court (the “ECC”) and competition boards all over the world, such as those in the European countries and the United States. However, as explained above Turkey has experienced a very rapid legislation amendment process in the energy sector. Therefore, the amendments in the energy sector were adopted without taking into account concerns and requirements with regard to competition laws. Hence, projects in the energy sector, especially mergers and acquisitions, submitted to the examination and approval of the Competition Board gave rise to some problems for investors.

Even though certain problems for energy investors may arise due to the current competition law rules, the Competition Board has developed an approach providing checks and balances in the energy sector to protect investors and, therefore, is reliable despite these problems. This approach can be seen in a recent decision of the board.1 In this case, a company holding a natural gas distribution license wanted to hold an electricity distribution license in the same area as well as conduct the electricity distribution activities. The board has evaluated whether the competition will be significantly restricted in this case. Based on its extensive research and after its examination of ECC decisions, it has decided that competition will not be significantly restricted and allowed such transactions.

The Renewable Energy Law and License Regulation provide a number of incentives to encourage investors

Incentives Provided under the Renewable Energy Law and License Regulation

The Renewable Energy Law and License Regulation provide a number of incentives to encourage investors. The most important incentive is the purchase guarantee foreseen under Article 6 of the Renewable Energy Law. Accordingly, legal entities holding retail sale licenses are obliged to purchase a certain amount of electricity from RER certified generation facilities, which have been in operation for less than ten years. The amount of electricity to be purchased by a retail sale license holder will be equal to the proportion of the total electricity sold by this license holder in the previous year to the total amount of the electricity sold in the Turkish market. The price of the electricity for such purchases will be the average Turkish wholesale price determined by EMRA for the previous year. However, this price cannot be lower or higher than the minimum and maximum amounts determined under Article 6. Accordingly, the price for these purchases shall be determined between the range of a minimum of 5 Euro Cent/kWh and a maximum of 5,5 Euro Cent/kWh. However, RER certified license holders are free to sell the electricity produced from renewable energy resources at a price above 5,5 Euro Cent/kWh in the market, if they can find such an offer. It should be noted that the provisions of Article 6 are applicable to generation facilities, which will start their operations before December 31, 2013.

Furthermore, Article 8 of the Renewable Energy Law provides that a discount of 85 percent shall be applicable on permits, rents and usage permits of state owned land where the property is used for the purpose of generating electricity from renewable energy resources. Article 8 sets forth another incentive providing that for the State or Treasury owned immovable property located in the reservoir area of hydroelectric generation facilities within the context of the Renewable Energy Resources Law, a usage permit shall be issued by the Ministry of Finance free of cost.

Article 12 (4) of the License Regulation provides that legal entities applying for licenses for the construction of facilities based on renewable energy resources shall pay one percent of the total licensing fee and will not pay annual license fees for the first eight years following the facility completion date. Moreover, Article 38 of the License Regulation provides that TEİAŞ and/or legal entities holding distribution licenses shall prioritize connection of generation facilities to the system based on whether they use renewable resources.

Expropriation

Expropriation is a long and tedious process under Turkish law. However, there are some specific regulations in relation to the electricity market that can facilitate and speed up this process. Such regulations, which may also assist the more rapid realization of investments, will be explained below.

Expropriation is only possible in the name of public interest and the competence for expropriation is given only to public authorities. However, there may be cases where there is a need for expropriation in the name of a real person or legal entity. In such a case, if the law grants a public entity the authority for such an expropriation, the legal entity or real person shall apply to the relevant administrative authority for the permission to expropriate.

EMRA is the competent authority to file for expropriation under the Electricity Law. According to Article 15, the expropriation requirements of the license holders performing generation and/or distribution activities in the electricity market shall be evaluated by EMRA. If appropriate, expropriation is permissible in accordance with the procedures established in the Expropriation Law dated November 4th, 1983 and numbered 2942 (the “Expropriation Law”).

Under the Expropriation Law, an administration shall first take a “public interest decision” before a “decision of expropriation.” However, according to Article 15 of the Electricity Law, the above-mentioned decision of EMRA shall serve as a public interest decision and EMRA does not need to take a further decision to that effect.

Immediate expropriation is an atypical method of expropriation that is regulated under Article 27 of the Expropriation Law. Immediate expropriation provides time-efficiency for reasons of public interest during the process of expropriation. Pursuant to Article 27 of the Expropriation Law, the Council of Ministers issued a decree regarding expropriation in relation to investments in the energy market. The President of EMRA will conduct the Expropriation Decree. Article 27 will be applicable to the necessary expropriations in relation to energy investments on electricity, natural gas, and petroleum markets.

The procedure for the immediate expropriation differs from the regular procedure, which may normally take 18 months after the expropriation case has been filed before the court, unless there is an extraordinary reason. During the expedited process for immediate expropriation, according to Article 27 of the Expropriation Law, upon the request of EMRA, land appraisal is ordered from the court of first instance and conducted within seven days after the expropriation request has been filed. The land access is obtained after the decision rendered by the court and upon deposition of the determined expropriation cost to a bank account of the initially determined shareholders. In case any discrepancy occurs regarding the initial shareholder identification or if the consideration for the expropriation is challenged by the owner(s), court proceedings, in accordance with Article 10 of the Expropriation Law, are pursued with the difference that the right of access to the land has already been granted to the relevant authority. In case of immediate expropriation, the proceedings other than those related to appraisal will be concluded later.

During the regular process of expropriation, the owner of the immovable property subject to expropriation will have the right to file an annulment lawsuit before the administrative courts. However, during the immediate expropriation, the owner(s) of the immovable property does/do not have the right to challenge the expropriation. They simply and solely have the right to challenge the cost and purchase price for the expropriation. The transaction of expropriation will be deemed valid. This characteristic of immediate expropriation significantly facilitates the process for investors.

However, the ownership of the expropriated land shall belong to the relevant authority or the Treasury in the absence of any such authority, and right of easement shall be established for the license holders that paid the expropriation cost by the Ministry of Finance free of charge.

Arbitration

An investment environment providing legal safety for foreign investors is vital in order to promote investments in the energy sector. Foreign companies do not want to invest in a country where disputes arising from their investments must be brought only to the courts of such country. Since settlement of disputes by an impartial method is indispensable for foreign investors, an alternative recourse other than to the state courts must be provided to them.

At this point, bilateral investment treaties and multilateral conventions/treaties regarding the protection and promotion of foreign investments take the center stage for the protection of foreign investors. As Turkey signed and ratified various bilateral investment treaties and multilateral conventions/treaties in this respect, it can be concluded that Turkey created a legally safe and comfortable climate in terms of settlement of investment disputes.

Turkey created a legally safe and comfortable climate in terms of settlement of investment disputes

Turkey signed the Washington Convention on the Settlement of Investment Disputes (the “Washington Convention”) on June 24, 1987 and ratified this convention on May 27, 1988. This convention was created to resolve disputes between foreign investors and host countries in line with the requirements of international trade. The International Centre for Settlement of Investment Disputes (the “ICSID”) provides an international impartial method for settlement of investment disputes, and pursuant to Article 54 of the Washington Convention, awards given by the ICSID can be enforced in any of the signatory countries as if they were final awards given by the court of the relevant signatory country.

Moreover, Turkey has signed many bilateral investment treaties (approximately 80) to procure a secure legal environment for foreign investors. These treaties set forth either ICSID, United Nations Commission on International Trade Law (UNCITRAL) or International Chamber of Commerce (ICC) arbitration.

Furthermore, in relation to the energy sector, Turkey signed the Energy Charter Treaty (the ECT) on December 17, 1994 and ratified this treaty on February 13, 2001. Article 10 of the ECT obliges contracting parties to encourage and create stable, equitable, favorable and transparent conditions for investors of other contracting parties to invest in their countries. Turkey, like other contracting parties, is under the obligation not to violate rights of investors of another contracting party.

Article 26 of the ECT regulates the settlement of disputes between an investor and a contracting party. According to this article, in case such an investment dispute cannot be settled amicably, the investor may choose to submit the dispute for resolution:

- to the courts or administrative tribunals of the contracting party to the dispute,

- if any, previously agreed dispute settlement procedure or

- (i) ICSID arbitration if any of two alternative requirements under the Washington Convention is met, (ii) UNCITRAL, or (iii) the Arbitration Institute of the Stockholm Chamber of Commerce.

Accordingly, investors in the Turkish energy sector may prefer to go to arbitration, provided by the ECT in cases where the relevant state is also a party to the ECT. In several arbitration cases against Turkey before the ICSID, such as Libananco Holdings Co. Limited, Cementownia Nowa Huta S.A. and Europe Cement Investment and Trade S.A. cases, the foreign investors relied on the ECT.

In addition, Turkey also ratified the New York Convention on the recognition and enforcement of foreign arbitral awards dated June 10, 1958 on May 8, 1991. The provisions of such a convention facilitate enforcement of foreign arbitral awards granted in jurisdictions of contracting parties. In addition, Turkey ratified the European Convention on International Commercial Arbitration dated April 21, 1961 (the European Convention) on May 8, 1991. The European Convention regulates the stages of the arbitration process until a final decision is reached by the arbitral tribunal. It also recognizes and enforces arbitration awards.

Although, the above-mentioned international agreements were signed at earlier dates, the amendments in the national legislation in parallel with these agreements were made at later dates. The amendment of Article 125 of the Constitution providing settlement of disputes arising from public service concession agreements through arbitration, enactment of the (i) law on principles to be followed in case of an arbitration regarding disputes arising from public service concession agreements dated January 21, 2000 and numbered 4501, (ii) International Arbitration Law dated June 21, 2001 and numbered 4686 and (iii) law regarding foreign direct investment dated May 6, 2003 and numbered 4875 are among the most noteworthy.

In light of the above-mentioned treaties/conventions and amendments introduced by Turkey, it can be said that Turkey provides a strong protection for foreign investors in terms of settlement of disputes. This is one of the reasons why Turkey had to pay significant amounts of compensations as a result of arbitral awards granted in relation to investment disputes in recent years.

Recommendations

Considering the number and potential capacity of available sites and areas in Turkey, Turkey’s electricity production potential is much higher than the total capacity of facilities already in operation. For example, at present, only 35 percent of the total hydroelectric power potential (approximately 13,000 MW) is operational.2 This percentage is much lower for wind energy. Although Turkey has great energy resources to generate electricity, the full potential use of its energy market is still limited for foreign and local investors. If such an attractive environment is not established in the future, an electricity shortage may occur. Therefore, in order to encourage investors, the Turkish government must improve energy market conditions. It cannot be denied that the Parliament has passed major regulations to that effect, especially after 2001. However, the conditions are still not fully satisfactory for investors, as investors are still confronted by certain obstacles, which the Government must remedy. Therefore, we believe that the following steps should be taken.

- More attractive purchase guarantees:

In this respect, a draft law, introduced by the legislator, has received very positive reactions from investors. The draft law provides different purchase prices for electricity generated between Euro Cent 7 /kWh and Euro Cent 25 /kWh, depending on the type of renewable energy resource. These prices will also be increased according to annex II of the draft law if a generation facility uses components produced in Turkey in the production of electricity. Prices between Euro Cent 0,3/kWh and Euro Cent 3/kWh will be added to the purchase price depending on the type of the component used in the production facility.

Investors have criticized the current purchase guarantee system under the Renewable Energy Law mainly for two reasons: there are no differences according to the types of renewable energy resources used, and they find the maximum price too low. Evidently, the needs and demands of investors have been taken into account by the draft law. Under the new system, reflection of the costs of the investors may be more realistic and therefore, the enactment of the draft law may encourage investors. However, although many investors expected that it would be enacted in June 2009, the enactment of the draft law was postponed, since the Treasury is of the opinion that the feed-in tariffs set forth under the draft law are very high and are a heavy financial burden. Enactment of the draft law may motivate investors in the renewable energy market.

- Amendment of the Turkish Commercial Code in line with global demands and corporate governance principles:

TCC entered into force on January 1, 1957 and it has not been extensively amended since then. In other words, Turkey has not yet adopted a new commercial code in view of the latest developments in the world occurring as a result of globalization. New business transactions require new corporate structures apart from joint-stock and limited liability companies. Furthermore, investors are also in need of more transparent and strict corporate governance principles. Attracting investors is crucial for Turkey. TCC should be amended and the new rules introducing new structures and corporate governance principles must be adopted. In this respect, in 2006, the Turkish Ministry of Justice appointed a commission to prepare a draft Turkish Commercial Code (the Draft Code), providing significant changes to that effect. However, it has not been submitted to the Parliament. We believe that the enactment of the Draft Code will respond to the needs of investors.

- Acceptance of a comfort letter or reference letter for the disclosure requirements:

EMRA should seek alternative ways for the disclosure requirements. This alternative could be a “comfort letter” or a “reference letter” from reputable auditing companies called the “big four.” However, these letters or auditing firms should be controlled strictly and sanctioned if misleading letters are used. This would serve as a deterrent for such practices. Thus, (i) EMRA can still control the investors and market structure, (ii) big players can invest in the Turkish market without having to comply with disclosure requirements, (iii) auditing firms would be liable for their “reference letters,” and (iv) competition between the big investors may affect the market and investments in a positive way.

- Definite time limits for court actions regarding cancellation of EIA decisions or reports:

As stated above, investors are under the risk that “EIA Positive” reports or “EIA not Required” decisions regarding their facilities could be cancelled after they start and/or complete the construction of their facilities because the time limit for such a cancellation action starts from the date the claimant has knowledge of the relevant report or decision. In order to prevent investors from incurring substantial losses and in the end wasting their investments, the legislator can amend the legislation in this respect. This amendment may set out a certain date for which possible claimants should have acquired knowledge of the relevant report or decision regardless of any actual knowledge. In other words, commencement of the time limit should be restricted to a certain date for such cancellation actions.

- Financial and technical evaluation of investors:

In order to avoid unscrupulous investors from taking advantage of trading licenses, EMRA should evaluate the competencies of the license applicants with respect to their technical and financial capabilities. This may require strict amendments in relevant legislation, particularly the Licensing Regulation. Even though the common market practice is forming a Special Purpose Vehicle company (“SPV”) for each of the license applications, EMRA should evaluate the parent companies of the SPVs as well. For instance, EMRA could review the balance sheet of the parent companies for a certain number of years and request a minimum financial strength which will be necessary to realize the investment.

- Cross-check mechanism between EMRA and GDMA:

In relation to the controversies arising from the overlap of licenses, it may be advisable to amend both electricity and mining legislation so that a provision providing a crosscheck mechanism would disclose an already existing license from one authority to the other.

Endnotes

- http://www.rekabet.gov.tr/dosyalar/kararlar/karar3337.pdf.

- Jonathan W. Blythe, “Turkey signs Kyoto Protocol – a boost for renewable energy in Turkey”, International Energy Law Review, Vol. 5, (2009), p. 162.